This week's release of the latest GDP figures reinforced the fact Aussie consumers continue to feel the sting of inflation.

Our economy managed to eke out just 0.2% growth for the December quarter which – on a per capita basis – actually represented a 0.3% contraction over the three-month period.

With most of us still tightening our belts and a much-anticipated interest rate cut reportedly still many months away, we could all use some extra spending money!

So, we asked our Foolish writers which ASX dividend shares they think are the best buys right now to get that juicy passive income flowing.

Here's what the team came up with:

7 best ASX dividend shares for March 2024 (smallest to largest)

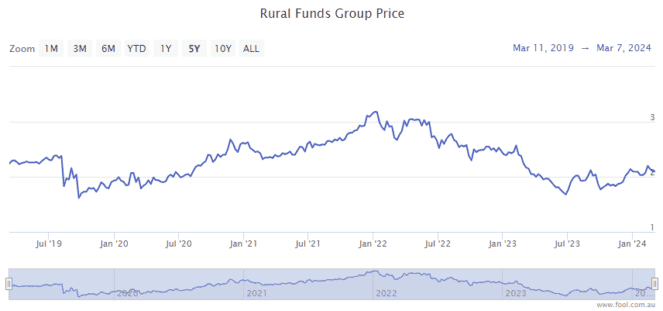

- Rural Funds Group (ASX: RFF), $833.26 million

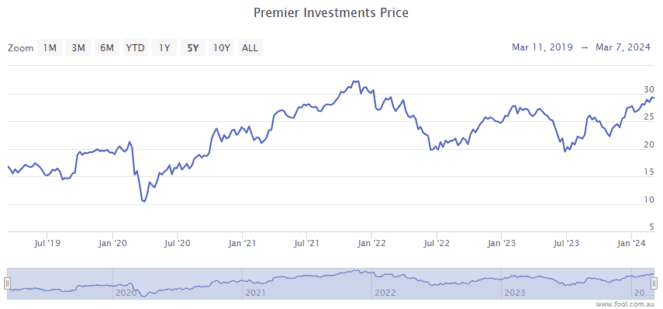

- Premier Investments Limited (ASX: PMV) $4.72 billion

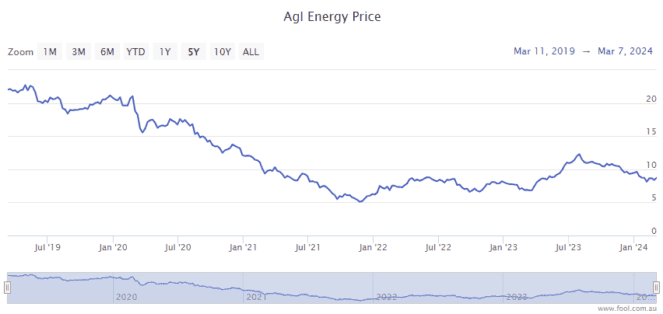

- AGL Energy Limited (ASX: AGL), $5.89 billion

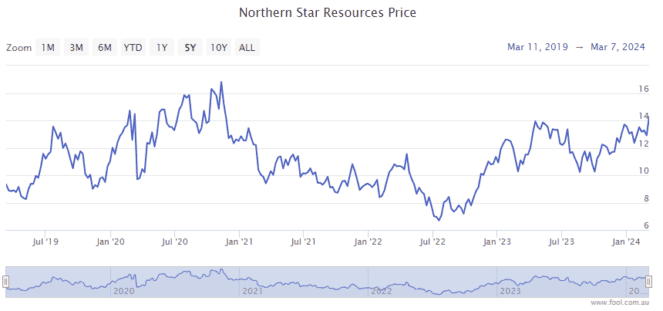

- Northern Star Resources Ltd (ASX: NST), $16.58 billion

- QBE Insurance Group Ltd (ASX: QBE), $25.58 billion

- Woolworths Group Ltd (ASX: WOW), $40.23 billion

- Telstra Group Ltd (ASX: TLS), $44.25 billion

(Market capitalisations as of market close 8 March 2024).

Why our Foolish writers love these ASX passive income stocks

Rural Funds Group

What it does: Rural Funds is a listed agricultural real estate investment trust (REIT) with a diversified farmland portfolio that is predominantly leased to corporate operators.

By James Mickleboro: The share market is trading within sight of a record high, and it is becoming harder and harder to find value. But that doesn't mean there aren't bargains out there.

I think Rural Funds could be classed as undervalued at present given its large discount to net asset value (NAV).

In addition, the company's shares offer a significantly better-than-average dividend yield. For example, management is guiding to an 11.73 cents per share dividend in FY 2024. This represents a yield of 5.6% for investors at current prices.

And with Bell Potter recently reiterating its buy rating and $2.40 price target on the ASX passive income stock, there's potential for some sizeable capital gains as well.

Motley Fool contributor James Mickleboro does not own shares of Rural Funds Group.

Premier Investments Limited

What it does: Nearly everyone who has been in an Australian shopping centre will have come across a retail brand operated by Premier Investments. Now spanning more than 1,100 stores across six countries, the likes of Just Jeans, Peter Alexander, Smiggle, and Portmans are highly established.

By Mitchell Lawler: If I had to guess what is most important to those seeking ASX passive income, from my personal experience, I would say it is consistency. A jumbo yield isn't much help if it's here one minute and gone the next.

Premier Investments strikes me as a company that has stood the test of time. Founded in 1987, the company is still growing to record profits and dividends, according to its latest full-year results. The combination of maturity and growth is an enticing duo for long-term income generation.

The company trades on a forward price-to-earnings (P/E) ratio of 18 times. It's a tad rich compared to the retail sector average. However, Premier Investments has a healthy balance sheet with $360 million in net cash and a strong history of achieving high returns on its capital.

Motley Fool contributor Mitchell Lawler does not own shares of Premier Investments Limited

AGL Energy Limited

What it does: AGL is an energy services provider that operates Australia's largest private electricity generation portfolio within the National Electricity Market. The company generates electricity using coal, gas, renewables like wind, solar and hydro, and batteries.

By Bronwyn Allen: AGL announced a near-360% rocketing in underlying profit after tax for 1H FY24 and a turbocharged interim dividend of 26 cents per share. That's 225% higher than last year and one of the biggest dividend boosts this earnings season.

Broker UBS retains its buy rating with a trimmed 12-month price target of $11.25. That's a potential 28.4% upside on the AGL share price of $8.76 at the close on Friday.

On top of that, the consensus forecast on CommSec is that AGL dividends will keep rising, from 50 cents in 2024 to 55 cents in 2025 and 58 cents in 2026.

Based on today's AGL share price, that's a yield of 5.7%, 6.3%, and 6.6%, respectively.

Motley Fool contributor Bronwyn Allen does not own shares of AGL Energy Limited.

Northern Star Resources Ltd

What it does: Australian gold producer Northern Star has a portfolio of high-quality, high-margin gold mining operations in Australia and North America. Those include the Kalgoorlie and Yandal projects in Western Australia, and the Pogo goldfields in Alaska.

By Bernd Struben: Northern Star might not be the first stock that springs to mind if you're after ASX passive income. The miner paid out 30.5 cents in unfranked dividends over the past 12 months. This sees shares trading on a trailing yield of 2.2%.

But I believe the ASX 200 gold miner's dividends and share price are set for a sizeable uptick in 2024 as the soaring gold price fuels its profits.

Earlier this week, bullion hit new all-time highs of US$2,142 per ounce, up 18% from US$1,820 per ounce on 5 October.

Macquarie is also bullish on Northern Star. Last month, the broker placed an 'outperform' rating on the gold miner, with a price target of $16.00. That's almost 11% above its price of $14.43 at Friday's close.

Motley Fool contributor Bernd Struben does not own shares of Northern Star Resources Ltd.

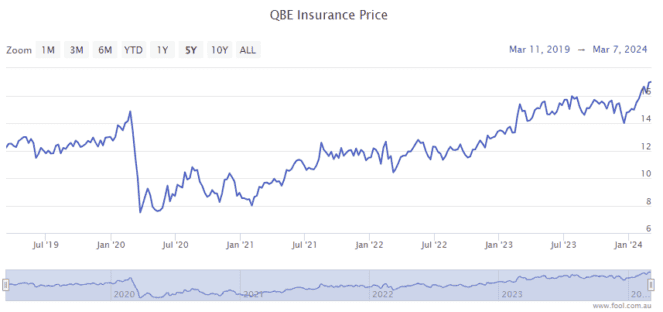

QBE Insurance Group Ltd

What it does: QBE is a consumer and commercial insurance company with headquarters in Sydney.

By Tony Yoo: I'm usually not a fan of insurance companies, but QBE has recently caught my eye, with multiple experts flagging it as one of the hottest ASX 200 stocks right now.

The company enjoyed an excellent February reporting season with higher interest rates bringing higher revenue on the money it invests from customer premiums. Marcus Today equities analyst Matthew Lattin noted how QBE's gross written premiums increased 10% in the last half-year.

A whopping 13 out of 14 analysts currently surveyed on CMC Invest reckon QBE is a buy. Trading at $17.09 at Friday's close, the QBE share price has risen 16.3% already this year, while the dividend yield stands at a tidy 3.6%.

Motley Fool contributor Tony Yoo does not own shares of QBE Insurance Group Ltd.

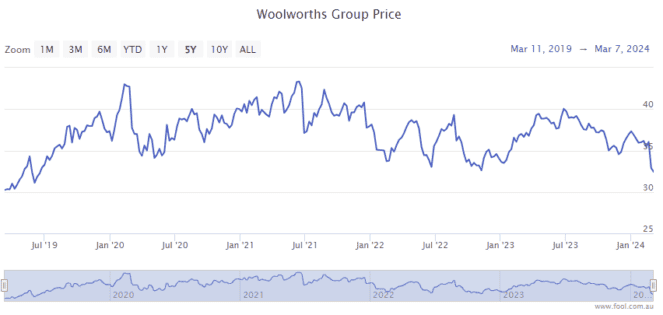

Woolworths Group Ltd

What it does: Woolworths is a company that needs little introduction. It is the largest supermarket chain in Australia with its vast network of eponymous stores. In addition, it also owns the Big W brand.

By Sebastian Bowen: I've rarely recommended Woolworths shares and usually prefer arch-rival Coles Group Ltd (ASX: COL) for income investing. But that's all changed this month, thanks to the steep share price fall Woolworths has suffered since its earnings report last month.

I've always liked Woolworths as a business but viewed its share price as too expensive and its dividend yield too low.

But on recent pricing, Woolies shares are at levels we haven't seen for a few years. This has pushed the company's fully-franked dividend well over 3%. As such, I think this ASX 200 passive income stock is well worth a look this March.

Motley Fool contributor Sebastian Bowen does not own shares of any stocks mentioned.

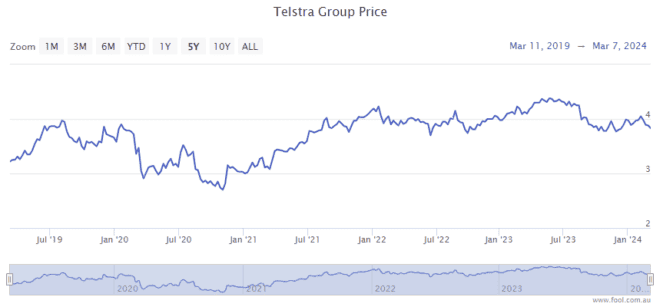

Telstra Group Ltd

What it does: Telstra is the largest telecommunications business in Australia, with the biggest mobile network and the most subscribers. It also has a lot of fixed telco infrastructure, offers NBN plans, and has an international presence. Telstra recently acquired Digicel Pacific.

By Tristan Harrison: With the Telstra share price trading around 52-week lows, I think this is a good time to invest in the telco. The inflationary environment has enabled the business to pass on inflation-linked price increases to subscribers, raising its average revenue per user (ARPU).

Telstra continues to win new subscribers each year, partly because Australia's population keeps increasing and partly because its network is, arguably, seen as better than the competition.

Furthermore, I believe telco earnings are more defensive than many other ASX sectors.

Lastly, the increasing ARPU and subscriber numbers are helping boost revenue and profit, which is enabling Telstra to grow its dividend. Commsec's estimate puts the FY24 Telstra grossed-up dividend yield at around 6.75%.

Motley Fool contributor Tristan Harrison does not own shares of Telstra Group Ltd.