- What is cryptocurrency?

- What is a blockchain?

- How is mining related to the blockchain?

- Is cryptocurrency a suitable investment?

- Quantitative easing

- Diversification

- Big opportunity

- Types of cryptocurrency

- Bitcoin

- Ethereum

- Tether

- Other popular digital coins

- What are the risks of investing in cryptocurrency?

- Questionable real-world intrinsic value

- Highly volatile prices

- Security risks

- Want to learn more about investing?

The global crypto market is regularly valued in the trillions. Tesla chief Elon Musk tweets about Dogecoin. El Salvador has adopted Bitcoin as legal tender (and even plans to mine it using computing power generated by a volcano!).

Despite these developments, the average investor still finds cryptocurrency challenging to understand.

In this article, we'll break it down to answer the all-important question: what is cryptocurrency? We will also unpack the underlying technology, the different types of crypto, and whether it could be suitable for an investment portfolio.

What is cryptocurrency?

Cryptocurrency – or crypto, for short – is a digital asset. In contrast to traditional forms of currency, such as the Australian dollar or the English pound, the various cryptocurrencies in circulation today do not exist as physical coins or notes. Instead, they constitute a virtual currency stored on computer software in a digital format.

While their digital nature separates them from traditional central bank-issued currencies, known as fiat currencies, there are similarities. For example, cryptos are designed to facilitate financial transactions. Just like the Aussie dollar, cryptocurrency tokens can be loaned, borrowed, or used to pay for goods and services.

However, where fiat currencies are issued and backed by governments, cryptocurrencies are created via decentralised computer networks called blockchains.

What is a blockchain?

If it weren't for blockchains, cryptos wouldn't exist. So let's have a closer look at blockchain technology and how it differs from our traditional financial system.

In the typical system, intermediaries such as banks help to facilitate financial transactions. Customers deposit their savings into the bank, which uses that money to issue loans.

From an accounting perspective, the bank then carries both a liability (the deposit) and an asset (the loan) on its balance sheet. But each customer only sees their side of the transaction. The customer who makes the deposit has an asset, and the customer who takes out a loan has a liability.

On the other hand, a blockchain removes the financial intermediary entirely from the equation. Instead of the two sides of a financial transaction being linked only on the intermediary's balance sheet, blockchain technology relies on a 'distributed ledger' to store and validate transactions.

In a blockchain, the balance sheet (or ledger) is distributed among a peer-to-peer network of computers that collectively assume the role of the financial intermediary. For a financial transaction to occur, all computers in the network must reach a consensus about what the ledger will look like once it goes through. If they can't agree, the transaction won't be processed.

Each transaction is considered a block added to an existing, immutable 'chain' of transactions. These blocks are linked together by a secure cryptographic code called a 'hash' in techno-speak.

How is mining related to the blockchain?

The idea behind blockchain technology is that it creates a decentralised record of transactions. It doesn't rely on any central authority to validate transactions. And because the history of prior transactions is immutable (that is, previous records on the blockchain can never be altered), it maintains its fidelity over time.

The drawback is a blockchain requires a sufficiently large network of computers to maintain the distributed ledger and to create the cryptographic code that links the whole thing together. So, to incentivise people to lend their computing power to the blockchain, each network participant is compensated with cryptocurrency.

Once a computer on the network creates a new hash, it is awarded a certain amount of crypto. You may have heard this referred to as 'cryptocurrency mining'. However, the amount and type of crypto awarded will vary depending on the particular blockchain.

Once crypto tokens have been created, they can be traded just like any other asset or exchanged for a limited range of goods and services. A good way to think of a crypto investment is having a stake in the underlying blockchain. If the blockchain is thriving and widely adopted, the value of the related crypto will most likely increase.

Is cryptocurrency a suitable investment?

Although investing in crypto carries risks (more on that later), it can still provide many benefits for your overall portfolio. There are several reasons why crypto may be a suitable investment, and we will explore a few below.

Quantitative easing

To combat the adverse economic impacts of the COVID-19 pandemic, governments across the globe launched large-scale quantitative easing (QE) programs.

QE is when a country's central bank purchases long-term securities – generally government bonds – in the open market, thereby injecting more cash into the economy. The central bank hopes to keep interest rates low by increasing money supply and encouraging borrowing to drive economic growth.

As time has passed, we have witnessed central banks switch to quantitative tightening (QT) – the reverse of QE – to quell unsustainable economic growth. This has given rise to historical inflation levels.

To hedge against dollar devaluation caused by inflation risk, investors typically seek out 'safe-haven' assets – stable stores of long-term value – like real estate or gold. Some investors see cryptocurrency, particularly Bitcoin, as a potential safe-haven asset – some even refer to Bitcoin as 'digital gold'.

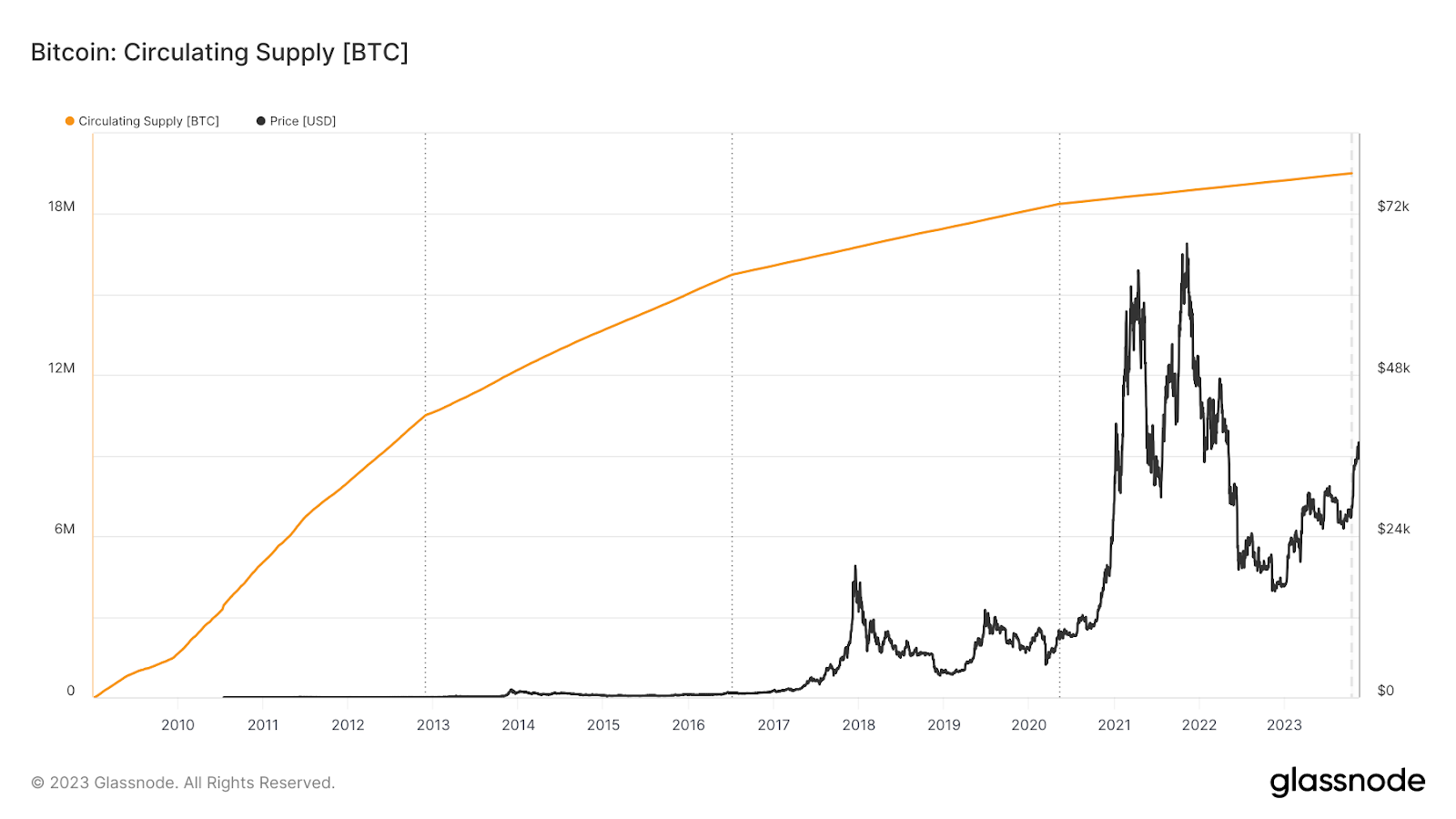

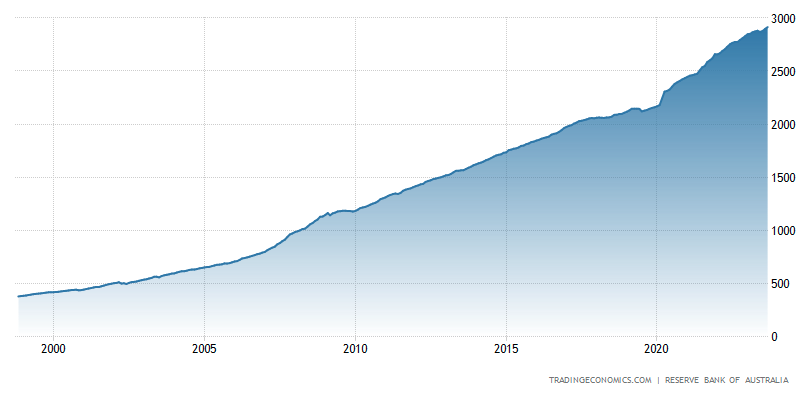

Although the price of bitcoins and most other crypto assets drastically fell throughout this tightening cycle, the reduction in the purchasing power of fiat money has not gone away. Crypto advocates will argue that Bitcoin – and even Ethereum post-merge – retain a limited or slowing supply, as opposed to the increasing supply of currency issued by central banks, as shown below.

Source: Glassnode

Source: Trading Economics | Reserve Bank of Australia

Diversification

Diversifying your portfolio is vital for generating stable, long-term growth. If you spread investment dollars across a range of asset classes, it can reduce the overall volatility of your returns.

For example, if you invest in both shares and real estate and property prices boom while the share market is down, your overall sense of wealth remains unaffected. It may even increase if house prices go high enough.

The diversification benefits are most substantial when the prices of two assets are negatively correlated with one another. When the price of one asset decreases, the other tends to increase, offsetting the loss on one side with a gain on the other.

Diversifying your portfolio by investing in crypto may be a way to ensure an alternative return source when other markets are down. However, many investors still consider cryptos a highly speculative asset class. It's wise to have only a small portion of your overall portfolio invested in cryptos at any one time.

Big opportunity

Cryptos and the blockchain technology associated with them are relatively new, and could shake up the financial system.

Blockchain technology might democratise lending and cause us to seriously rethink how we do business and process transactions. Investing in cryptos allows you to buy a small stake in that technology and share in any potential economic benefit.

Types of cryptocurrency

There are more than 10,000 different cryptocurrencies out there, though many have little to no real value. Some of the most popular cryptocurrency projects include:

Bitcoin

A mysterious Japanese coder, Satoshi Nakamoto, whose true identity remains unknown, is credited with creating the oldest and most widely known crypto, Bitcoin (CRYPTO: BTC). Nakamoto first proposed the blockchain technology that all cryptos are now based on in a paper published in 2008 titled Bitcoin: A Peer-to-Peer Electronic Cash System.

Nakamoto set the Bitcoin blockchain into motion in January 2009, with the first Bitcoin transaction happening soon after when he transferred 10 bitcoins to software developer Hal Finney.

The first commercial purchase using Bitcoin occurred in 2010 when computer programmer Laszlo Hanyecz traded 10,000 bitcoins for two pizzas. By today's standards, that transaction would be the equivalent of Hanyecz paying more than US$200 million for those two pizzas.

Ethereum

Ether is the native cryptocurrency of the Ethereum (CRYPTO: ETH) blockchain. It is currently the second most valuable crypto after Bitcoin. The Ethereum network was launched in 2015.

Ethereum expands the use of blockchain technology by using a 'smart contract'. These are blockchain-hosted lines of code programmed to conduct predetermined actions based on an event.

The use of smart contracts unlocks the ability to build immutable applications that sit on top of the network. This increases the range and complexity of transactions that can be performed on the blockchain.

For example, we have the Ethereum network to thank for creating non-fungible tokens (NFTs). These are essentially like certificates of authenticity issued for digital property such as images, videos, and audio files.

Although the digital files can be reproduced, owning the NFT proves that you own the original version. Ethereum's increased functionality allows these new forms of digital property to be created, verified and exchanged.

Tether

Unique to other cryptocurrencies, stablecoins are another cryptocurrency in common usage today. Currently, the most popular stablecoin traded is Tether (CRYPTO: USDT). It has frequently outranked even bitcoins and ether as the most traded crypto token over a given 24-hour period.

Deviating from the usual behaviour of crypto assets, stablecoins carry minimal volatility – which might have been obvious based on their name. Tether – and others like it – achieves this stability by pegging its value to a non-volatile asset. As such, this type of digital currency is often intrinsically tied to the value of a traditional currency.

Price parity is the primary goal of this type of crypto, shifting it away from the realm of cryptocurrency investment and more toward a tokenised currency.

While there has been controversy in the past around whether Tether is truly 100% backed by reserves, it remains the largest stablecoin in use.

Other popular digital coins

Binance Coin: As of November 2023, Binance Coin (CRYPTO: BNB) is the fourth-largest cryptocurrency by market capitalisation. It is the native crypto of the Binance network, the largest cryptocurrency exchange in the world. It is primarily used to pay transaction fees when trading cryptocurrencies on the Binance exchange.

Dogecoin: Developed initially as a joke by two software engineers to highlight the highly speculative nature of the crypto market, Dogecoin (CRYPTO: DOGE) has become a legitimate investment for many crypto traders.

Although many people still consider Dogecoin to be a 'meme coin' – essentially a fad that figures like Musk have jokingly spruiked – its supporters praise the efficiency of its blockchain's transaction processing ability and compare it favourably against the Bitcoin network.

What are the risks of investing in cryptocurrency?

Despite its upsides, there are still plenty of risks associated with investing in cryptocurrencies. Cryptos are a relatively new asset class and should be considered a highly speculative investment.

Some of the critical risks of crypto investing are detailed below.

Questionable real-world intrinsic value

When you buy shares in a company, you are purchasing a stake in that company's future success. If the company makes a profit, you get paid a cut of it in the form of dividends.

Using real-world inputs, financial analysts can create sophisticated models to try and determine the intrinsic value of a share in the company based on its underlying business performance. This enables investors to understand whether a company's shares are undervalued or overvalued based on their current market price.

This is much harder to do in the case of cryptocurrencies. They aren't backed by anything, leading some analysts to contend that they have no real intrinsic value. In a worst-case scenario, the whole crypto market could collapse, leaving all the currencies worthless.

Others might argue that a given crypto is backed by its blockchain. If a particular blockchain becomes widely adopted as an alternative to traditional financial systems, its native crypto would be used more frequently as a medium of exchange, thereby shoring up its value.

However, with thousands of blockchains out there, only a fraction could hope to survive and become mainstream, so plenty will lose out.

Highly volatile prices

Because of how difficult cryptos are to value – if it's even possible to value them at all – their prices tend to be incredibly volatile. Over a 12-month period, the price of Bitcoin dropped as low as US$25,119 in June 2023, then reached an all-time high of US$75,830 in March 2024.

Those are some huge price swings to endure as an investor – and most other cryptocurrency prices are even more volatile.

So, if you choose to invest in cryptos, you must be prepared for a rollercoaster ride of quickly changing prices. The real risk is if you need cash quickly to cover an unexpected expense right when the prices of cryptos are tumbling.

This could force you to realise a loss on your investment, which is never a good feeling. Therefore, never invest any money in cryptos that you can't afford to lose – and don't use your crypto portfolio as your emergency fund.

Security risks

It's important to remember that cryptocurrency markets are largely unregulated. After all, much of the blockchain ethos is that it evades institutional or government control. The downside is that you're largely on your own if you fall victim to theft or fraud.

In 2014, Mt. Gox – once the world's largest Bitcoin exchange – was hacked and subsequently declared bankruptcy. An estimated US$615 million in bitcoin was stolen from Mt. Gox customers' digital wallets, and most still have not received compensation.

External threats are not the only concern for crypto investors, funds are also susceptible to destruction from within. As the third-largest crypt exchange at the time, FTX was trusted by more than 1 million customers.

However, a bank run in late 2022 caused by solvency worries revealed that FTX founder and former CEO Sam Bankman-Fried and others associated with the company misappropriated US$8 billion of customer deposits.

On 2 November 2023, Sam Bankman-Fried was convicted on several fraud and money laundering charges. At this time, it is believed that affected customers could receive 90% of their assets upon settlement.

If you choose to invest in crypto, read up on the security of the crypto exchange you're planning to use. Also, consider whether storing your crypto in a private cryptocurrency wallet might provide added security.

A private wallet is software that allows you to keep your crypto on your computer's hard drive and off the exchange so that only you can access it.

- With additional reporting from Motley Fool contributor Mitchell Lawler

Want to learn more about investing?

You've come to the right place!

This article is part of Motley Fool Australia's comprehensive Investing Education series, covering everything from budgeting and saving to basic investing concepts and how much money you'll need to start.

Packed with easy-to-understand and regularly updated information, our articles contain the answers to your most frequently asked questions about share market investing.

Motley Fool's Education series is tailored for beginner and experienced investors alike and also includes helpful tools and resources, an A-Z glossary of Investing Definitions, and guides to specific topics of interest, including retirement planning, gold and property investment.

- The previous article in this section is about adding international exposure

- Check out our next article on how to analyse stocks