Joel Greenblatt's The Little Book That Still Beats the Market would have served ASX investors very well over the past few years, had they followed his simple investing strategy.

Just ask Webjet Limited (ASX: WEB) and MACA Limited (ASX: MLD) shareholders.

Who is Joel Greenblatt?

Joel Greenblatt is a famous — and hugely successful — US investment manager. His hedge fund, Gotham Capital, is believed to have delivered an average yearly return of 40% over the years 1985 to 2006. That turns $10,000 into over $8 million.

Greenblatt authored the funny, easy-to-read and simple book called The Little Book That Beats the Market.

So what?

In the book, Greenblatt details a simple "Magic Formula" for sharemarket success, which requires investors to buy shares in quality companies when they're cheap.

Sounds simple, right?

Yes, it's simple. But it is not easy.

Why?

Most people are too scared to hold some of the shares that the formula tells us to buy.

Returns in Action

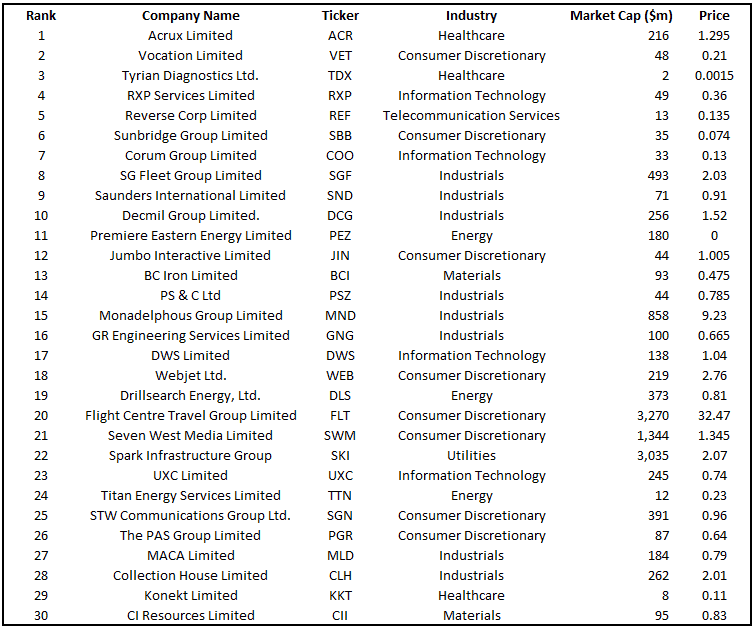

Going on three years ago, my colleague Matt Joass, CFA, wrote this article and provided a list of 30 shares which would have been produced by the "Magic Formula" on the ASX:

In 2014, the mining sector was on its knees and mining services companies were being thrown out. China's slowdown was going to wreak havoc on these companies, or so we thought.

Based purely on share prices (no dividends), the S&P/ASX 200 (Index: ^AXJO) (ASX: XJO) is up 10.4% since that time.

Although it is not exactly correct I excluded the companies from Matt's list that were smaller than $100 million in market capitalisation. I also excluded Premiere Eastern Energy (ASX: PEZ) because it had a share price of $0 according to the table.

The result?

Drum roll, please…

| Price then | Price now | Price return | ||

| Acrux | ASX:ACR | 1.29 | 0.17 | -86.82% |

| SG Fleet | ASX:SGF | 2.03 | 3.9 | 92.12% |

| Decmil Group | ASX:DCG | 1.52 | 1.24 | -18.42% |

| Monadelphous | ASX:MND | 9.23 | 16.36 | 77.25% |

| GR Engineering | ASX:GNG | 0.665 | 1.3 | 95.49% |

| DWS | ASX:DWS | 1.04 | 1.42 | 36.54% |

| Webjet | ASX:WEB | 2.76 | 11.37 | 311.96% |

| Drillsearch^ | ASX:DLS | 0.81 | 1.09 | 34.57% |

| Flight Centre | ASX:FLT | 32.47 | 46.4 | 42.90% |

| Seven West Media | ASX:SWM | 1.34 | 0.64 | -52.24% |

| Spark Infrastructure | ASX:SKI | 2.07 | 2.58 | 24.64% |

| UXC Limited** | ASX:UXC | 0.74 | 1.22 | 64.86% |

| STW Communications* | ASX:SGN | 0.96 | 0.915 | -4.69% |

| MACA Limited | ASX:MLD | 0.79 | 2.16 | 173.42% |

| Collection House | ASX:CLH | 2.01 | 1.38 | -31.34% |

| Average: | 50.68% | |||

| *Merged with WPP at 91.5c; ^Drillsearch merged with Beach Energy for 1.25 Beach shares (currently 87.2c) for every one Drillsearch share; **UXC was bought by CSC for $1.22 per share | ||||

Adjusting for takeovers and mergers, the average return of these $100m+ companies in the Magic Formula was almost 51%. In other words, almost five times the return of the market, excluding dividends.

I think you will admit, that's a pretty handy return over three years.

Foolish Takeaway

I'm always sceptical (skeptical?) of quantitative or 'formulaic' investing strategies. However, the Magic Formula is simple, logical and well supported by research. If nothing else it would provide a useful starting point for investment ideas.

As a bonus, the book is easy-to-read and short, so you could get the low-down on the formula for less than $20 and a weekend of reading!