Turning $100,000 into a million bucks might sound like magic.

But no one needs supernatural powers if they use ASX shares and compounding to their advantage.

Allow me to introduce you to three stocks that I reckon could do the trick:

Temporary glitch, with long-term tailwinds still there

Johns Lyng Group Ltd (ASX: JLG) is an insurance claims repairer that has been a favourite of professional investors for years now.

And why not? The stock price has gained an astounding 366% over the past five years for an incredible compound annual growth rate (CAGR) of 36%.

With the world unfortunately seeing more extreme weather events due to global warming, building repair demand from insurers is on an upward trend.

The great news for those who haven't bought Johns Lyng yet is that the stock is in a bit of a dip right now.

The company put out a half-year result in February that didn't quite meet expectations, so the stock tumbled more than 13% in a single day.

Earnings before interest, taxes, depreciation, and amortisation (EBITDA) were up, but sales revenue and net profit after tax (NPAT) both dipped.

Professional investors aren't panicking, though. They have their eyes on the prize in the long run.

Nine out of 11 analysts currently surveyed on the broking platform CMC Invest still reckon Johns Lyng is a buy. Eight of those recommend it as a strong add.

Look past the fear for these ASX shares

Similar to Johns Lyng, healthcare stock Neuren Pharmaceuticals Ltd (ASX: NEU) is also in a funk of late.

After snatching the crown as the S&P/ASX 200 Index (ASX: XJO)'s best performer in 2023, the stock has dived more than 16% to start 2024.

Much of that market fear has been driven by a short seller report that criticised the effectiveness of its Daybue drug.

But again, similar to Johns Lyng, the professional community is ignoring the noise. In fact, many analysts say the claims in the short report are just plain incorrect.

For example, the team at Blackwattle told its clients that the fear-mongering was "at odds with trial data and the real-life experience of medical specialists, patients, and their carers".

The analysts at Elvest Fund have also told its clients that their "thesis for Neuren Pharmaceuticals is unchanged".

"New CY24 Daybue sales guidance of US$370 to US$420 million (+120%) underpins another solid year of royalty and milestone revenue for Neuren."

Neuren shares are roughly an 18-bagger over the past half-decade, equating to a crazy CAGR of 78%.

The ASX shares riding high on AI

The investment case for data centre operator Nextdc Ltd (ASX: NXT) is straightforward.

Artificial intelligence (AI) is in hot demand. AI requires huge computing power. Those computers need to be housed somewhere.

This tailwind has already been recognised, with NextDC shares rocketing 75% over the past 12 months.

But many experts believe the world is at the start of its AI journey.

Fifteen analysts out of 18 currently surveyed on CMC Invest recommend buying NextDC shares.

Over the past five years, the stock has realised a 23% CAGR.

Of course, not all shares you buy will do as well as the above trio.

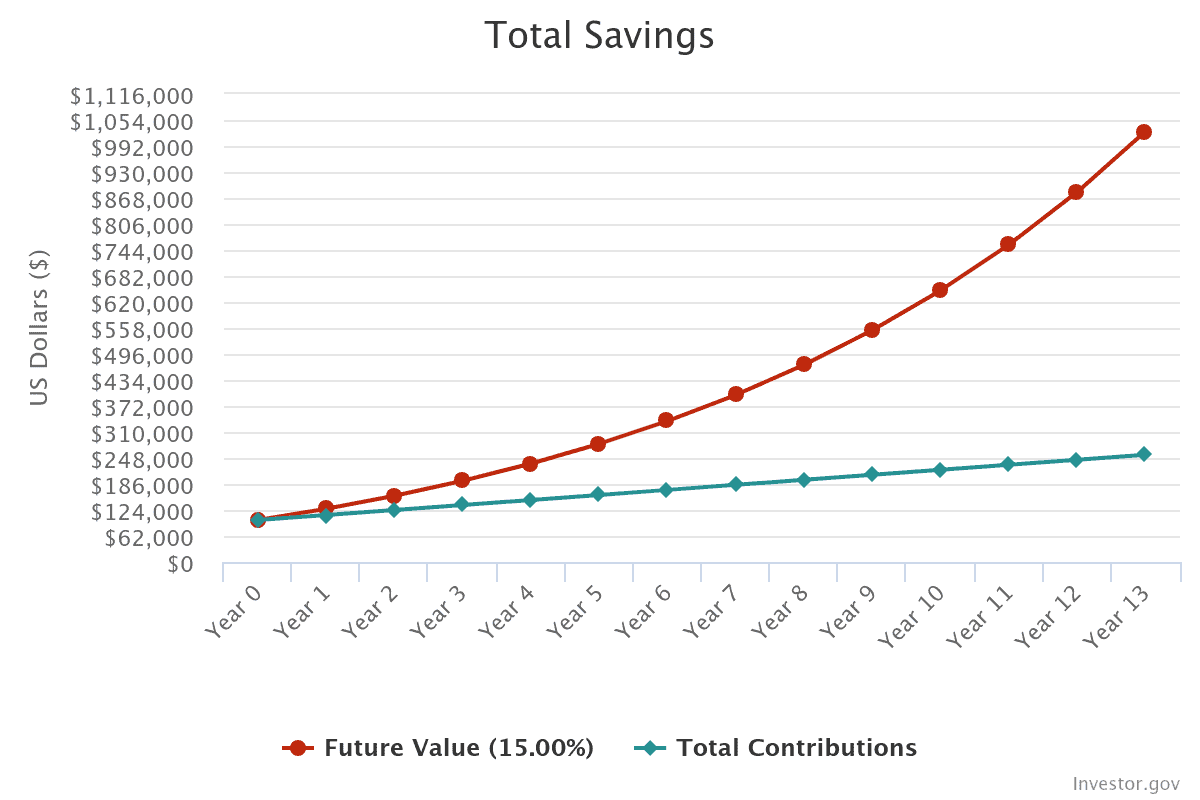

But with proper diversification, it's not out of the question that your portfolio could achieve an average of 15% CAGR with the help of such massive winners.

So if you start with a $100,000 portfolio and then keep adding $1,000 to it each month, after 13 years, the nest egg will have expanded to $1,027,501.

And there it is, a million to your name.

Best wishes for your investments.