The official ASX reporting season is almost upon us, commencing next week. Heading into company results, we're presented with a tremendously different backdrop.

The S&P/ASX 200 Index (ASX: XJO) is up 8% since the end of last year's reporting period, interest rates have been above 4% for 13 months (not two), and the top 200 companies trade on a price-to-earnings (P/E) ratio of 25 times (compared to 16.5 times a year ago).

Results will soon begin hitting the headlines, setting share prices into motion. It's a time when emotions can run high, and short-term thinking often prevails — ideal for some good ole' value hunting.

Except, what could trigger 'buying season' in the first place?

When expectations clash with reality

Despite slipping 2% in the past week, the Australian share market is near all-time highs.

I'm no doomsdayer… I'm not trying to predict the next crash. However, I think the recent unabated euphoria coinciding with the rise in artificial intelligence (AI) excitement and pre-emption of interest rate cuts has jumped the gun somewhat.

This is why I suspect shares in even good companies could fall this ASX reporting season. It's not as if the businesses are bad — I'm suggesting that the short-term expectations of investors (or traders and speculators) are inaccurate.

The economy and the stock market rarely reflect one another. Nevertheless, it seems odd just how resilient some company valuations have been while consumers cut back. However, the ASX reporting season might be what narrows this divergence.

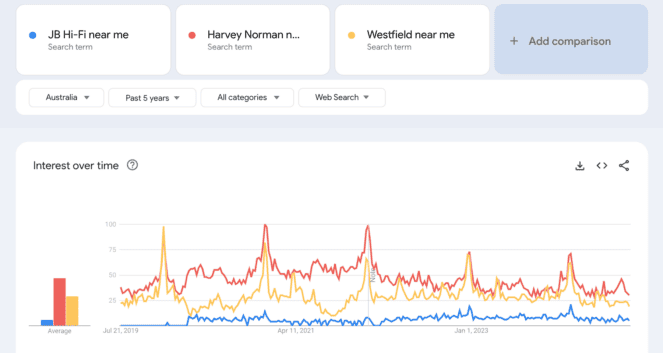

Australian retail is a prime example. As the Google Trends snippet above shows, searches for 'JB Hi-Fi near me' or 'Harvey Norman near me' are below 2019 levels. Yet, the JB Hi-Fi Ltd (ASX: JBH) share price is trading near all-time highs, and Harvey Norman Holdings Limited (ASX: HVN) is up 26% over the last 12 months.

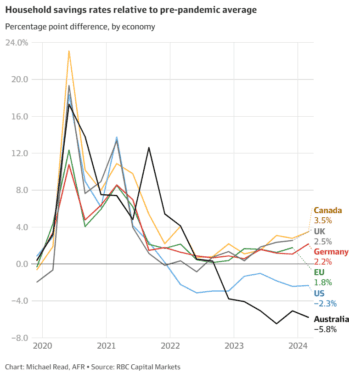

In addition, Australia's household savings rate is 5.8% lower than before the COVID-19 pandemic hit, as depicted above. It's fair to assume the average Aussie has less money available to splash, with the 4.35% RBA interest rate eating into our bank accounts.

Data on real household disposable income per capita in Australia further paints the picture, as shown below. The amount of disposal income per capita has been falling for years now, and it looks like the bottom isn't in yet.

Basically, I'm guesstimating the market will be disappointed many times this earnings season.

ASX reporting season gold mine

It all sounds a tad bleak, I know. Fortunately, I'm an optimist in the long run.

There's a marvellous Warren Buffett quote that reads, "The stock market is a device for transferring money from the impatient to the patient."

See, I don't mind a bad full-year result. Heck, even a couple of ordinary years won't burst my bubble if we're dealing with a good business. Meanwhile, impatient participants can't deal with it — they want their big life-changing profits yesterday.

This is where patient capital prevails.

I'll be ready to buy good companies that are knocked down by bad numbers this ASX reporting season. The trick is to stick with the good companies, though. A good business won't be behind every lousy result.

My eyes are locked on ASX shares like Nick Scali Limited (ASX: NCK), Accent Group Ltd (ASX: AX1), Lovisa Holdings Ltd (ASX: LOV), and PWR Holdings Ltd (ASX: PWH).