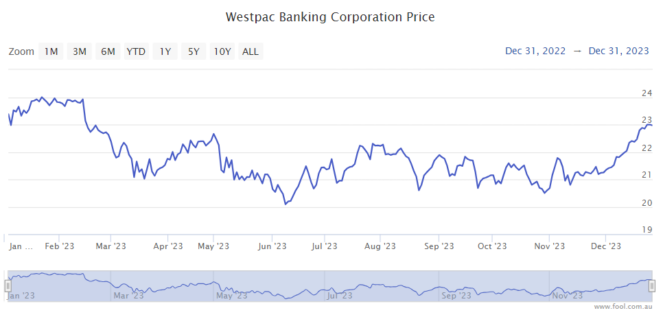

The Westpac Bank Corp (ASX: WBC) share price rose slightly in 2023 but didn't even manage a rise of 1%. The S&P/ASX 200 Index (ASX: XJO) saw capital growth by just over 9%, so the ASX bank share significantly underperformed the ASX index.

While the ASX 200 was driven by names like BHP Group Ltd (ASX: BHP), Fortescue Ltd (ASX: FMG), Wesfarmers Ltd (ASX: WES) and Goodman Group (ASX: GMG), banks didn't have such a compelling year.

What happened in 2023?

Westpac is in a tricky competitive situation – there are numerous lenders that offer almost exactly the same thing – Commonwealth Bank of Australia (ASX: CBA), ANZ Group Holdings Ltd (ASX: ANZ), National Australia Bank Ltd (ASX: NAB), Macquarie Group Ltd (ASX: MQG), Suncorp Group Ltd (ASX: SUN), Bendigo and Adelaide Bank Ltd (ASX: BEN), Bank of Queensland Ltd (ASX: BOQ), MyState Limited (ASX: MYS) and Pepper Money Ltd (ASX: PPM). There are plenty of sizeable non-ASX lenders too.

With all of these lenders, the industry has collectively seen the net interest margin (NIM) challenged at the start of 2023 compared to the end of the year. In the first half of Westpac's FY23, the 'core NIM' was 1.90% and it had fallen to 1.84% in the second half. For the month of September 2023 (the last month of FY23), the core NIM had fallen to 1.81%.

The Reserve Bank of Australia (RBA) has sent its cash rate all the way up to 4.35%, which raises the risk of borrowers defaulting on their loans, which could mean higher bad debts for banks in 2024. Westpac reported a couple of months ago that it was seeing rising home loan arrears. This could lead to lower cash flow and hits to profit if a growing number of Westpac borrowers struggle.

In the FY23 report, Westpac revealed net profit excluding notable items of $7.37 billion, an increase of 12%. However, the FY23 second half saw net profit excluding notable items of $3.5 billion, which was down 7% compared to the first half of FY23. That may foreshadow that the FY24 first-half profit may drop compared to the FY23 first-half.

Outlook for Westpac shares

Investors usually like to value a business based on what they're expecting from the company in the next 12 to 24 months.

The bank said it will integrate more technology in the coming years to "deal with complexity, cost and service issues from past acquisitions." The ASX bank share thinks this will improve service for customers, grow the business in line with the overall lending system, deliver a cost-to-income ratio closer to peers and remove legacy systems and duplication.

Westpac concluded with the following statement about the outlook:

While more customers are calling us, hardship levels remain at around half the numbers we saw during COVID and we are not yet seeing significant increases in customers falling behind on repayments. But this doesn't mean it's been an easy road. From experience we know customers prioritise paying their mortgage while cutting back their spending elsewhere. We remain focused on helping those who need it and encourage customers to call us early.

Looking ahead there are some uncertainties in the economic outlook. While inflation is coming down, challenges remain, including volatile energy prices and geopolitical uncertainty due to conflict in Europe and the Middle East.

In Australia, employment and productivity are key measures to watch. The jobs market has proved robust but will be tested through 2024. Consumer sentiment remains weak but there are glimmers of hope with some cost pressures starting to ease for businesses, which in time should flow through to prices paid by consumers.