The market finished strongly on Wednesday but don't be fooled into thinking the volatile ride is over for the S&P/ASX 200 Index (Index:^AXJO) (ASX:XJO).

While the top 200 share benchmark closed 5.5% higher, experts are reluctant to call the bounce a turning point for the bear market.

But the turnaround is a question of "when" and not "if". The analysts at Macquarie Group Ltd (ASX: MQG) released a note today spelling out how investors can best position themselves for what the broker is calling "the inevitable recovery".

Recession 2020, recovery 2021

The broker is assuming the damage from the COVID-19 pandemic will be limited to the 2020 calendar year and that the following year will see a rebound in economic activity.

"The fading Covid-19 headwinds plus fiscal/monetary stimulus then support a recovery in the economy in CY21," said Macquarie.

"We also asked analysts to select companies where the balance sheet is relatively resilient to weather the challenges in Calendar 2020."

Industry captains

Macquarie best buy picks for the recovery include a number of ASX shares that could be considered global leaders, and could therefore be attractive to both domestic and international investors.

It's also worth noting that most of these stocks generate most or a substantial amount of their income from overseas. This means their earnings will get an extra boost from the weak Australian dollar, which is fetching around US60 cents compared to US70 cents at the start of January.

Top 14 ASX buys

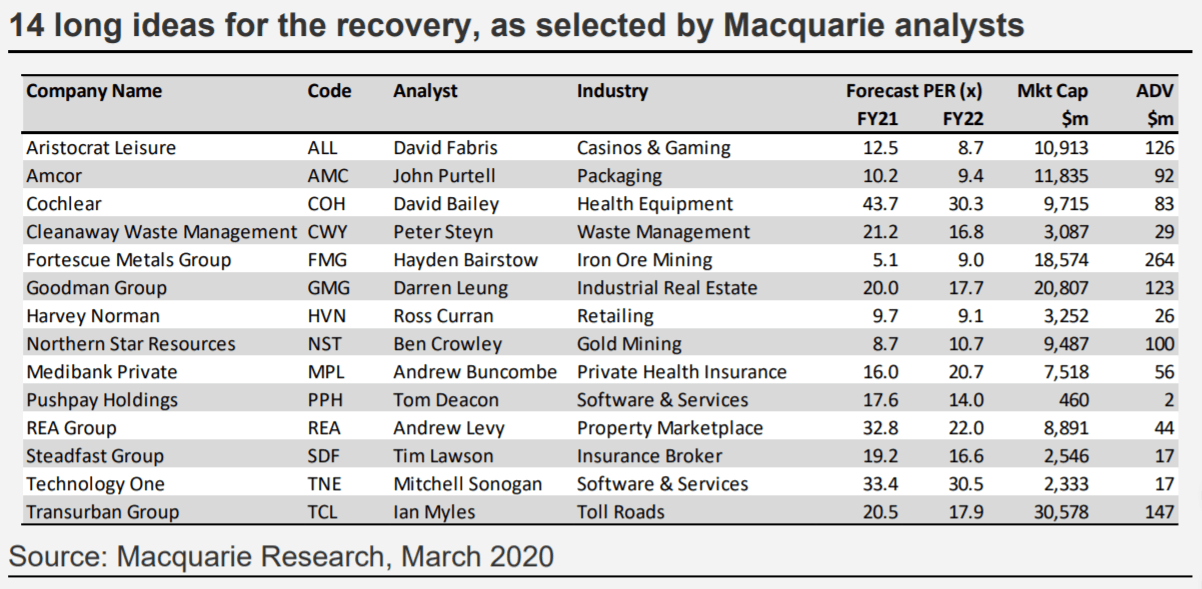

There are 14 stocks on Macquarie best buy list. This includes gaming machine maker Aristocrat Leisure Limited (ASX: ALL), global packaging group AMCOR PLC/IDR UNRESTR (ASX: AMC), hearing implant developer Cochlear Limited (ASX: COH) and iron ore miner Fortescue Metals Group Limited (ASX: FMG).

Others on the list are industrial property company Goodman Group (ASX: GMG), online property classifieds REA Group Limited (ASX: REA), toll road operator Transurban Group (ASX: TCL) and Harvey Norman Holdings Limited (ASX: HVN).

Rounding up the group are gold miner Northern Star Resources Ltd (ASX: NST), donor management system company Pushpay Holdings Ltd (ASX: PPH), private health insurer Medibank Private Ltd (ASX: MPL), waste company Cleanaway Waste Management Ltd (ASX: CWY), insurance broker Steadfast Group Ltd (ASX: SDF) and IT services group Technology One Limited (ASX: TNE).

Don't try picking the bottom

"This note is not about calling the bottom. It's about highlighting a group of quality stocks that investors could start to buy now, acknowledging that even the best investors rarely invest all their money at the bottom," said Macquarie.

"Investors can also change their portfolio to allocate more to one or more of the stocks we highlight."