G'day, I'm Scott Phillips. I'm The Motley Fool's Chief Investment Officer here in Australia.

I make my living in large part trying to explain how people can use the power of investing to improve their lives. It's something of a passion project for me: I took a pretty big pay cut to join The Motley Fool back in 2012, because I'd been fortunate enough to have been a customer of our US operation in the past, and that experience had changed my financial life.

And so, whether inside our members-only services, in the Fairfax press, in Money magazine, on ausbiz, Channel 9's Late News, on Triple M or 2GB, on social media — or in forums like this — I spend a decent chunk of my time trying to spread the word.

I get some wonderful feedback from our members and readers. I'm humbled by the trust our members place in us, and we've heard some wonderful stories of financial success from them.

Which is all well and good, but we also hear criticism. Which isn't great, but which gives us the opportunity to learn and be better.

Frankly, I think we've done a pretty good job, overall. We're not immune from market volatility. We've made some mistakes. At the same time — despite the setbacks and the errors — the service I run, Motley Fool Share Advisor, is beating the market after more than a decade serving our members. I don't think that's an accident.

And yet, we have some disgruntled members and ex-members. That's bad for business, but it's — far more importantly — bad for those members. I worry that a bad experience with us will see them either quit investing, or make bad decisions trying to chase the next big winner somewhere else.

You can't make everyone happy, of course. But we wondered if, despite our best efforts, we simply weren't adequately preparing our members for the slings and arrows of life as an investor.

This article, then, is my best attempt to help our members and readers understand a little more of what I've learned about investing, and the approach we take here at The Motley Fool.

1. We're standing on the shoulders of giants

There is nothing genuinely new in investing. Yes, there are different circumstances, and lessons we can learn in our quest to improve, but little has truly changed in the last century when it comes to the principles of sound investing.

We don't offer magic formulas or 'black boxes'. We don't offer get-rich-quick schemes or make silly promises.

Instead, we try to take the best of what we've learned from others, and help our members become better investors, through careful research and recommendations, and a focus on education.

2. We expect volatility

If you're in sales, at least in the financial services industry, there are two ways to really make a killing. You can sell 'confirmation' or you can sell 'certainty'.

The former is a confidence-trick, akin to the shop assistant telling you how wonderful your choice is, after you've made it. We all like to hear others compliment us on our choices. If you have already decided to buy BHP shares, the best way for a broker to earn his commission is to congratulate you on a good choice, and take your money.

The latter, 'certainty', is a similar vice. Investing can seem scary and volatile. Many, perhaps most, investors, just want to know everything will be okay. So, if you know that's what your customer wants, you give it to them. Ultra-specific share price 'targets' and forecasts of where the stock market will be by Christmas are two such examples.

"I don't know" isn't exactly inspiring, but it's more honest than a confident, but baseless prediction. Unfortunately, human brains instinctively prefer the latter.

Here's the truth, though:

The stock market has a year of negative returns about one year in three. (Good luck trying to find a broker's or analyst's forecast that included a 'down' year!)

Big falls happen. You remember the GFC. You probably remember the dot.com crash. You've certainly heard about the 1987 'Black Monday' market plunge.

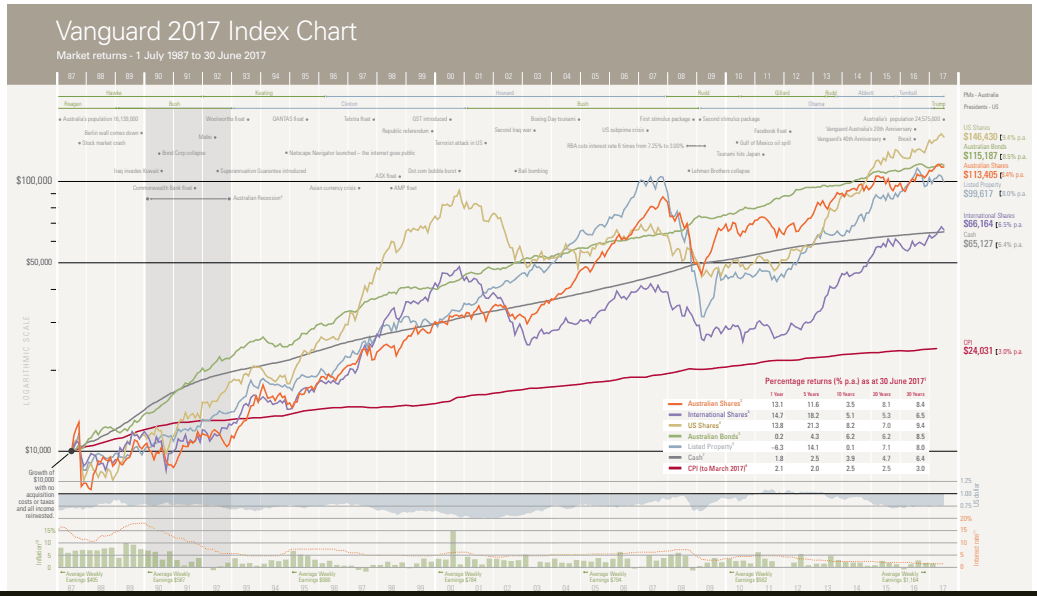

Now look at the long term story:

Source: Vanguard

Can you see the 87 crash? (Hint, it's at the far left) It's not that scary is it?

Can you spot the dot.com bust?

I bet you can find the GFC… but it's hardly the catastrophe it felt like at the time, is it?

Exactly.

And despite all that, the chart moves 'up and to the right'. The price of avoiding volatility is a very dear price, indeed.

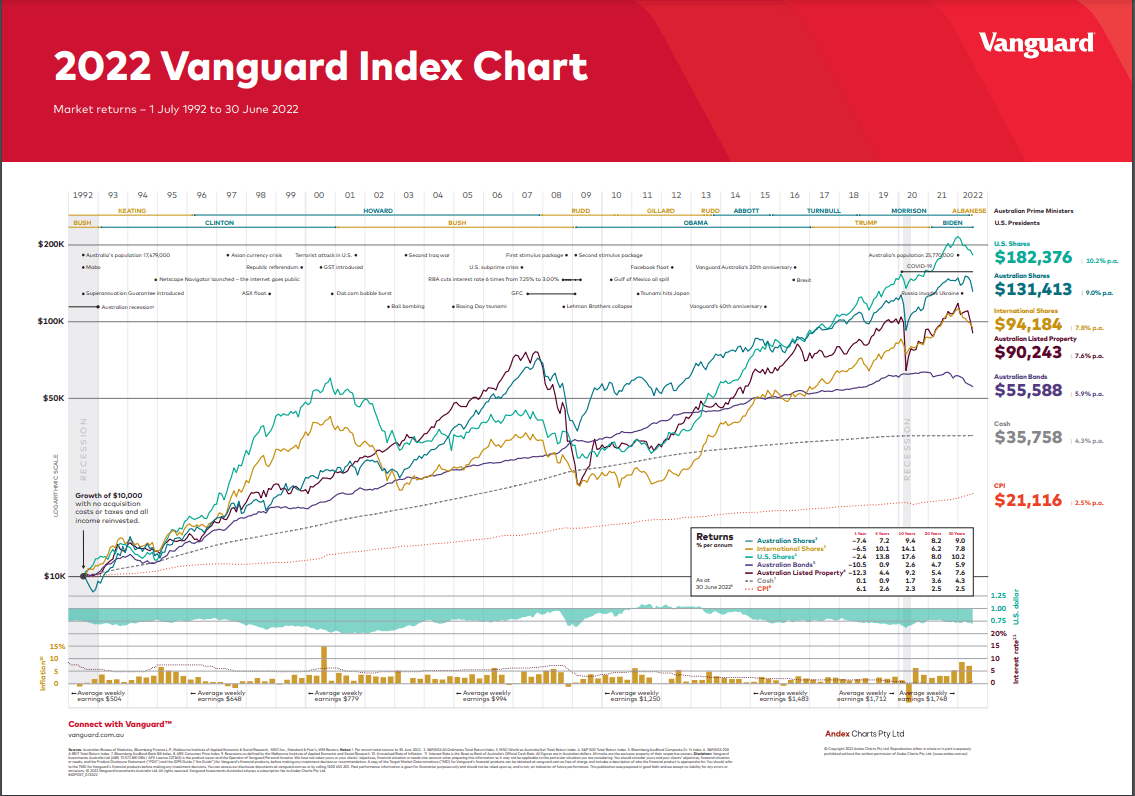

Aha! But what about the COVID crash?

I'm glad you asked. We used the 2017 chart, above, because it included the '87 crash, for those who remember it.

But the chart looks pretty similar for 2022, too!

Funny that!

Seems like — despite the volatility — long term investing works, huh?

3. We know the odds

"In this business, if you're good, you're right six times out of ten. You're never going to be right nine times out of ten." That's a quote from US fund manager extraordinaire Peter Lynch. In other words, you'll be 'wrong' 40% of the time — and that's if you're good! They don't put that in their television ads, or tell you that when you hand over your cash, do they?

I first wrote this in May 2018. I updated it in the middle of August, 2022.

Here are the 2018 stats:

- We'd made 78 individual ASX recommendations since we launched

- Of those 78, 50 have delivered a positive return (that means 28 are losing money)

- Of those 78, 46 are beating the market (meaning 32 are losing to the market)

In other words:

- We were only delivering a positive return 64% of the time (just over 6 out of 10)

- We were only beating the market 59% of the time (just under 6 out of 10)

And in mid-August, 2022:

- We've made 129 individual ASX recommendations since we launched

- Of those 129, 74 have delivered a positive return (that means 55 are losing money)

- Of those 129, 60 are beating the market (meaning 69 are losing to the market)

In other words:

- We're only delivering a positive return 57% of the time (just under 6 out of 10)

- We're only beating the market 47% of the time (just under 5 out of 10)

But get this: being 'right' 5-6 times out of 10 means our average return is 48.1% per recommendation, well ahead of the ASX average return of 41.7%.

(The last 12 months has been tough for the sorts of companies we prefer — growing businesses with long runways ahead of them. Time will tell, but I think we'll get back closer to the 2018 proportions over time. The key point holds, though, in both time periods: our winners are winning and making us more than our losers are costing us. That's a good equation.)

4. We're diversified — and you should be, too

Diversification has been described as 'the only free lunch in investing'. Whether that's true or not, being diversified across a large number of shares is vital.

As I said, above, we're 'right' about 60% of the time. I won't go into the statistics here, but essentially, the more shares you own, the more likely you are to own a representative sample of our scorecard.

If you buy one recommendation, it's almost a coin toss whether you win or lose.

We know that a fair coin has a 50% chance of landing on heads and a 50% chance of landing on tails, but if you only toss it once, you'll either get 100% heads or 100% tails.

Toss it three times, and you'll either get 33% heads, 67% heads or 100% heads.

The more times you toss the coin, the closer the return will get to the average odds of 50%. You should consider your portfolio the same way.

Be diversified. Get to 15-20 holdings as quickly as you reasonably can.

Remember: If a stock picker — us or someone else — is 'good', they'll be right only 60% of the time. You need to own enough stocks to put the odds in your favour.

5. We're long-term investors

God love chart readers. And short-term traders. They're pursuing a degree of difficulty that even Olympic divers would shy away from. And with much lower odds of success.

Not only do we embrace diversification, but we know that market-beating results will come over the long-term. And there's a very good reason why:

Someone smart once encapsulated the challenge like this: "If you want to beat the market, you have to do something different to the market." Sensible, right?

Except that here's the thing: In the short term, you're betting against the consensus. The market has determined a price for a company, but you're buying it because you think it's cheap — that the market has made a mistake.

By trying to beat the market, you're saying to the market "I think you're wrong". You're choosing to zig when the market zags. And unless you have incredibly lucky timing, the market's going to keep disagreeing with you for a while.

Let's say you thought Woolworths shares were overpriced at $30 back in 2012. Then they went to $34 in 2013 and $37.50 in 2014. Of course, you and I know that they hit $21 by 2016. You were right in 2012, but you had to wait a while to be proven correct.

Or say you liked Cochlear at $85 in 2011. The shares subsequently fell to under $55 by the end of that year. "You're wrong!" shouted the market. And you were tempted to believe it. At the time of writing, shares were changing hands for over $220 a piece.

Just because you're right doesn't mean the market will agree with you straight away. It can take time for a company's full value to be realised by the market. Or, as Warren Buffett's mentor Ben Graham put it:

"In the short run, the market is a voting machine but in the long run it is a weighing machine."

The other benefit of being a long term investor is that, if you find — and buy — a quality business, you can reap rewards for a long time, courtesy of the wonderful benefits of compounding.

Thanks to our 'Buy-to-Hold' mentality, we have sold relatively few of our recommendations, meaning we've enjoyed gains of 4 times, 7 times, and 10 times our money on individual recommendations. We've had some losers, too, of course, but the overall result has been very pleasing.

You might have heard the line 'you don't go broke taking a profit'. That's probably technically true, but you don't get rich taking a profit, either!

6. We work on our temperament

"In theory there is no difference between theory and practice. In practice there is." — Yogi Berra

The first five points, above, outline our approach to investing. I haven't gone into the nitty-gritty of how we find and evaluate different ideas… that's a whole other lengthy essay. But those five points:

- Stand on the shoulders of giants

- Be prepared for volatility

- Know the odds

- Diversify; and

- Be long-term

… are the bedrock of our successful investing approach. (For the record, our US sister company takes the same approach and its Stock Advisor service has been soundly beating the market since 2002).

But as Yogi Berra inferred (at least, I think!), there's difference between having the information and being able to use it well.

Knowing markets rise, over time, is one thing. Being able to hold on, in the face of a market crash such as the one we experienced during the GFC, is quite another.

Of course, it was the right thing to do. But some investors just couldn't stand it, selling out in despair at exactly the wrong time.

The same thing happened during the COVID crash, when some very smart, seasoned investors tried to time the market and, well, missed out.

This isn't our first rodeo. I was investing when the dot.com bubble was inflating, and during the bust that followed. I was investing during the GFC. I'll be investing when the next market crash arrives… and during it… and after it.

You need to be prepared for it, financially, mentally and emotionally. My hope is that, when that next crash does come, our members will be able to use our services as a touchstone: that we will have prepared them — you — for it, that we can hold your hand through it, and that we can help you come out the other side with maybe a couple of battle scars, but still investing, Foolishly.

Over to you

That, in a nutshell, is the way we approach investing. It is, I hope, how you'll approach investing, too.

And, whether you're a member of one of our services, or a reader of our articles at Fool.com.au or via email, I hope it gives you a better sense of how to make best use of our services, to set you up for the best possible chance of long-term success.

To mangle a metaphor, we think investing (capital-F) Foolishly is a great way to build long-term wealth, but it's a six-legged stool (I know, but work with me). If you take away one of those six things listed above, I believe you reduce, perhaps significantly, your chances of achieving your goals. Take away two or more, and your odds fall to very low levels, indeed.

So, over to you, Fool.

Fool on!

Scott Phillips

Chief Investment Officer, The Motley Fool

P.S.: Want to know more about The Motley Fool? Click here to learn all about us.