The S&P/ASX 200 Index (ASX: XJO) stock Washington H. Soul Pattinson and Co. Ltd (ASX: SOL), AKA Soul Patts, is soon going to report its FY24 first-half result. All eyes are going to be on Soul Patts shares later this month.

There are a lot of moving parts to the business – it owns sizeable stakes in numerous businesses including TPG Telecom Ltd (ASX: TPG), New Hope Corporation Ltd (ASX: NHC), Brickworks Limited (ASX: BKW), Tuas Ltd (ASX: TUA), Pengana Capital Group Ltd (ASX: PCG) and Apex Healthcare.

It also has an ASX large-cap share portfolio, with names like Macquarie Group Ltd (ASX: MQG), BHP Group Ltd (ASX: BHP), CSL Ltd (ASX: CSL), Wesfarmers Ltd (ASX: WES) and Commonwealth Bank of Australia (ASX: CBA).

Other segments of the business include a private equity portfolio, an emerging companies portfolio, a structured yield portfolio and a property portfolio.

What I'm expecting to see from Soul Patts shares

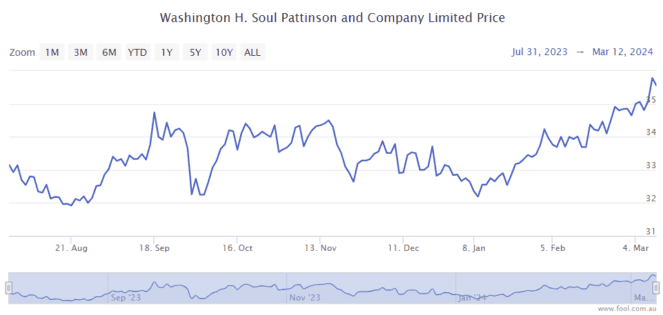

Over the six months to 31 January 2024, the Soul Patts share price (which rose by 4.4%) outperformed the ASX 200 (which climbed by 3.6%). It seems the ASX 200 stock will be able to report another good period of shareholder returns compared to the market.

I also expect that Soul Patts' board will decide to increase the dividend. It has increased its annual ordinary dividend each year since 2000, and I think that will continue. FY23 saw the ordinary dividend increase by around 20%.

One of the biggest positives in the result may be the amount of interest income that it generates from its cash and loans. The company has allocated a lot more to its structured yield portfolio over the last couple of years and it's generating a much stronger yield now.

A year ago, in the FY23 first-half result, we learned that New Hope accounted for $103 million of the $240.2 million total dividend and distribution income that Soul Patts made. However, the coal price has dropped heavily and New Hope's latest dividend – special and ordinary – was cut by nearly half to 30 cents per share.

We've also seen cuts from names like Macquarie and BHP.

But, other names like Brickworks, CBA and Wesfarmers have grown their dividend.

We don't know how the ASX 200 stock's private equity portfolio has performed, so that will be interesting to see.

Any new investments?

The business may provide some more detail about where it has been putting its money.

At the AGM in December, it said it had made some investments across its agriculture, credit and emerging companies.

It said it acquired one of the most advanced fruit packing and processing plants globally to its agriculture portfolio. Soul Patts also revealed that it had made a major investment in ASX uranium miner Nexgen Energy (Canada) CDI (ASX: NXG), which is reportedly developing the largest low-cost producing uranium mine globally.