Joel Greenblatt is a first class super-investor that should need no introduction. Over a 19 year stretch Greenblatt's hedge fund generated compound annual returns of an astounding 45%.

Over 19 years that turns a $10,000 jet ski in to an $11,641,046 private yacht.

Today, Greenblatt has pivoted 180 degrees from his origins in special situations. He is now managing over $5 billion with a quantitative value approach that is based on an expansion of his famous Magic Formula.

The premise of the Magic Formula is simple: buy good companies at a cheap price. Quality is measured by return on capital employed, while cheapness is measured by the earnings yield (EBIT/Enterprise Value).

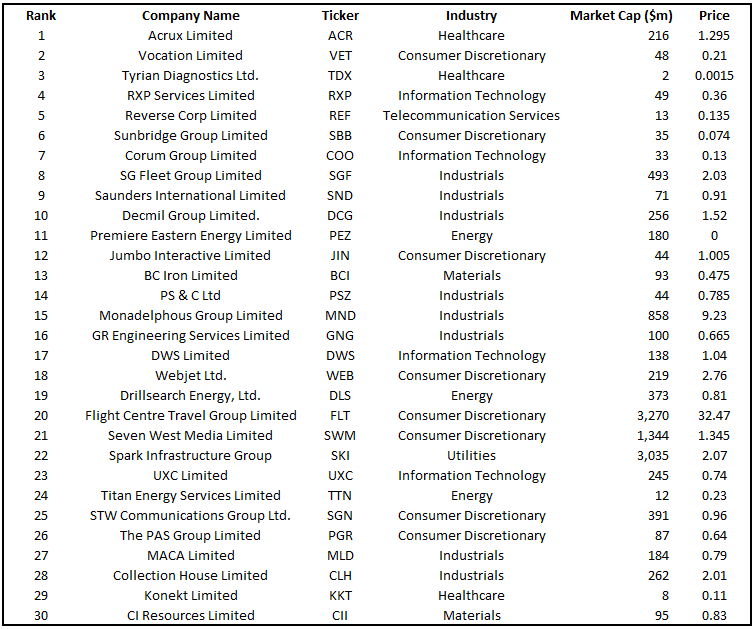

Applying this test to the Australian market, and filtering out financials we arrive at the following list.

(Data Source: Capital IQ)

This list will always be full of names that make investors squeamish. There is, after all, a reason that these companies are cheap.

But that is also why Greenblatt advocates a mechanical adoption of the Magic Formula strategy. When we add our own human biases to the process we are more likely to under-perform, not less.

There are two companies within this list that are recent additions to my own portfolio: Vocation (ASX:VET) and Reverse Corp (ASX:REF).

Neither are pretty businesses. Vocation faces a class action lawsuit regarding its disclosure practices, and Reverse Corp's reverse calling 1-800 number faces long term structural decline. The bear case is easy to make for each, but that is the nature of deep value investments.

What matters is the price that we pay for a given level of quality. Reverse Corp's main business may be in structural decline, but with $6 million in cash and expected half year EBITDA of $1.35 million, it doesn't take much to justify the current $12.5 million valuation.

Following a mechanical quantitative-value approach empowers us to avoid the gag-reflex that these type of companies typically engender.

I back tested this approach over the past 12 months. The results were encouraging. The December 2013 portfolio of 30 companies is up 8.01% for the year, compared with the All Ordinaries which is down -1.07%.

However it must be noted that this back test is subject to survivorship bias. I have taken a list of the 2,144 companies that currently make up the ASX and then selected based on what their rankings would have been a year ago. This excludes any companies that would have been selected a year ago but which have since stopped trading under that name (bankruptcy, reverse listing etc).

I will be revisiting this list throughout 2015 to see how it is doing, and re-balancing the portfolio. I am also looking at a couple of ways to tweak the algorithm and underlying data to better target what Greenblatt is reaching for.

It is easy for us to dismiss the Magic Formula as too simple to be taken seriously. But with one of the world's all time greatest investors now managing over $5 billion using a modified version of this strategy, it's about time the Magic Formula gets the attention it deserves.