The S&P/ASX 200 (INDEXASX: XJO) faced the worst day on the share market since the GFC as it fell over 7%.

To be precise, the index dropped 7.3% in one of the worst days in its history.

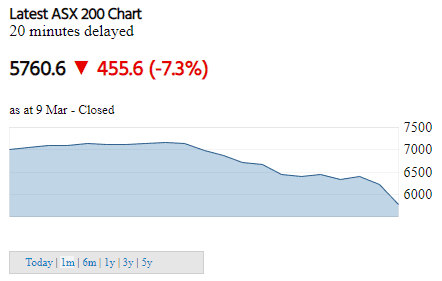

Just look at the past month for the ASX 200:

It wasn't long ago that the ASX 200 was above 7,000 and now it's at 5,760. It was almost a sea of red right from the opening bell.

Oil sees the worst falls

The share prices of businesses connected to oil production have been utterly smashed today.

The share price of Oil Search Limited (ASX: OSH) fell 35%.

The share price of Santos Ltd (ASX: STO) dropped 27%.

The share price of Worley Ltd (ASX: WOR) declined 19.7%.

The share price of Beach Energy Ltd (ASX: BPT) tanked 19.4%.

Even the BHP Group Ltd (ASX: BHP) share price went down 14.4%.

Why the oil carnage? Well, the oil-producing countries of OPEC plus Russia couldn't agree on a reduction of oil production. This led to a fall in the oil price by around 30% with Saudi Arabia cutting oil prices. Production is now a lot higher than demand.

Growth shares also suffer heavy declines

Oil shares weren't the only ones to be sold off heavily. Almost every industry saw big declines.

For example, the Afterpay Ltd (ASX: APT) share price plunged 16%. The Appen Ltd (ASX: APX) share price fell 8.9%. The WiseTech Global Ltd (ASX: WTC) share price dropped another 10.3%.

Various other growth shares also suffered. The Kogan.com Ltd (ASX: KGN) share price was sold off by 12.7% and even the CSL Limited (ASX: CSL) share price went down almost 6% today.

Travel shares plunge again

The travel sector received another painful pummelling today with more disruptions to 2020 travel.

The Corporate Travel Management Ltd (ASX: CTD) share price dropped 12.4%.

The Webjet Limited (ASX: WEB) share price fell 17.2%.

The Flight Centre Travel Group Ltd (ASX: FLT) share price declined by 6.6%.

The Sydney Airport Holdings Pty Ltd (ASX: SYD) share price fell 8.8%.

Banks suffer major pain

Banks across the board suffered major selloffs. The Commonwealth Bank of Australia (ASX: CBA) share price dropped 6.5%, the Westpac Banking Corp (ASX: WBC) share price fell 8.6%, the National Australia Bank Ltd (ASX: NAB) share price dropped 8.5% and the Australia and New Zealand Banking Group (ASX: ANZ) fell 8.5%.

Even the smaller, regional banks suffered a painful selloff as investors headed for the exits.

The Bendigo and Adelaide Bank Ltd (ASX: BEN) share price went down 9.5% and the Bank of Queensland Limited (ASX: BOQ) share price dropped 8.8%.

Indications are that the US market will suffer a painful selloff on Monday, US time, as well.