In the share market even blue-chip shares can explode higher over short periods on the back of improved sentiment or better-than-expected profits. If you combine improved sentiment with profit beats you usually hit a sweet spot for share price growth.

Another advantage of large-cap shares is that their scale means they're more likely to sustain strong performance over the long term compared to small cap rivals that may be a flash in the pan.

It's only when a company can grow its share price over the long term of say 8 years or more that the power of compound returns can really work to lift a share portfolio's value.

If a company you buy does deliver strong long-term growth that should also negate the risk of overpaying for the business in the short term.

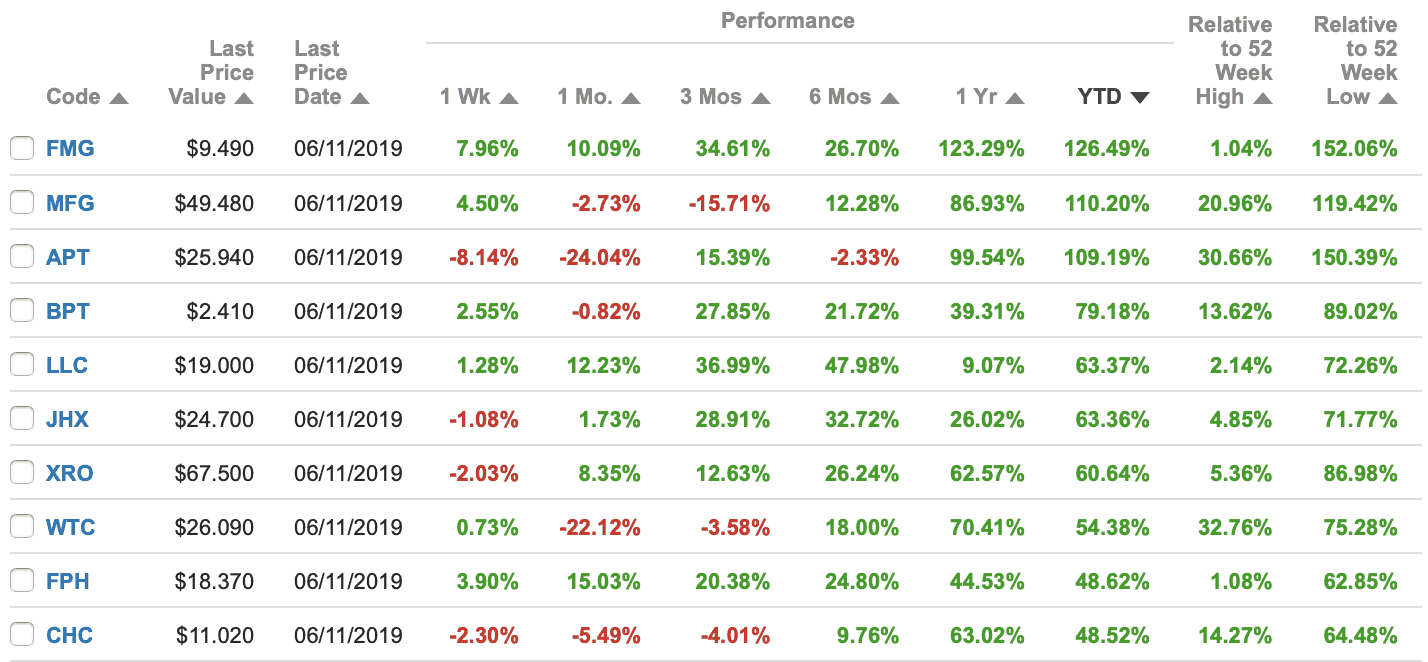

So let's take a look at the below businesses and consider whether they have what it takes to deliver strong long term growth for today's investors.

Source: Commsec as at Nov 7, 2019.

Fortescue Metals Group Ltd (ASX: FMG) is the iron ore miner that has returned 126% year to date on the back of rising iron ore prices and a deleveraged balance sheet. If Fortescue is to deliver really strong long-term returns it's going to need a much higher-than-expected iron ore price.

Magellan Financial Group Ltd (ASX: MFG) is the international equities manager that has returned 110% in 2019 thanks to strong funds under management growth powering profits and dividends higher. Magellan has been both innovative and aggressive in its approach to raising money and is likely to stay that way under its founder-led management team. However, it's still tied to the unknown health of equity markets going forward.

Afterpay Touch Group Ltd (ASX: APT) is the buy-now-pay-later business probably growing stronger than any other business on this list. No surprise the share price has soared and the business sure has potential to keep growing strongly. The question for investors is whether the headline growth will translate into growing profitability.

Beach Energy Ltd (ASX: BPT) is the oil and gas producer that posted a net profit up 86% to $560 million over fiscal 2019. It also has a positive net cash position and ambitious plans to post over $1 billion in free cash flow by FY 2024. Overall though Beach is a price taking business and remains leveraged to swings in the oil price.

Lend Lease Group (ASX: LLC) is something of a turnaround story with investors bidding the shares higher on the back of a solid fiscal 2019 result. It paid dividends of 42cps on earnings of 82.4cps. Return on equity came in at 12.4%. Gross borrowings stood at $2.7 billion and Lend Lease shares could remain volatile.

James Hardie Industries (ASX: JHX) is another turnaround story that saw its share price collapse at the end of 2018 on the back of a profit warning. The stock has recovered over 2019 thanks to renewed investor optimism over its outlook in the U.S. market.

Xero Limited (ASX: XRO) this morning handed in a profit of NZ$1.3 million on sales of NZ$339 million for the period ending September 30 2019. That might not sound too flash, but the online accounting platform is growing subscribers strongly and has large global addressable markets.

WiseTech Global Ltd (ASX: WTC) is up 54% year-to-date despite the shares having a torrid October on the back of a short seller report. WiseTech has completed a lot of acquisitions recently to mean it's higher up the risk curve. More so when you consider the sky-high valuation.

Fisher & Paykel Healthcare Ltd (ASX: FPH) is the sleep apnea business that is delivering consistent profit growth thanks in part to strong underlying clinical demand for its products. As a medical device business in a growing area it may deliver more profit growth into the future if it can maintain or grow margins.

Charter Hall Group (ASX: CHC) is the property investment group on a strong run thanks to a mix of organic and acquisitive growth. It's also benefited as the falling interest rate environment has boosted property values and jacked up the yield chase. If rates ever do turn higher the dream run could come under pressure.