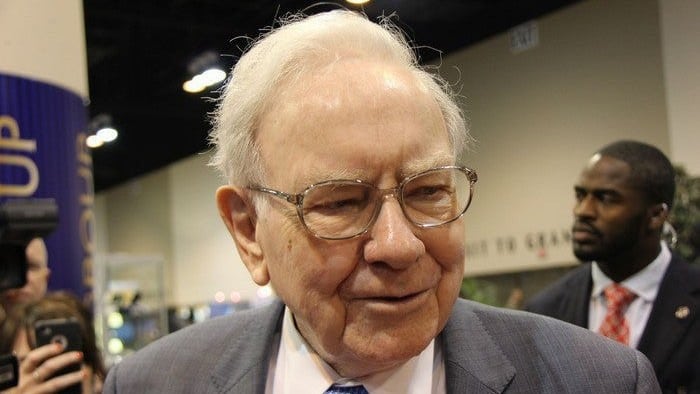

Warren Buffett, one of the world's greatest investors, has led Berkshire Hathaway to grow into one of the world's biggest businesses. There's an ASX share that's similar to Berkshire Hathaway called Washington H. Soul Pattinson and Co. Ltd (ASX: SOL), or Soul Patts.

Berkshire Hathaway has its own businesses, such as Geico (insurance), BNSF (railways), and Berkshire Hathaway Energy. The US giant is also invested in listed businesses, including Coca-Cola, American Express, Apple, Bank of America, and Occidental Petroleum.

Warren Buffett has shown a willingness to invest in businesses outside of the US in recent times. For example, Berkshire Hathaway has been investing in five Japanese businesses that are similar to the US company. Buffett said to CNBC:

I just thought these were big companies. They were companies that I generally understood what they did. Somewhat similar to Berkshire in that they owned lots of different interests.

And they were selling at what I thought was a ridiculous price, particularly the price compared to the interest rates prevailing at that time.

What does the ASX share do?

Soul Patts is an investment conglomerate. It's invested in numerous ASX shares including Brickworks Limited (ASX: BKW), TPG Telecom Ltd (ASX: TPG), New Hope Corporation Ltd (ASX: NHC), Tuas Ltd (ASX: TUA), Pengana Capital Group Ltd (ASX: PCG), BHP Group Ltd (ASX: BHP), Macquarie Group Ltd (ASX: MQG), CSL Ltd (ASX: CSL), Goodman Group (ASX: GMG) and Wesfarmers Ltd (ASX: WES).

The business has a credit/bond portfolio, an ASX small-cap share portfolio, a property portfolio (including a retirement living property) and a private equity portfolio.

Some of those private equity investments include swimming schools, investment banking and electricity/electrification.

The business continues to grow its portfolio as it invests in new opportunities with its retained cash flow from its investment portfolio.

Are Soul Patts shares at a ridiculous price?

Warren Buffett mentioned a "ridiculous price" when investing in the Japanese businesses. Let's look at the ASX share's value.

Soul Patts recently announced a financing update, which included an update about its FY24 result.

The company reported that its pre-tax net asset value (NAV) at 31 July 2024 is expected to be between $11.6 billion and $12 billion. That represents a year-over-year increase of between 7.4% to 11.1%.

According to the ASX, the business currently has a market capitalisation of $12.50 billion, so it's priced more expensively than the net value of its portfolio. I wouldn't call it ridiculously cheap, so I don't think Warren Buffett or Berkshire Hathaway will appear on the share register soon.

However, I'd be willing to buy some shares – I did recently – and hold it for the ultra-long term. The business is already 120 years old and I think it will offer plenty more compounding potential in the coming years.