Another completed trip around the sun is drawing near. The closing 2023 chapter offers a moment for reflection on the year that has been for each of our share portfolios, along with the chance to map out our intentions for the next 12-month-long tango with Mr Market.

In this article, I pull back the curtain on my entire personal portfolio — at least the portion I actively manage — to give some insight into portfolio construction, my 2023 mistakes, and where I most see opportunity for 2024 and beyond.

Let's begin.

Inside my share portfolio

Despite it being another eventful year full of trials and tribulations, equity markets are in the green as we approach the home stretch. The enticing proposition of 5% interest, or more, on cash savings has failed to put a dent in the S&P/ASX 200 Index (ASX: XJO) — returning 3.3% year-to-date at the time of writing.

Ironically, the tech and consumer discretionary sectors have been 2023's breadwinners — creating some juxtaposition with the ongoing economic tightening. Investors looking ahead to future interest rate cuts might have supported the buoyant optimism in these sectors.

Nonetheless, it meant a much rosier year for my share portfolio, recovering from a rough performance in 2022. As of 7 December 2023, my collection of companies had returned 30.1% YTD, exceeding the Vanguard MSCI Index International Shares ETF (ASX: VGS) by approximately 10%.

While the result is good for the ego, I'll hold off until the 10-year or 20-year return before I go chalking up a win in my books. Still, I'm pleased with the refinement of my share portfolio this year — now holding the following companies:

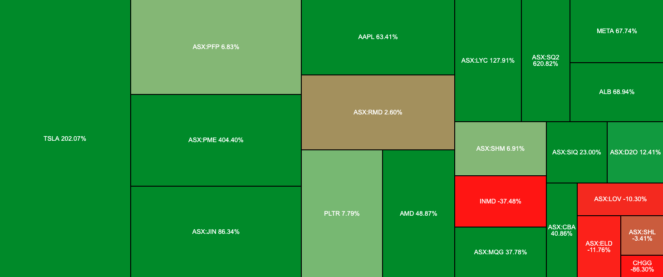

| Company | YTD return | % of Portfolio |

| Tesla Inc (NASDAQ: TSLA) | 121.4% | 17.0% |

| Cash | N/A | 14.5% |

| Propel Funeral Partners Ltd (ASX: PFP) | 9.2% | 7.5% |

| Pro Medicus Limited (ASX: PME) | 63.8% | 7.3% |

| Jumbo Interactive Ltd (ASX: JIN) | -4.3% | 7.2% |

| Apple Inc (NASDAQ: AAPL) | 53.8% | 5.4% |

| Resmed CDI (ASX: RMD) | -18.4% | 5.3% |

| Palantir Technologies Ltd (NYSE: PLTR) | 168.1% | 4.8% |

| Advanced Micro Devices Inc (NASDAQ: AMD) | 82.5% | 4.3% |

| Lynas Rare Earths Ltd (ASX: LYC) | -16.6% | 3.8% |

| Block Inc CDI (ASX: SQ2) | 12.1% | 2.8% |

| Meta Platforms Inc (NASDAQ: META) | 154.5% | 2.7% |

| Albemarle Corporation (NYSE: ALB) | -44.9% | 2.5% |

| Shriro Holdings Ltd (ASX: SHM) | 16.9% | 2.3% |

| Inmode Ltd (NASDAQ: INMD) | -39.7% | 2.2% |

| Macquarie Group Ltd (ASX: MQG) | 1.9% | 2.1% |

| Smartgroup Corporation Ltd (ASX: SIQ) | 67.6% | 1.7% |

| Duxton Water Ltd (ASX: D2O) | 0.0% | 1.6% |

| Commonwealth Bank of Australia (ASX: CBA) | 4.9% | 1.3% |

| Lovisa Holdings Ltd (ASX: LOV) | -10.5% | 1.3% |

| Elders Ltd (ASX: ELD) | -26.3% | 1.2% |

| Sonic Healthcare Ltd (ASX: SHL) | 2.4% | 0.8% |

| Chegg Inc (NYSE: CHGG) | -58.6% | 0.4% |

The 10 largest equity positions in my portfolio constitute approximately 65% of my holdings. This is intentional. These positions are my highest conviction investments, the ones I'm most comfortable having large sums of money in.

During my almost seven years of investing, I've come to learn that time is your most scarce resource as an investor. As such, I dedicate the majority of my time and money towards the top 10 largest holdings in my share portfolio.

If I were to try to know all 22 companies intimately, I think I'd risk being stretched too thin. I still know the nuts and bolts of the remaining 12 companies, but not enough to warrant larger allocations of my wealth to them.

Biggest mistake of 2023

I was taught an expensive lesson this year by an investment in Unity Software Inc (NYSE: U).

Heading into 2023, the game development software company was one of my largest holdings. Due to its robust revenue growth, I was willing to look past the lack of profits. Unfortunately, I also overlooked a few red flags.

The first bright red flag… the company made an enormous US$4.4 billion acquisition at the end of 2022 before refining its own business — funded completely by issuing stock, no less. Secondly, the CEO, John Riccitiello, had a poor track record in making customer-friendly decisions.

Unity announced plans to charge game developers per game download, a move that reportedly would have bankrupted some. The move, since canned, was reminiscent of Riccitiello's proposition to charge Battlefield players to reload in-game.

I eventually sold out of Unity Software in May after learning the hard way how costly poor management can be.

Stock buying plans for 2024

As noted earlier, 14.5% of my share portfolio is sitting in cash. I plan to put this money to work as opportunities arise next year.

For example, Resmed is a relatively recent addition, getting added amid the Ozempic-driven sell-off. I still think the medical device maker trades at an attractive valuation. While weight-loss drugs are expected to reduce the sleep apnea market somewhat, I think the size of the forecast reduction is overblown.

Another ASX share I'm looking to add to is Sonic Healthcare. The chart below shows that Sonic is an insignificant holding in my share portfolio. The paltry position doesn't align with my level of conviction in the medical services provider — it should be much larger.

Lastly, several companies on my watchlist could find their way into my portfolio next year. I'd argue companies such as Kone Oyj, Trane Technologies PLC (NYSE: TT), Super Retail Group Ltd (ASX: SUL), and Nick Scali Limited (ASX: NCK) are high-quality and attractively priced.