Cryptocurrency has gone genuinely mainstream over the past few years – and no crypto is more ubiquitous than Bitcoin.

Sometimes referred to as 'digital gold', Bitcoin is the oldest and most valuable cryptocurrency, with a market capitalisation approaching US$800 billion as of December 2023 (though it has previously topped US$1.23 trillion). However, as with many cryptos, Bitcoin remains a bit of a mystery to many investors.

In this article, we will explain Bitcoin and the technology that makes it possible, so strap yourselves in.

What is Bitcoin?

Bitcoin (CRYPTO: BTC) is a type of digital asset. It is the first – and still the most widely recognised and traded – cryptocurrency ever created.

Like any traditional currency, Bitcoin can be used as a medium of exchange, although the finance industry more popularly sees it as part of a new and speculative investment class. Unlike fiat currency, Bitcoin is entirely digital, meaning there are no physical notes or coins in circulation.

Bitcoin's origins remain mysterious, with its creator's genuine identity still unknown. Apparently, Bitcoin was conceived by a Japanese coder named Satoshi Nakamoto. But no one has been able to confirm any details about Nakamoto, including their real name or whereabouts, and no viable candidates have presented themselves.

Whatever their true identity, someone claiming to be Nakamoto published a paper titled Bitcoin: A Peer-to-Peer Electronic Cash System in October 2008. The paper proposed a new type of digital payment network that would allow users to transact directly with one another without the need for any financial institution like banks.

This network – now better known as the Bitcoin blockchain – sought to remove central sources of authority from the financial system, such as central banks. It also created the world's first digital currency: Bitcoin.

What is a blockchain?

In the paper, Nakamoto described the proposed network as "a system for electronic transactions without relying on trust". Traditional financial systems are opaque. As customers, we invest our trust in banks and other financial services providers to execute our transactions faithfully. However, a blockchain is transparent, removing the need to trust any central authority.

Think of it like this: In a traditional financial system, a customer deposits their money with a bank, and the bank then takes some of this cash and lends it out to borrowers. The bank records both the deposit and the loan on its balance sheet. But the two customers – the depositor and the borrower – are invisible to one another and simply have to trust in the bank's ability to maintain their respective accounts properly.

In a blockchain, each network user has a 'copy' of the balance sheet, with the entire network taking on the bank's role. For cryptocurrency transactions to be processed successfully, the network as a whole must reach a consensus. In other words, all their balance sheets need to match. When a new batch of transactions is successfully processed, it is encoded in a 'block', which is added to an immutable 'chain' of previous transactions.

Each block in the chain is connected by a cryptographic code called a 'hash'. Maintaining the blockchain and developing increasingly complex hash codes requires time and consumes computing power. So, Nakamoto proposed that peers on the network be compensated with a new type of virtual currency – called a 'bitcoin' – in exchange for lending their resources to the blockchain.

Coming up with the code and creating new bitcoin tokens is done via a process called 'mining'.

Bitcoin mining

Mining is how new bitcoins are created and is an essential part of the blockchain. To confirm a new block of transactions and add them to the existing chain, users in the network compete to solve complex computational problems. This is how the cryptographic hash that links the chain together is derived. The first computer, or 'bitcoin miner', to solve the problem creates the hash and is awarded a number of bitcoin tokens. Then the process repeats itself.

Bitcoin mining requires a lot of computing power and can be costly and time-consuming. However, many investors are drawn to the idea that they can literally mint new bitcoins simply by harnessing the power of their home computers.

Real-world cryptocurrency mining is a bit tougher because solving these computational problems requires incredible processing power. Miners sometimes have to spend thousands of dollars on computer equipment capable of successfully mining bitcoin.

Oddly enough, the network's size determines the complexity of these problems rather than the number of transactions in the blockchain.

In the early days of Bitcoin, when there were fewer users on the network, many home computers had the processing capacity to solve these problems. However, as the network grew in popularity and added more users, the problems developed in complexity, so a larger group of computers wouldn't solve them more rapidly.

The rationale behind this is stabilising the flow of new bitcoins into circulation and thereby preserving its scarcity. The Bitcoin network aims to add one block to the chain roughly every 10 minutes, adjusting the complexity of the cryptographic problems to maintain that rhythm. This prevents the market from being flooded with new bitcoin tokens, but it also makes crypto mining increasingly expensive – and energy-inefficient.

The other major downside is that it is mainly down to chance as to which computer on the network will solve the problem – meaning you could invest all that processing power and energy and still get little in return. However, many die-hard miners would still argue that it's worth all the costs for the potential reward: brand-new bitcoins.

Bitcoin 'halving'

As of December 2023, the computer that solves the cryptographic problems the fastest is awarded 6.25 brand-spanking new bitcoins for its efforts. The award changes over time. In 2009, just after Nakamoto proposed the Bitcoin network, the winner was awarded a whopping 50 new bitcoins for their troubles.

A process called 'halving' drives the reduction in the number of bitcoins awarded. Every time an additional 210,000 blocks are mined – roughly every four years – the number of new bitcoins minted through the mining process drops by half. In 2012, it dropped to 25 bitcoins; in 2016, it went down to 12.5; and in 2020, it fell to its current number, 6.25.

It's worth pointing out that 6.25 bitcoins created every 10 minutes is nothing to scoff at, considering it still translates to about $260,000 based on current market prices. It's potentially so lucrative that many companies focusing solely on bitcoin mining have sprung up across the globe.

While it's true that a lot of bitcoin miners have jumped on board over the years, it's not for the faint-hearted. Some have lost part or all of their investments due to recent volatility in the bitcoin price. Specifically, the falling value and rising energy costs have made the undertaking uneconomical for some mining operators.

Theoretically, the halving process is intended to continue until a limit of 21 million bitcoins is reached. At this point, computers on the network will be compensated with other fees for maintaining the fidelity of the blockchain. But we don't have to worry about this until about 2140 when the halving process is estimated to end.

Like the increasing complexity of the cryptographic problems, halving helps preserve Bitcoin's scarcity. For many investors and enthusiasts, this element of scarcity is the thing that gives the cryptocurrency its value. Knowing that only a finite number will ever exist tends to make bitcoins intrinsically more valuable to people – as is the case with gold and other precious metals. For this very reason, many investors refer to Bitcoin as 'digital gold'.

The recent history of Bitcoin

In early 2009, shortly after Nakamoto first published the paper, the Bitcoin network was launched. The first ever Bitcoin transaction via the blockchain network happened only a few days later when Nakamoto transferred 10 bitcoins to software programmer Hal Finney.

The first commercial transaction using Bitcoin didn't occur until 2010 when a Florida computer programmer named Laszlo Hanyecz traded 10,000 bitcoins for two pizzas. The crypto world now commemorates this incidental transaction each year on 22 May under the aptly titled Bitcoin Pizza Day.

From these humble beginnings, Bitcoin has grown into an asset with a global market capitalisation approaching US$800 billion. For context, that means by today's standards, Hanyecz would have paid more than US$400 million for those two pizzas. Hope they were worth it!

Bitcoin introduced an entirely new digital asset class: cryptocurrency. Other tech entrepreneurs are continuing to build on blockchain technology, with the Ethereum (CRYPTO: ETH) network, in particular, expanding blockchain applications.

Key developments in the evolution of Bitcoin include:

Creation of 'bitcoin cash'

Bitcoin cash (CRYPTO: BCH) launched in August 2017, following an event called a 'hard fork'. This is when there is a substantial change in the protocol or rules of a blockchain, such that the newest version of the blockchain no longer accepts the older chain of transactions. You can imagine this as a literal 'fork in the blockchain'. One chain continues under the 'old' rules while a second branches off, obeying an updated set of rules.

In the case of Bitcoin, the hard fork was a change in protocol that allowed for a larger number of transactions to be stored in each block, speeding up processing times. This hard fork effectively created a new blockchain with different rules and a new native cryptocurrency, dubbed 'bitcoin cash'. The crypto never took off with investors like Bitcoin did and has lost about 95% of its value since launching.

The latest Bitcoin halving

The halving process discussed earlier can significantly impact Bitcoin's price. A reduction in an asset's supply tends to increase its price, which is typically observed with Bitcoin.

The Bitcoin price skyrocketed following its halving in May 2020. A similar, though not as dramatic, price surge also occurred around the time of its 2016 halving. The same could not be said in the days following its most recent halving in April 2024, with the Bitcoin price slumping amid the prospect of interest rates remaining higher for longer.

Bitcoin ETF creation

In February 2021, the world's first Bitcoin exchange-traded fund (ETF), backed by physically settled bitcoins, launched and became available to investors. The Purpose Bitcoin ETF (TSX: BTCC) was the first to offer access to the world's largest crypto asset using traditional investment vehicles without derivatives.

This was a big deal as it meant institutional investors and everyday people alike had an easy way to invest in Bitcoin without the arduous process of setting up a digital wallet and buying crypto directly.

As time has passed, others have joined in on providing various cryptocurrency ETFs. Even Australia witnessed the launch of its first crypto ETFs in April 2022. However, due to an underwhelming reception, one of the providers (Cosmos Asset Management) has since delisted its offering.

Bitcoin made legal tender

The Congress of El Salvador made an unprecedented decision in September 2021 to make Bitcoin legal tender in the country. President Nayib Bukele led the move in a bid to increase foreign investment and improve financial equality.

Upon implementing the crypto asset as a legally recognised form of payment, people in El Salvador could opt to pay for their coffee with a digital wallet containing bitcoins instead of United States dollars. However, the country still lacks widespread internet access, making the use of a crypto wallet a challenge for some. According to Trading Economics, the percentage of El Salvadorians using the internet in 2020 was 54.6%.

Many have criticised El Salvador's decision, arguing it risks the country's financial stability. In early 2022, the International Monetary Fund (IMF), an international financial institution, urged El Salvador to backtrack on its Bitcoin adoption. It warned that it would be difficult to provide a loan to the country in the event of economic distress.

The Central Republic of Africa followed in El Salvador's footsteps, adopting Bitcoin as legal tender in April 2022. However, the local parliament repealed the cryptocurrency's newfound status in the country earlier this year.

Bitcoin performance so far

Despite its price volatility, Bitcoin has delivered some staggering returns. It's mind-boggling to think that, as recently as 2016, you could buy a Bitcoin token for well under US$1,000. In March 2024, the coins reached an all-time high price of US$75,830 apiece — albeit short-lived!

Caution is necessary, however, as investing in Bitcoin is not for the faint-hearted. Although it has delivered some astounding long-term returns, the price of Bitcoin has been incredibly unstable. Plenty of investors have still lost big by mistiming the market.

If you choose to invest in Bitcoin, ensure you understand the risks involved. And don't invest any money you can't afford to lose.

Adding Bitcoin to a portfolio

Speaking of investing in Bitcoin… you might be wondering how someone would go about converting their fiat currency into crypto. Aside from mining, there are several methods for gaining exposure to Bitcoin these days.

Once upon a time, to facilitate a transaction, people would need to trawl through forums to find someone willing to sell their bitcoins. In the present day, the process is much less tedious, thanks to the proliferation of crypto exchanges. Now, a variety of platforms exist where bitcoins can be bought and sold, much like any other asset. Popular exchanges include CoinSpot, CoinJar, Kraken, and Swyftx.

Investors can also buy into a Bitcoin ETF, such as the Global X 21 Shares Bitcoin ETF, which essentially tracks the price without owning any underlying coins. This option has gained popularity among those who want to add crypto to their portfolio without the complexities of buying and storing it.

One other viable method is the use of a good old-fashioned automated teller machine (ATM) with a new twist. That's right, Bitcoin ATMs exist… and there isn't just one of them, but 750 scattered throughout the country.

Source: Bitcoinist

However, a cryptocurrency exchange is typically the most convenient option for people looking to add Bitcoin to their portfolio.

Let's go through some basic steps to becoming a Bitcoin 'holder'.

How to buy Bitcoin

The first point of order in purchasing the original crypto asset via an exchange is to find a reputable source. Research online to find an exchange that has been around for some years. It needs to be well-known among crypto investors with minimal transaction fees.

Once you have found a suitable platform, the next step is to register an account. This part of the process is similar to setting up a bank account. You'll need to provide personal details and identification documents for the exchange to fulfil its 'know your customer' obligations.

From here, it is as simple as depositing funds into your account using a payment option such as direct deposit, PayID, or linking a debit or credit card. After the funds have landed, it's a matter of finding Bitcoin on the exchange and placing an order.

What to do after buying

Once you have placed your order and successfully purchased your Bitcoin, the next step is to look for a digital wallet to store your new asset.

While you can keep your crypto on the exchange, it is much less safe than storing it in your own personal wallet. Cybercriminals often target exchanges, hoping to breach the security of such operations for financial gain.

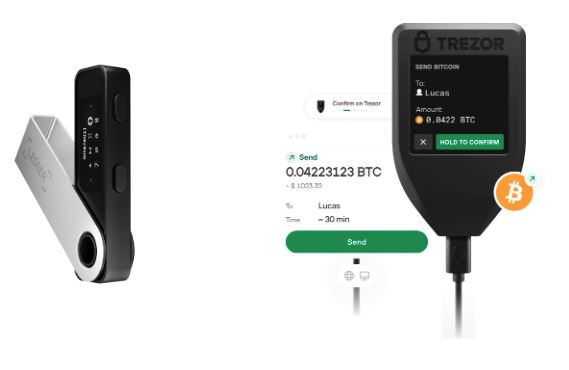

A few different types of wallets are available, but the two most common are 'hot wallets' and 'cold wallets'. A hot wallet stores your Bitcoin online and is connected to the internet. A cold wallet stores your Bitcoin offline on a USB drive or in a paper wallet.

The benefit of using a hot wallet, such as MetaMask, is that it is much more convenient for everyday bitcoin payments. You can easily transfer funds in and out of it. However, because it is connected to the internet, it is also more vulnerable to hacks.

This is where a cold wallet comes in handy. It provides an added layer of security by keeping your bitcoins – or, more specifically, your private key – isolated and offline. Popular cold wallet options include those sold by Ledger and Trezor.

Once you have chosen a Bitcoin wallet, you must transfer your bitcoins from the exchange account into your preferred wallet. This is a relatively simple process, but it is essential to check you are moving to the correct wallet address to avoid losing your funds. Double-check and triple-check! There are no intermediaries to reverse a transfer in the crypto world.

You should now be familiar with Bitcoin, especially if you now own some. Make sure to keep your private key safe. Whoever has access to it will have access to your Bitcoin.

And welcome to the world of cryptocurrency!

- With additional reporting from Motley Fool contributor Mitchell Lawler.