At a macro level, ASX shares outperformed investment property in 2024.

The benchmark S&P/ASX 200 Index (ASX: XJO) lifted 7.49% last year, with total gross returns (including dividends) of 11.44%.

Meantime, the median national home value rose by 4.9%, with total gross returns (including weekly rents) of 8.9%, according to CoreLogic data.

Shares vs. property: What's the outlook for 2025?

Looking ahead to the outlook for shares vs. property in 2025, Morgan Stanley predicts the ASX 200 will rise to about 8,500 points by year's end.

This implies a potential uplift of 1.08% from Friday's closing value of 8,408.9 points.

Dr Shane Oliver, Chief Economist at AMP Ltd (ASX: AMP), is more bullish.

He expects the ASX 200 to rise to 8,800 points by year's end, a potential 4.6% rise. But he factors in a "highly likely" 15% correction along the way.

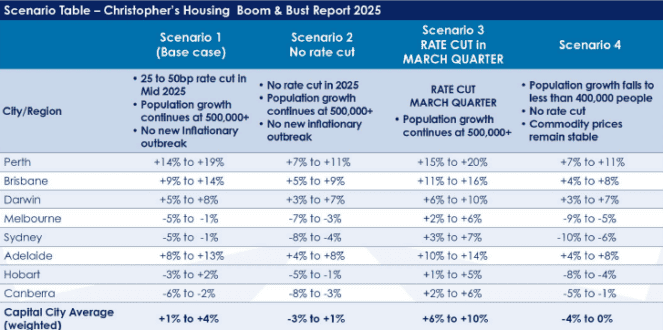

Meantime, Louis Christopher, Head of Research at SQM Research, expects capital city home values to rise by 1% to 4% under his base case scenario this year.

His base case involves a 25 to 50 basis-point interest rate cut in mid-2025, continued population growth above 500,000 per annum, and no inflationary outbreak.

Christopher is more ambitious for home values if a rate cut occurs sooner, in the March quarter, and population growth continues at 500,000-plus. In this case, he predicts capital city price rises of 6% to 10%.

Check out Christopher's specific predictions from his annual Housing Boom and Bust Report below.

Which ASX stocks are ripe for investment?

Now that we've looked at the macro view for shares vs. property, let's drill down to some specifics.

Based on recent notes from top brokers, here are some ASX stock picks for your consideration this year.

Goldman Sachs has a buy rating on BHP Group Ltd (ASX: BHP) with a share price target of $46.80.

A share price target is a broker's estimate of how much a stock will be trading for in 12 months' time.

Goldman is also encouraging investors to buy the dip on Woolworths Group Ltd (ASX: WOW) shares after a significant fall in 2024. Goldman has a $36.10 share price target on the supermarket giant.

The broker also likes Xero Limited (ASX: XRO) shares (price target $201), CSL Ltd (ASX: CSL) (price target $325.40), and Web Travel Group Ltd (ASX: WEB) (price target $7).

Morgans has an add rating on Lovisa Holdings Ltd (ASX: LOV) with a 12-month price target of $36.

The broker also has add ratings on ASX gold stock Regis Resources Ltd (ASX: RRL) (price target $3.82), Pilbara Minerals Ltd (ASX: PLS) (price target $3.25), and Nextdc Ltd (ASX: NXT) (price target $20).

Bell Potter likes Boss Energy Ltd (ASX: BOE) and has a $4.70 price target on the uranium mining stock.

The broker also sees value in diversified asset manager HMC Capital Ltd (ASX: HMC) with a price target of $13.50.

Hot suburb picks for 2025

The CEO of McGrath Estate Agents, John McGrath, has outlined his top suburb picks along the East Coast of Australia for the new year.

National network LJ Hooker has also released its hot spot forecasts for 2025.

In NSW, McGrath likes Glebe, Millers Point, and Eastlakes in Sydney and Long Jetty on the Central Coast.

LJ Hooker names Mosman, Freshwater, Blacktown, and Wattle Grove in Sydney, along with Orange and Warrawong in the regions, as 2025 hot spots.

In Victoria, McGrath likes Keilor East, St Kilda East, and Altona North in Melbourne. His top regional pick is Spring Gully, on the edge of Bendigo.

LJ Hooker names Werribee and Frankston in Melbourne as hot spots, along with Geelong and Ballarat in the regions.

In Queensland, McGrath tips Springwood, Forest Lake, and North Ipswich in Brisbane. In the regions, he likes Caloundra West on the Sunshine Coast and Townsville in North Queensland.

LJ Hooker tips Coorparoo and Springfield Lakes in Brisbane, along with Toowoomba and Nambour in the regions.

In Tasmania, McGrath likes Kingston in Hobart, Legana in Launceston, Latrobe in Devonport, and Primrose Sands in the regions. LJ Hooker also tips Kingston in Hobart.

In South Australia, LJ Hooker tips Hillcrest and Seacliff in Adelaide and Port Lincoln in the regions.

Over in Western Australia, LJ Hooker names Innaloo in Perth and Busselton and Geraldton in the regions as areas to watch.

In the ACT, LJ Hooker names Kambah, Wright, and Amaroo as 2025 hot spots.

McGrath says affordability remains a key issue for buyers this year.

He says:

The age of 2% to 3% mortgage rates is over, and many buyers are responding to tighter credit by moving to more affordable areas, particularly along the coast, or buying smaller homes in the cities.

LJ Hooker Head of Research, Mathew Tiller, says interest rates will "heavily influence market performance in 2025, and the impact will be dependent on the timing and the depth of the cut".

He comments:

An earlier announcement and a significant reduction will likely strengthen the market, while prolonged rate stability at elevated levels may soften conditions.