If your New Year's resolution is to focus on building a strong financial future, an investment in ASX shares is a great place to start.

Consistent and long-term investing can help seriously grow your wealth over time. But taking the leap and actually buying your first stock can be challenging.

Fear not! We have enlisted the help of our Foolish writers! Now, bear in mind that most experts recommend owning a diversified and well-balanced portfolio of at least 15 stocks. But everyone has to start somewhere, right?

So, here are the ASX shares our writers would buy first if they were kick-starting their investing journeys in 2024:

6 ASX stock tips for new investors in 2024

- Vaneck Morningstar Wide Moat ETF (ASX: MOAT), $783.67 million

- Accent Group Ltd (ASX: AX1), $1.20 billion

- Life360 Inc (ASX: 360), $1.37 billion

- Metcash Ltd (ASX: MTS), $3.49 billion

- Vanguard Australian Shares Index ETF (ASX: VAS), $14.08 billion

- BHP Group Ltd (ASX: BHP), $241.83 billion

(Market capitalisations as of 12 January 2024).

Why our Foolish writers think you should buy these ASX shares

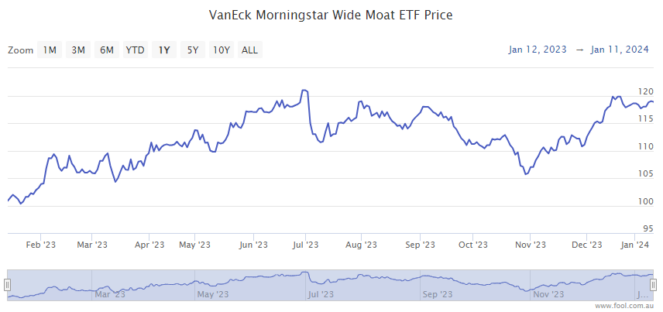

Vaneck Morningstar Wide Moat ETF

What it does: This exchange-traded fund (ETF) provides exposure to a portfolio of US stocks that are constituents of the Morningstar Wide Moat Focus NR AUD Index.

By Tony Yoo: The idea behind this ETF is that it will invest in US businesses that Morningstar has recognised as possessing competitive advantages, or what it calls a "wide economic moat".

I believe this is a great starter stock for beginner investors, as just buying a single ETF provides instant diversification.

The Wide Moat ETF has historically performed well, returning more than 15% per annum over the past five years. As a sweetener, the fund also pays out a small dividend that's averaged out to be around 2.4% per annum.

Last year, it paid out a whopping 8.8% yield, which appears to be an anomaly.

Motley Fool contributor Tony Yoo owns units of the Vaneck Morningstar Wide Moat ETF.

Accent Group Ltd

What it does: Accent is home to many of Australia and New Zealand's most popular footwear and apparel brands. The company's network of 821 retail stores includes Platypus, The Athlete's Foot, Glue, and dozens of other household names. A retailer and distributor for more than 35 years, Accent has grown to reach 9.8 million customers in FY23.

By Mitchell Lawler: If I were making my first investment into the Australian share market, there are two qualities – in addition to solid fundamentals – that I'd seek for my inaugural portfolio addition, these being:

- A simple, tangible business

- Proven and profitable.

I believe investing should be approached with a business-owner mindset. I wouldn't own a business I couldn't understand. Selling shoes and apparel is pretty straightforward, which means more time focusing on whether or not the company is doing a good job of it.

Secondly, getting involved in a profitable investment rather than a speculative one should provide more insightful lessons. I'd argue that a pre-revenue business yields little more in investment education than what can be obtained at the race track.

Coincidentally, Accent Group, with its impressive track record and modest earnings multiple, is also my top ASX share for January.

Motley Fool contributor Mitchell Lawler does not own shares of Accent Group Ltd.

Life360 Inc

What it does: Life360 is the technology company behind the eponymous Life360 mobile app. It is a market-leading app for families with 58 million monthly active users. Its features include communications, driving safety, and location sharing.

By James Mickleboro: I think that Life360 could be a great option for a beginner investor who has an interest in growth shares. That's because this Silicon Valley-based tech company has been growing at a rapid rate for a number of years and is tipped to continue this trend long into the future.

For example, Goldman Sachs is forecasting a gross profit compound annual growth rate of 36% between FY22 and FY25. This is a quicker rate than its peer Duolingo (NASDAQ: DUOL), which trades on valuation multiples many times greater. I believe this is a sign that Life360 shares are significantly undervalued.

Goldman agrees. It has a buy rating and $10.50 price target, which offers more than 50% upside from current levels.

Motley Fool contributor James Mickleboro owns shares of Life360 Inc.

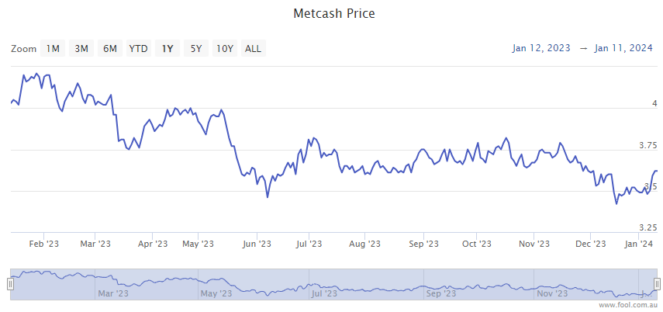

Metcash Ltd

What it does: Metcash supplies independent retailers around Australia, including IGA, IGA Liquor, Cellarbrations, The Bottle-O, Porters Liquor and state-based brands such as Thirsty Camel. It has a hardware division which includes Mitre 10, Home Timber & Hardware, and Total Tools. Metcash also supports independent operators under Thrifty-Link Hardware and True Value Hardware.

By Tristan Harrison: Metcash is a very easy business to understand, and it has a long history of operations and stability.

The company can benefit substantially from Australia's population growth because it means more potential customers. The hardware division has grown a great deal over the last few years, and a recovery of construction and renovation activity in the medium term would be a useful boost for profitability.

Metcash has a low price-to-earnings (P/E) ratio and generous dividend payout ratio (70% of the underlying profit), resulting in an attractive valuation and a high dividend yield.

According to Commsec, it's valued at under 13x FY24's estimated earnings and a grossed-up dividend yield of 8.1%.

Motley Fool contributor Tristan Harrison owns shares of Metcash Ltd.

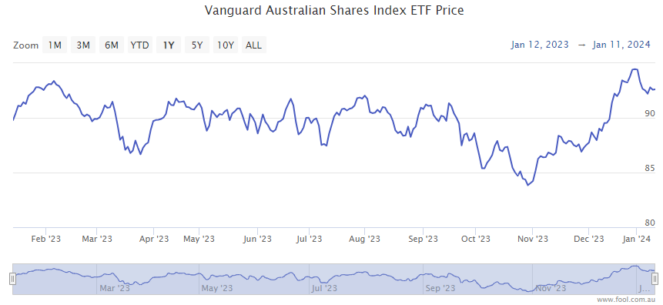

Vanguard Australian Shares Index ETF

What it does: The Vanguard Australian Shares ETF sticks to a simple index: the ASX 300. It holds 300 of the largest ASX shares within its portfolio, giving investors simple exposure to a broad slice of the Australian economy.

By Sebastian Bowen: I've long advocated simple index funds for a beginner investor, given the almost non-existent risk of losing all of your money.

This one from Vanguard is about as simple as it gets, holding the largest 300 shares on our stock exchange. That's everything from Commonwealth Bank of Australia (ASX: CBA) and Telstra Group Ltd (ASX: WOW) to Coles Group Ltd (ASX: COL) and JB Hi-Fi Ltd (ASX: JBH).

You won't get rich overnight with this ETF, but that's exactly why it's perfect for a beginner. Investors can expect a decent long-term return (judging by its historical performance), as well as a strong stream of dividend income.

Motley Fool contributor Sebastian Bowen owns shares of Telstra and the Vanguard Australian Shares ETF.

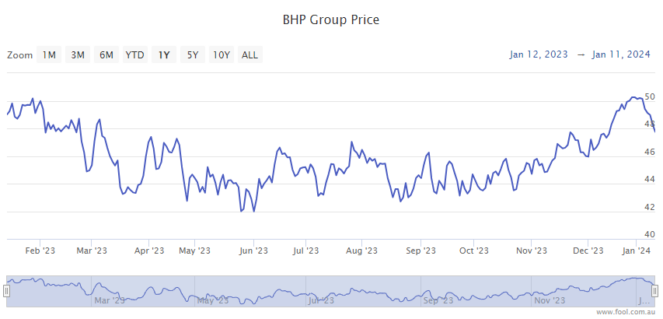

BHP Group Ltd

What it does: BHP is the world's biggest miner and the largest company listed on the ASX, with a market capitalisation of almost $242 billion.

By Bronwyn Allen: I think beginner investors should start with large-cap companies that offer earnings diversity and reliable, fully franked dividends.

Their scale will give you peace of mind, allowing you to begin your investment journey without too much risk while you learn.

BHP is the world's biggest mining company (based on market cap) and one of the world's best dividend payers. It digs up a variety of metals and minerals, including iron ore, copper, coal and nickel, which provides some diversity in earnings.

Experts forecast BHP to pay $2.24 per share in dividends in FY24. Based on the current BHP share price, this equates to a dividend yield of 4.69%.

Motley Fool contributor Bronwyn Allen owns shares of BHP Group Ltd.