When it comes to buying ASX dividend shares, some beginner investors are seduced by the lure of high payouts. But there's much more to picking the right passive income stocks for your portfolio than just dividend yield.

Is the company retaining enough profit to reinvest for future growth? Are its dividends sustainable? Does the stock have a decent track record of growing its shareholder payouts? Is the yield rising sharply on the back of recent share price falls, and if so, why are investors selling? And so it goes on…

To help sort the income-stock treasure from the traps, we asked our Foolish writers which ASX dividend shares they think should be on your buy list right now. Here is what the team came up with:

7 best ASX dividend shares for February 2024 (smallest to largest)

- Graincorp Ltd (ASX: GNC), $1.83 billion

- Fletcher Building Ltd (ASX: FBU) $3.32 billion

- Metcash Limited (ASX: MTS), $3.56 billion

- Super Retail Group Ltd (ASX: SUL), $3.64 billion

- NIB Holdings Limited (ASX: NHF), $3.88 billion

- Endeavour Group Ltd (ASX: EDV), $10.28 billion

- BHP Group Ltd (ASX: BHP), $241.32 billion

(Market capitalisations as of market close 2 February 2024).

Why our Foolish writers love these ASX passive income stocks

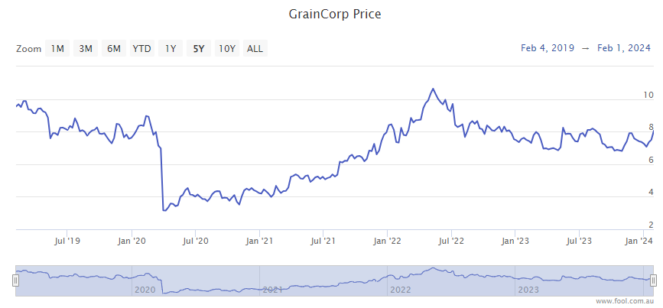

Graincorp Ltd

What it does: GrainCorp is a 100-year-old agribusiness and processing company that connects growers and producers with local and international customers. It manages a wide range of grains, pulses, oilseeds, biofuel components, animal feeds, and oils and shortenings used in food production.

By Bronwyn Allen: I used CommSec's stock screener to identify the S&P/ASX 200 Index (ASX: XJO) stock with the best five-year growth rate for dividends. Up came Graincorp shares with an impressive 82.3% growth rate over five years and 22.1% over 10 years.

Could this ASX agriculture stock be worth looking into for income investors?

Among the nine analysts covering the stock on CommSec, five rate Graincorp a strong buy, three a hold, and one a strong sell.

While the long-term dividend growth rate is great, ag stocks can be volatile. The consensus expectation for Graincorp dividends in 2024 is 30.8 cents per share, well down on the 54 cents paid last year.

However, on today's share price of $7.92, 30.8 cents still equates to a reasonable dividend yield of 3.9%, plus 100% franking.

Motley Fool contributor Bronwyn Allen does not own shares of Graincorp Ltd.

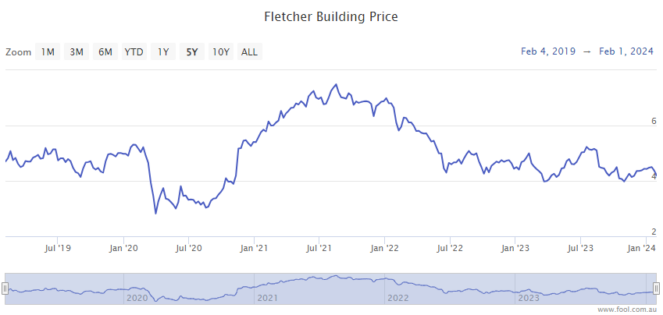

Fletcher Building Ltd

What it does: Fletcher Building is a New Zealand company that makes and distributes construction materials.

By Tony Yoo: This Kiwi outfit has been a consistent dividend payer over the past four years. The yield is already excellent at 7.4%, but if you include supplemental distributions, that is bumped up to 8.5%.

The cyclical nature of the construction industry is such that now might be a cheap time to buy a stock like Fletcher Building before the real estate market heats up from interest rate cuts. The current share price is around 19% off last August.

Pleasingly, revenue, operating margin and net profit before abnormals have all trended up over the past four financial years. According to CMC Invest, nine out of 11 analysts currently believe Fletcher Building shares are a buy.

Motley Fool contributor Tony Yoo does not own shares of Fletcher Building Ltd.

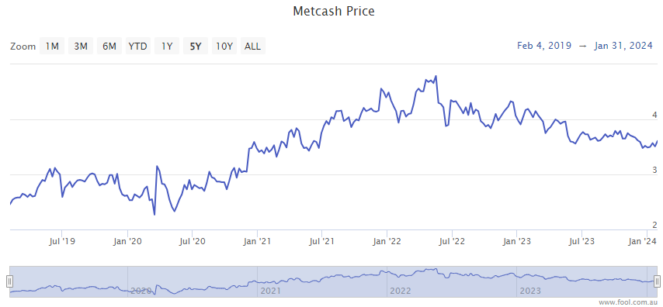

Metcash Limited

What it does: Metcash distributes food and drink to independent supermarkets and liquor stores around the country, including IGA supermarkets, IGA Liquor, Cellarbrations, The Bottle-O, Porters Liquor, Thirsty Camel, Big Bargain Bottleshop, and Duncans. It also has a hardware division that owns Mitre 10, Home Timber & Hardware, and Total Tools.

By Tristan Harrison: A number of ASX dividend shares have rallied in the last few weeks and months, reducing their dividend yields, but Metcash hasn't seen that, making it look much better value relative to others.

Using Commsec forecasting, Metcash is projected to pay a very healthy grossed-up dividend yield of around 8%.

Furthermore, I think Metcash is one ASX stock that could strongly benefit from potential interest rate cuts, which could lead to stronger demand for its hardware division. Before economic conditions weakened, the hardware division was the most profitable, so a rebound in demand would be very helpful.

Population growth is also a useful tailwind for Metcash, with more people equating to more households and potential customers. The company recently announced it's in the running to acquire Superior Food Group, which could further boost earnings.

In my opinion, the Metcash share price is good value. It's priced at 13x FY24's estimated earnings.

Motley Fool contributor Tristan Harrison owns shares of Metcash Limited.

Super Retail Group Ltd

What it does: Super Retail Group is a retailing conglomerate behind the popular Rebel, Super Cheap Auto, Macpac, and BCF chains.

By Sebastian Bowen: I've long been impressed with the performance of Super Retail Group. Sure, this company does operate in the usually-cyclical consumer discretionary sector. However, its stores — particularly Super Cheap and BCF — are famously recession-resistant.

Its recent numbers also suggest resistance to both high inflation and high interest rates, too. This alone makes it a good candidate for a dividend investor, in my view.

But what's really caught my eye this February is Super Retail's chunky dividend. At recent pricing, this company offers investors a yield close to 5%, which typically comes with full franking credits attached for an added bonus.

As such, I think you could do far worse than this company for a passive income investment today.

Motley Fool contributor Sebastian Bowen does not own shares of Super Retail Group Ltd.

NIB Holdings Limited

What it does: NIB is a private medical insurance provider to residents of Australia and New Zealand. After privatising in 2007, the company has grown to serve more than 1.5 million people. NIB also has a substantial presence in travel insurance and National Disability Insurance Scheme (NDIS) plan management.

By Mitchell Lawler: Jostling with heavyweights, such as Medibank Private Ltd (ASX: MPL) and Bupa, the smaller NIB has managed to grow at an above-industry rate for the last 20 years.

Dividends are dependent on profits. The business continues to report strong policyholder growth and attractive net margins. In particular, the international inbound health insurance segment posted a 15.7% policyholder increase in FY23, delivering a sensational net margin of 13.1%.

Furthermore, the core Australian resident offering continues to expand, increasing its policyholder count by 4.7% in FY23. As immigration into Australia surges, NIB could be well-positioned to reap the rewards.

Investors can secure NIB shares on a 3.6% dividend yield right now. It may not be quite as generous as other alternatives. However, I believe this company's dividends have plenty of room to grow.

Motley Fool contributor Mitchell Lawler does not own shares of NIB Holdings Limited.

Endeavour Group Ltd

What it does: Endeavour is the drinks giant behind the BWS and Dan Murphy's brands, as well as a large network of hotels/pubs.

By James Mickleboro: I think Endeavour would be a great ASX dividend share to buy due to its leadership position in a market that has defensive qualities.

In addition, the company still has plenty of growth opportunities. It added 39 retail stores to its network in FY 2023, bringing its network to 266 Dan Murphy stores and 1,435 BWS stores. While these may sound like large numbers, management isn't stopping there, with plenty more store openings planned.

Goldman Sachs expects this to underpin the payments of fully-franked dividends per share of 21 cents in FY 2024, 23 cents in FY 2025, and 25 cents in FY 2026. This will mean yields of 3.8%, 4.2%, and 4.5%, respectively.

The broker also sees value in Endeavour shares at current levels. It has a buy rating and $6.40 price target on them. This represents more than 11% upside from Friday's closing price of $5.74.

Motley Fool contributor James Mickleboro owns shares of Endeavour Group Ltd.

BHP Group Ltd

What it does: BHP is the largest company listed on the ASX. It has top-tier mining operations in Australia, North America, and South America. The diversified resources company earns most of its revenue from iron ore, with copper coming in at number two and coal also providing significant income.

By Bernd Struben: BHP is well known for its reliable, fully franked dividends. And BHP's share price and dividends are closely aligned with the price of iron ore, which topped US$220 per tonne in mid-2021.

The retrace in the price of the industrial metal in the latter half of 2022 and much of 2023 to below US$100 per tonne also saw BHP's dividends come down from the all-time highs of late 2021 and 2022.

Though at yesterday's closing price of $47.61, BHP still trades at a healthy 5.5% trailing yield.

When it comes to the outlook for the iron ore price, I'm in agreement with Citi's analysts. They see it rebounding to US$150 per tonne (up from the recent US$136 per tonne) in the first quarter of 2024. This would bode well for BHP's share price and dividends.

Motley Fool contributor Bernd Struben does not own shares of BHP Group Ltd.