A year ago, Shaw and Partners portfolio manager James Gerrish bought up tech shares with the belief that they were about to pop.

He was proven right as the technology sector rallied hard in 2023, especially in the first half.

But now he and his Market Matters team have cooled on technology and are seeking the next bargains to buy.

"Market Matters has now donned its 'seller hat' with regard to tech stocks from a risk-reward perspective."

Let's check out which industries they are keen on for a 2024 rally:

The ASX sector regaining its mojo

With the funds from selling off tech stocks, Gerrish revealed his analysts would likely buy into the resources, healthcare, and real estate sectors.

One driver of this belief is that bond yields will settle down heading into next year.

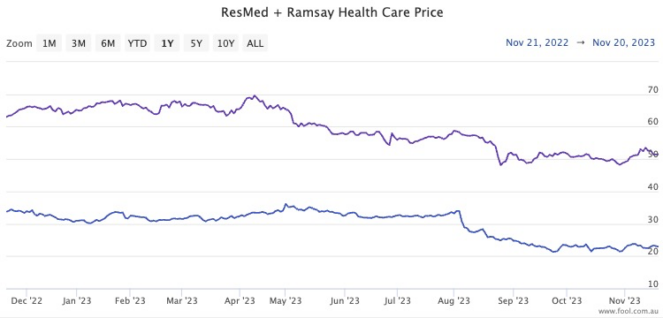

"Healthcare stocks historically struggle when bond yields rise," said Gerrish.

"If we are correct about bond yields into 2024, the healthcare sector should regain some of its 'mojo'."

His analysts are currently backing Resmed CDI (ASX: RMD) and Ramsay Health Care Ltd (ASX: RHC).

Real estate is an obvious pick with interest rate rises nearing the end, although the sector has already rallied in recent weeks.

"We have recently purchased Goodman Group (ASX: GMG) and Lendlease Group (ASX: LLC) for further real estate exposure in our active growth portfolio.

"In contrast, our active income portfolio holds Dexus (ASX: DXS) and Centuria Capital Group (ASX: CNI), which feels on point after the sector's sharp +15% advance."

Revival of economy means revival of this sector

Many resources stocks have sold off this year as dark economic clouds have moved in.

But with 2024 potentially seeing a recovery, commodities like coal and copper could be roaring back.

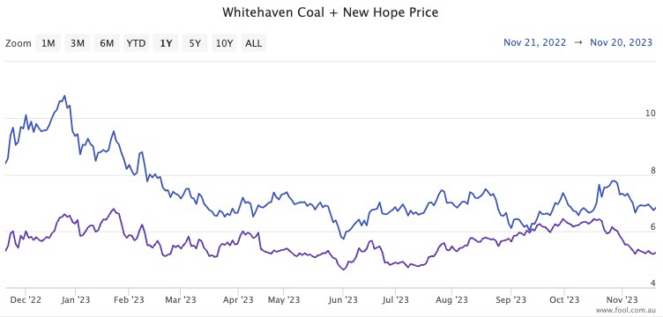

"Market Matters is bullish on coal stocks through 2024/5," said Gerrish.

"Since COVID, the coal price has been on a rollercoaster ride, with the last 12 months [seeing] ~70% decline, taking prices back down to more sustainable levels."

Unfortunately, it looks like the transition to clean energy sources will take longer than many of us would like. This means, according to Gerrish, coal shares will benefit.

And they are cheap right now.

"Whitehaven Coal Ltd (ASX: WHC) is trading on a PE of ~8x while being forecast to yield north of 6%," he said.

"We continue to like Whitehaven Coal for growth and New Hope Corporation Ltd (ASX: NHC) for income."

Copper is also critical for the transition to net zero.

"We are bullish on copper, believing China will rise from the ashes as Beijing increases stimulus," said Gerrish.

"And the supply side of copper will provide a significant tailwind over the coming years while demand should be firm as electric vehicle take-up increases — i.e. EVs use far more copper than traditional vehicles."

Because of China's sputtering economy this year, copper shares remain decent value to buy at the moment.

"We own Sandfire Resources Ltd (ASX: SFR) and BHP Group Ltd (ASX: BHP) for copper exposure.

"We may increase one/both of these into 2024 – we added to our Sandfire in the emerging companies portfolio on Monday."