Investing legend Warren Buffett once said, "Never count on making a good sale. Have the purchase price be so attractive that even a mediocre sale gives good results".

If you're an admirer of the Oracle of Omaha (and, let's face it, who isn't?), you'll likely already appreciate that the price at which you buy your ASX shares is just as important as that at which you sell!

But how to sort the oversold bargains from the falling knives?

For their thoughts, we asked our Motley Fool writers which ASX shares they reckon offer the best-value buying right now. Here is what the team came up with:

6 cheap ASX for February 2024 (smallest to largest)

- KMD Brands Ltd (ASX: KMD), $441.23 million

- Rural Funds Group (ASX: RFF) $860.39 million

- Domino's Pizza Enterprises Ltd (ASX: DMP), $3.57 billion

- Block Inc (ASX: SQ2), $3.73 billion

- IDP Education Ltd (ASX: IEL), $5.38 billion

- Lynas Rare Earths Ltd (ASX: LYC), $5.51 billion

(Market capitalisations as of market close 9 February 2024).

Why our Foolish writers think these ASX stocks offer great value buying

KMD Brands Ltd

What it does: KMD Brands is a retail business that operates three leading brands: Kathmandu, Oboz and Rip Curl.

By Tristan Harrison: The KMD Brands share price is down 33% in the past year and has dropped close to 60% since October 2021.

The company's recent trading update revealed group sales were down 12.5%, reflecting "ongoing weakness in consumer sentiment." Kathmandu's rainwear and insulation categories were down, while wholesale sales for Rip Curl and Oboz also declined as retailers reduced inventory holdings in the short term.

But there were some positives. The group gross profit margin improved, and operating costs were "well-controlled and actively managed".

I think the current KMD share price reflects short-term weakness. Commsec numbers suggest earnings per share (EPS) could rise to 6.5 cents and 8.3 cents in FY25 and FY26, respectively. This puts the stock at 10x FY25's and 8x FY26's estimated earnings, which looks cheap to me. The FY26 dividend yield could also be an attractive 8.75%.

Motley Fool contributor Tristan Harrison does not own shares of KMD Brands Ltd.

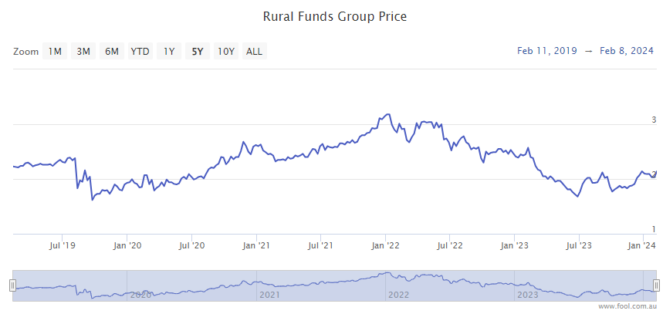

Rural Funds Group

What it does: Rural Funds Group is a real estate investment trust (REIT) that owns a large portfolio of farmland and other agricultural assets.

By Sebastian Bowen: The Rural Funds unit price has not had a fun time over recent years. Back in early 2022, units of this REIT were asking for more than $3 each. But today, those same units were going for $2.22 at Friday's close of trade.

Rising interest rates have hurt Rural Funds. As an REIT, this trust uses loans and other financing to help build out its portfolio. With rising rates, this financing has become a lot more expensive.

Yet, I think this situation has resulted in Rural Funds stock becoming oversold. The REIT operates a strong portfolio of different agricultural assets, including vineyards, cattle and macadamia, almond, and cotton farms. Those are all commodities that have a strong and inelastic market.

Additionally, Rural Funds is a strong dividend payer, having increased or maintained its quarterly dividend payments since 2017. Today, you can expect a dividend distribution yield of more than 5.28% from this REIT.

Motley Fool contributor Sebastian Bowen does not own units of Rural Funds Group.

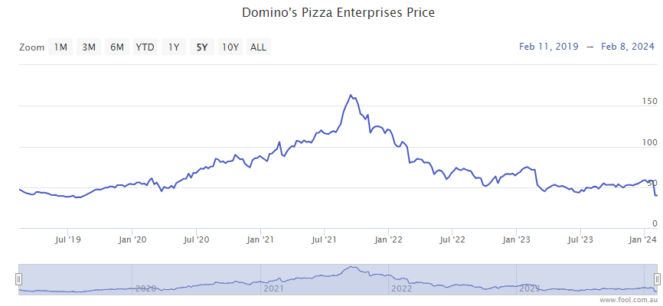

Domino's Pizza Enterprises Ltd

What it does: Australian-owned Domino's is the master franchise holder for Domino's Pizza stores in Australia, New Zealand, Belgium, France, the Netherlands, Japan, Germany, Luxembourg, Taiwan, Malaysia, Singapore, and Cambodia.

By Bernd Struben: It's been a rough start to 2024 for Domino's shares, with the stock down 32% year to date. Most of those losses came on 25 January, when shares closed down 31%.

This followed an update that showed significant half-year sales growth in its ANZ home markets and Germany, but was overshadowed by a sales slowdown in Malaysia and Japan.

Management forecast net profit before tax for the half year between $87 million and $90 million, down year on year but up from $74 million in the prior half. It will now focus on delivering the same successful strategies driving growth in ANZ to boost its Asian operations.

The stock should also get a longer-term lift as slowing inflation and falling interest rates boost discretionary consumer spending.

Domino's shares trade on a 2.8% partly-franked dividend yield.

Motley Fool contributor Bernd Struben does not own shares of Domino's Pizza Enterprises Ltd.

Block Inc

What it does: Block Inc is a US fintech that provides payment terminals for small retailers, a consumer finance app, and Afterpay, to name a few of its offerings.

By Tony Yoo: It might be odd calling a stock that's risen 70% since the end of October "oversold". But the fact remains the Block share price is more than 14% down over the past year and 43% lower since April 2022.

The financial services company is on the way up after cleaning up its act in recent months. Management has cut costs, reduced staff share issuances, and generally placed a greater emphasis on cash flow. The revival in the Bitcoin price has helped too, with co-founder Jack Dorsey a firm believer in cryptocurrencies.

All three analysts currently surveyed on CMC Invest rate Block shares as a strong buy.

Tony Yoo does not own shares of Block Inc CDI, but does own Block Inc shares listed on the NYSE.

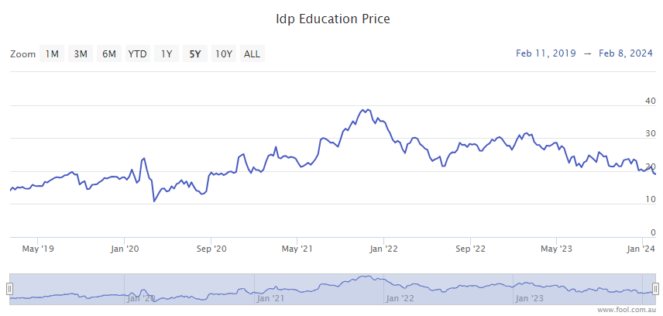

IDP Education Ltd

What it does: IDP Education is a provider of international student placement services and high-stakes English language testing services.

By James Mickleboro: IDP Education shares have lost almost 40% of their value over the last 12 months after the company was hit with bad news after bad news. This included the loss of its language testing monopoly in Canada and changes to student visas at home and abroad.

While these events have undoubtedly had a negative impact on the stock's near-term performance, I believe the selling has been severely overdone. In light of this, I feel it has created an opportunity for ASX investors to buy a high-quality company with strong long-term growth potential.

Analysts at Goldman Sachs agree with this view and remain bullish on its outlook. The broker highlights that "IEL's fundamental quality and structural growth drivers remain intact while the company possesses levers to continue to grow earnings (e.g. costs)."

Goldman currently has a buy rating and a $27.60 price target on IDP shares.

Motley Fool contributor James Mickleboro does not own shares of IDP Education Ltd.

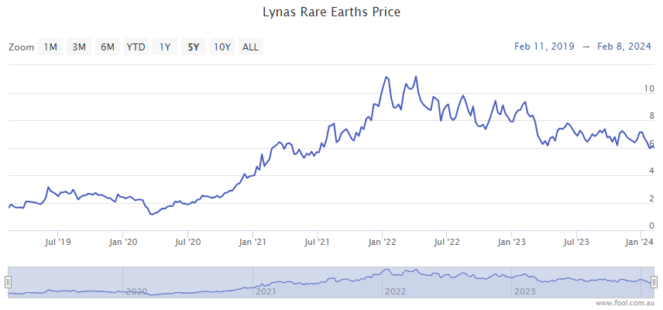

Lynas Rare Earths Ltd

What it does: Helmed by Amanda Lacaze, Lynas Rare Earths is one of the largest producers of rare earth elements, which are critical in many of our modern-day technologies. The company owns two highly regarded operations: the Mount Weld mine in Western Australia and a processing plant in Malaysia.

By Mitchell Lawler: The past year has not been kind to the Lynas share price. Coinciding with a drop in the going rate for rare earths, shares in the Australian miner have fallen 35% to reflect the shrinking revenue and profits.

I'll go out on a limb and say this could all be a temporary weakness in an otherwise strong long-term outlook. Interest rates have constricted the consumer's appetite for electric vehicles recently, but with rates expected to be cut at the tail end of 2024, we may soon see strength again.

I think Lynas' current valuation is appealing based on the company's recently increased production capacity and the Kalgoorlie facility achieving its first feed-on in December last year.

Furthermore, management's decision to pursue organic growth over a merger with MP Materials relays a level of confidence among management in the company's own future prospects.

Motley Fool contributor Mitchell Lawler owns shares of Lynas Rare Earths Ltd.