- Understanding time and compounding

- What to consider when calculating compound interest

- Increased compounding periods/frequency

- The effect of time

- Simple vs. compound interest

- Where does compound interest come from?

- Why is compounding over time essential?

- Get started with compounding your wealth

- How does compounding work with shares?

- Want to learn more about investing?

The effects of compounding over time are what make compound interest such a powerful force.

Albert Einstein is once claimed to have said: "Compound interest is the most powerful force in the universe. Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't pays it."

Let's heed his advice because Albert Einstein was one smart cookie. Once you understand the remarkable power of compounding, you can harness it to your advantage.

In this article, you'll learn what compounding is, how to calculate it, and what you can do next to turbocharge your savings account and share portfolio.

Understanding time and compounding

Before we delve into compounding, let's take a look at simple interest.

Simple interest is calculated on the initial principal. For example, if you have $10,000 in the bank and your simple interest rate is 4%, then the interest earned is $400. Very clear and simple to understand.

Your savings grow steadily, but there's no exponential growth. However, with compounding interest, your money accumulates faster because you earn interest on top of interest.

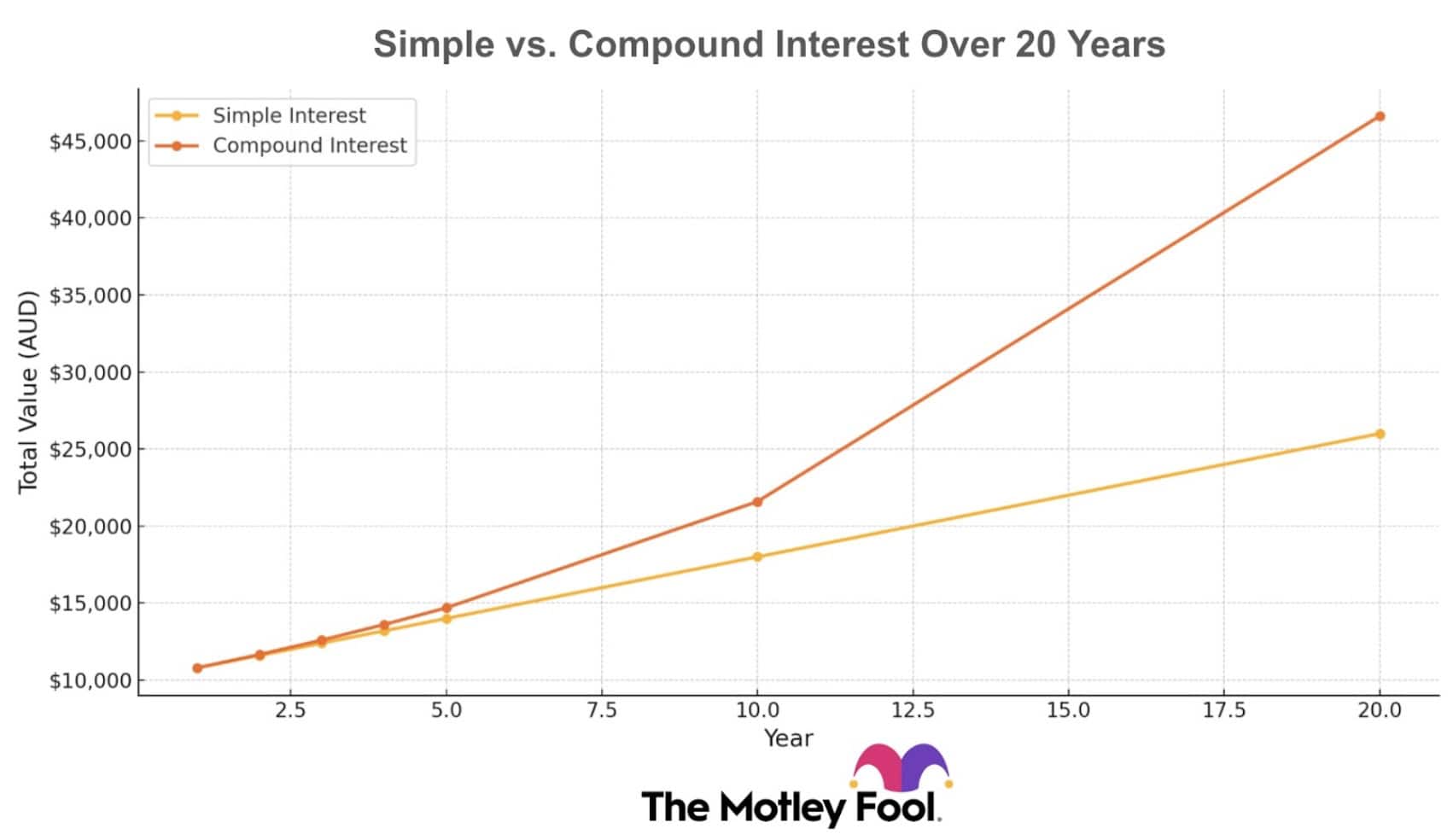

Let's take the earlier example and double it with an 8% growth rate (which is roughly the growth of the S&P/ASX All Ordinaries Total Return Index of the past 20 years). With simple interest, you would end up with $26,000 AUD. With compounding interest, you would have over $46,000 AUD after 20 years.

This graph depicts the differences in growth rate: (see the year-by-year amounts further below)

As you can see, the impact of compounding interest over the long term effectively supercharges your investment return.

Compound interest doesn't just apply to savings in the bank. It also works on your share portfolio. When people refer to compounding in relation to investments, they're talking about the process whereby investment returns are reinvested to generate additional returns over time.

What to consider when calculating compound interest

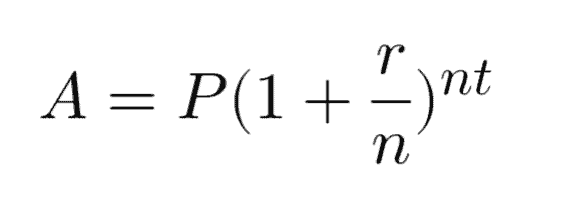

To calculate compound interest, we need to use the compound interest formula:

A = Final amount, including principal

P = Principal amount

r = Interest rate

n = Number of times interest is calculated per time period

t = Number of time periods

With compound interest, you earn interest on previous interest payments. To benefit from compounding, you need to reinvest the returns made on your investments, whether they are in the form of interest payments, dividends, or capital gains.

The effects of compounding apply equally to investments in ASX shares and cash in the bank. With ASX shares, you earn dividends on your dividends. With cash in the bank, you earn interest on your interest. This allows your wealth to grow at an accelerated rate.

Increased compounding periods/frequency

You only need three inputs to take advantage of compounding – time, money, and earnings. The effects of compounding, however, will vary depending on the specifics of those inputs. The greater the compound frequency, the faster your investment will grow.

So, if you have two otherwise identical investments, but one is compounded annually while the other compounds twice as often, the one that compounds more frequently will earn greater returns over the long term. The more frequently earnings are compounded, the more rapidly your money can grow.

Regularly contributing to your principal or share portfolio will also help you grow your wealth over time. A good rule of thumb is to make regular and consistent contributions and let the wonderful power of compounding work its magic.

The effect of time

Here is an example of the impact of saving and compounding over time.

Let's say you have three people who start saving at different points in their lives. One person makes an initial investment at age 25, another at age 35, and the other at age 40.

The first two investors save $300 per month, while the last investor saves $600 to catch up for lost time.

Each investor earns an annual interest rate of 5%.

Comparing the results of all three investors when they reach age 65, we can see how investing early pays off.

- Investor 1, who started saving at age 25, ends up with $460,000

- Investor 2, who started saving at age 35, ends up with $251,000

- Investor 3, who started saving at age 40, ends up with $180,000 despite investing more money.

Unsurprisingly, investor 1, who took advantage of compounding for the greatest number of years, ended up with the greatest amount of money.

Simple vs. compound interest

There is a major difference between simple and compound interest. With simple interest, your interest is calculated solely on your principal amount. You do not earn interest on interest.

As for compound interest, it's calculated on the principal amount and previous interest payments, so you do earn interest on interest.

Here's an example of simple interest over 20 years with an 8% return.

| Year | Balance | Annual interest | Total value |

| Year 1 | $10,000 | $800 | $10,800 |

| Year 2 | $10,000 | $800 | $11,600 |

| Year 3 | $10,000 | $800 | $12,400 |

| Year 4 | $10,000 | $800 | $13,200 |

| Year 5 | $10,000 | $800 | $14,000 |

| Year 10 | $10,000 | $800 | $18,000 |

| Year 20 | $10,000 | $800 | $26,000 |

That's $26,000 total value across 20 years.

Now, with compounding interest, you earn interest on your initial deposit and every interest payment made on top of it.

Here's how compound interest plays out over 20 years at an 8% interest rate.

| Year | Balance | Annual interest | Total value |

| Year 1 | $10,000 | $800 | $10,800 |

| Year 2 | $10,800 | $864 | $11,664 |

| Year 3 | $11,664 | $933.12 | $12,597.12 |

| Year 4 | $12,597.12 | $1,007.77 | $13,604.89 |

| Year 5 | $13,604.89 | $1088.39 | $14,693.28 |

| Year 10 | $19,990.05 | $1599.20 | $21,589.25 |

| Year 20 | $43,157.01 | $3,452.56 | $46,609.57 |

That's more than an extra $20,000 additional value just by taking the interest and reinvesting it.

As you can see, thanks to continuous compounding, your money snowballs. Of course, the big lesson here is that the earlier you start, the better. The longer you can reap the benefits of compounded interest the better. You can experiment using a savings calculator online to see the effects of compound interest over different time periods.

Where does compound interest come from?

The concept of compound interest has been around for a very long time. however, the modern understanding and widespread use of compound interest can be traced back to the development of modern banking in 17th-century Europe.

During this time, banks began offering interest-bearing accounts to depositors, and the concept of compound interest became a fundamental part of modern finance.

Today, compound interest is used in a wide variety of financial applications, from simple savings accounts to complex investment portfolios. It is a powerful tool for growing wealth over time and has played a critical role in the development of modern finance and economics.

Why is compounding over time essential?

Compounding plays a pivotal role in growing your wealth. Your money won't grow if you keep it under the mattress. But if you invest your money and let the power of compounding work for you, it can grow exponentially over time.

Warren Buffett made most of his wealth later in life, thanks in no small part to the effect of compounding on his investments. The investment icon turned a net worth of $1 million at age 30 into $1 billion by the age of 56. He is now worth some $70 billion.

"My wealth has come from a combination of living in America, some lucky genes, and compound interest," Buffett said.

Get started with compounding your wealth

If you would like to play around with some numbers and understand the power of compounding, you can do so using this compound interest calculator.1

Simply enter the initial principal, monthly contributions, and interest rate, and the calculator will automatically calculate the numbers for you.

Remember: The sooner you get the magic of compounding working for you, the sooner you'll be able to turbocharge your wealth.

How does compounding work with shares?

The effects of compounding work similarly for share portfolios as they do for money in the bank. The key is to reinvest your investment earnings.

ASX shares generate earnings in the form of dividends and capital gains. If you reinvest these earnings in more shares, you can earn more dividends and capital gains.

These can be reinvested to earn more again! Not only are you making earnings on your initial investment, but also on your earnings. This can result in your wealth rapidly snowballing.

The longer you leave your investments to compound, the greater the effects will be. Time is the magic ingredient in the compounding formula.

An investment left untouched for decades can add up to a sizeable sum, even if you never add another dollar. That's what makes compounding so powerful and how it can help you exponentially grow your wealth.

Want to learn more about investing?

You've come to the right place!

This article is part of Motley Fool Australia's comprehensive Investing Education series, covering everything from budgeting and saving to basic investing concepts and how much money you'll need to start.

Packed with easy-to-understand and regularly updated information, our articles contain the answers to your most frequently asked questions about share market investing.

Motley Fool's Education series is tailored for beginner and experienced investors alike and also includes helpful tools and resources, an A-Z glossary of Investing Definitions, and guides to specific topics of interest, including retirement planning, gold and property investment.

- The previous article in this section covers different types of investments

- Check out our next article to learn more about risk and reward

Frequently Asked Questions

-

In finance, 'compound' refers to the process of earning interest on both the initial principal and the accumulated interest from previous periods. This is known as compound interest. Unlike simple interest, where you earn interest solely on the principal amount, compounding allows your investment to grow at an accelerated rate because you earn interest on all previous interest payments as well as the principal amount, creating a snowball effect.

If you invest a sum of money and it earns interest, that interest is added to the original principal amount, and in the next period, you earn interest on this new, larger amount. This process repeats over time, leading to exponential growth of your investment. Compounding can be applied to various financial instruments, including savings accounts, bonds, and dividends or capital gains from stocks, making it a fundamental concept in personal finance and investment strategies. The power of compounding is maximised over time, making it especially beneficial for long-term investments.

-

The number one rule of compounding, according to investing legend Charlie Munger, is to "never interrupt it unnecessarily". This rule highlights the importance of allowing your investments to grow over time without withdrawing the gains prematurely. The power of compounding is most effective when earnings (such as interest, dividends, or capital gains) are continually reinvested over long periods. By not interrupting this process, the initial investment and the accumulated earnings from previous periods can generate even more earnings. Munger's advice underscores the value of patience and long-term thinking in investing. It suggests that the key to building wealth is reinvesting and allowing the compounding process to work its magic over many years.

-

Time plays a critical role in compound interest, significantly influencing the growth potential of an investment. The key principle is that the longer your money is invested, the more time it has to grow through compounding. With compound interest, you earn interest not only on your original principal but also on the interest that has been added to your investment over time. The impact of compounding is relatively modest in the early years but becomes increasingly powerful over time. This is often referred to as the 'snowball effect'. As your investment grows, the amount of interest it generates grows as well, leading to faster and larger increases in the total value of your investment. The longer the period, the more interest accumulates on top of interest, leading to exponential growth.