Perhaps unexpectedly, 2024 has been a phenomenal year for anyone with a decently diversified share portfolio. The highest Australian interest rate in 13 years has proved insufficient to derail markets, which have kept chugging like a freight train.

Of course, the year isn't over, and anything can happen. But I'll risk prematurely counting my chickens to squeeze in my annual review before everyone is comatose from too much trifle and plum pudding… myself included.

Reflection is a grossly undervalued practice — not just for investing but also in life. After all, "Those who fail to learn from history are doomed to repeat it." By reviewing what has transpired before, we can better understand what should be done moving forward.

As of today, my stock-picking portfolio has returned 63.9% in 2024 (including dividends). How does that compare to the broader market? Below are a few indices to stack it up against:

- S&P/ASX 200 Index (ASX: XJO) gross total return of 12.3%

- S&P 500 Index (SP: .INX) return of 27.6%

- Nasdaq Composite (NASDAQ: .IXIX) return of 35.0%

- iShares MSCI World ETF (NYSE: URTH) return of 22.3%

I won't claim to be some Sage of the Sunshine State. Some years are better than others, and to claim victory as an investor because of one good year would be fallacious. But there is merit in deciphering what worked and trying to replicate the success repeatedly.

What's inside the share portfolio?

In many ways, this year has been a continuation of the last. Again, tech and consumer discretionary have shined bright despite crimped household budgets.

Some of this is arguably fuelled by the excitement surrounding artificial intelligence. This is supported by such companies seeing their valuations soar more from an increasing price-to-earnings (P/E) ratio than profit growth.

It makes the stellar year somewhat hard to celebrate. Yes, in the short term, it's great for the ego and the wealth on paper. However, it's not what you want as an investor in the long run. The premium paid for a slice in a company can not expand forever; eventually, its earning power must support it.

A few of my top holdings, Tesla and Apple, are guilty of this earnings-deficient rally. The heightened premium probably reflects optimism about future profitability as we hopefully emerge from a high interest rate environment.

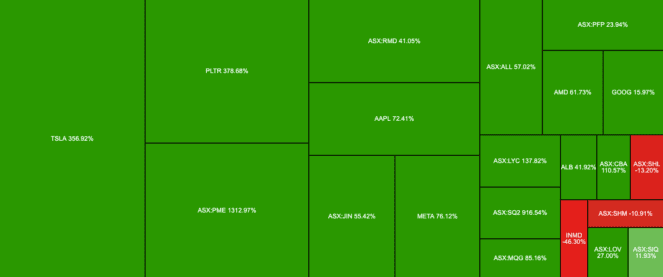

| Company | YTD return | % of Portfolio |

| Tesla Inc (NASDAQ: TSLA) | 75.6% | 21.9% |

| Palantir Technologies Inc (NASDAQ: PLTR) | 358.8% | 12.7% |

| Pro Medicus Limited (ASX: PME) | 159.5% | 11.9% |

| Resmed CDI (ASX: RMD) | 47.4% | 7.7% |

| Apple Inc (NASDAQ: AAPL) | 33.7% | 6.7% |

| Jumbo Interactive Ltd (ASX: JIN) | -0.3% | 5.7% |

| Meta Platforms Inc (NASDAQ: META) | 79.1% | 5.6% |

| Aristocrat Leisure Limited (ASX: ALL) | 66.7% | 4.6% |

| Propel Funeral Partners Ltd (ASX: PFP) | 13.1% | 3.3% |

| Advanced Micro Devices Inc (NASDAQ: AMD) | -8.4% | 2.8% |

| Alphabet Inc (NASDAQ: GOOG) | 37.1% | 2.7% |

| Lynas Rare Earths Ltd (ASX: LYC) | -6.2% | 2.3% |

| Block Inc CDI (ASX: SQ2) | 28.4% | 2.3% |

| Macquarie Group Ltd (ASX: MQG) | 22.3% | 1.7% |

| Albemarle Corporation (NYSE: ALB) | -32.3% | 1.3% |

| Commonwealth Bank of Australia (ASX: CBA) | 39.7% | 1.2% |

| Sonic Healthcare Ltd (ASX: SHL) | -13.4% | 1.1% |

| Inmode Ltd (NASDAQ: INMD) | -17.8% | 1.1% |

| Shriro Holdings Ltd (ASX: SHM) | -7.4% | 1.1% |

| Lovisa Holdings Ltd (ASX: LOV) | 20.0% | 1.1% |

| Smartgroup Corporation Ltd (ASX: SIQ) | -10.9% | 0.9% |

| Cash | 0.3% |

A few notable changes were made to my share portfolio this year.

- Increased my ResMed position

- Increased my Meta position (the owner of Facebook, Instagram, and WhatsApp)

- Added Aristocrat Leisure

- Added Alphabet (the owner of Google)

- Reduced my Propel Funeral Partners position on dilutionary concerns

- Exited Duxton Water amid worsening execution

- Exited Elders on increasing margin pressure

Ultimately, my big winners of 2024 are Tesla, Palantir, Pro Medicus, ResMed, Meta, and Aristocrat. In many cases, these are companies that have been (and possibly continue to be) misunderstood.

ResMed is a prime example. Investors ditched the sleep apnea maker, worried that weight-loss drugs would demolish its market. So far, the impact has failed to materialise, with some suggesting the Ozempic craze is giving the sleep apnea market a boost.

I think the lesson here is that it pays to build conviction. Once you've built a conviction based on logic, it's much harder to lose money through emotionally driven decisions.

Change afoot in 2025

A big part of investing is knowing thyself.

I have limited mining knowledge. So, what am I doing investing in Lynas and Albemarle?

Both investments were added to my share portfolio several years ago, rooted in basic supply and demand principles.

While I've managed to achieve decent returns from both, it isn't a great way to invest realistically. A business is more than its market, and I don't possess the comprehension to understand whether Lynas or Albemarle are good companies compared to their peers based on their resources.

For the above reason, I'll probably sell a few positions in 2025 and redeploy the money to companies I can better understand.