Happy New Year to all our readers!

If we're not mistaken, there just might be a sparkle of optimism in the air. Let's hope 2024 comes through with lots of positive energy that will help us achieve our Motley mission to make the world smarter, happier, and richer.

To that end, we asked our Foolish writers to let us know which top ASX shares they reckon are worth adding to your must-have list for 2024. Here is what the team came up with:

6 best ASX shares for January 2024 (smallest to largest)

- MMA Offshore Ltd (ASX: MRM), $700.12 million

- Accent Group Ltd (ASX: AX1), $1.09 billion

- Life360 Inc (ASX: 360), $1.53 billion

- Boss Energy Ltd (ASX: BOE), $1.63 billion

- Lovisa Holdings Ltd (ASX: LOV), $2.68 billion

- Wesfarmers Ltd (ASX: WES), $64.69 billion

(Market capitalisations as of market close 29 December 2023).

Why our Foolish writers love these ASX stocks

MMA Offshore Ltd

What it does: MMA Offshore provides marine services to clients with infrastructure in the sea, such as providing boats to get personnel out to oil rigs or wind turbines.

By Tony Yoo: The energy insecurity caused by wars in Europe and the Middle East has seen MMA Offshore's clients boom. This in turn is benefitting investors in the seafaring services provider, with the stock price almost doubling last year. If you go back to the start of 2022, the stock has rocketed more than 400%.

Despite this spectacular rise, many experts are tipping further rises for the shares. Glenmore portfolio manager Robert Gregory noted recently how the business has "a high fixed cost base" while it welcomes more work, making for a "likely" upside to future earnings.

Motley Fool contributor Tony Yoo does not own shares of MMA Offshore Ltd.

Accent Group Ltd

What it does: Accent is a footwear and apparel retail powerhouse across Australia and New Zealand. The company distributes through popular brands such as Timberland, The Athlete's Foot, Skechers, and Vans across an 821-strong store footprint.

By Mitchell Lawler: The retail industry can be ruthless and unforgiving. It can be all too easy to end up trying to compete on price – a race to the bottom that has led to many retailers collapsing throughout history.

Fortunately, I consider Accent Group a company that wields a competitive advantage unrelated to product price… distribution. Walk into any major shopping centre, and you'll often find Accent's brands dominating in footwear, unbeknownst to most shoppers.

It's the illusion of choice. Whether a 'sneakerhead' decides to buy some fresh kicks from Platypus or Glue Store, the sale is going into Accent's back pocket either way. The historical revenue growth is evidence of the success.

Motley Fool contributor Mitchell Lawler does not own shares of Accent Group Ltd.

Life360 Inc

What it does: Life360 operates in the digital consumer subscription services market with a focus on products and services for digitally native families. Its core offering is the Life360 app, which offers features such as communications, driver safety, and location sharing.

By James Mickleboro: I think Life360 is one of the best tech stocks on the Australian share market and doesn't get anywhere near as much attention as it deserves.

In November 2023, the company released its third quarter update and reported global monthly active users (MAU) of 58.4 million, an increase of 24% from the same period a year earlier. This gives it a significant user base to monetise in the future.

It is partly because of this latent monetisation opportunity that Goldman Sachs is so bullish on the company. In fact, Goldman is forecasting Life360 to grow its revenue from US$228.3 million in FY 2022 to US$444.7 million in FY 2025.

The broker currently has a buy rating and a $10.50 price target on its shares.

Motley Fool contributor James Mickleboro owns shares of Life360 Inc.

Boss Energy Ltd

What it does: Boss Energy is a uranium company primarily focused on its Honeymoon Uranium Project in South Australia.

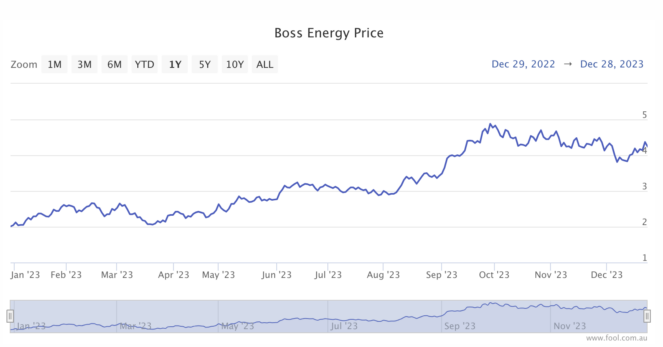

By Bernd Struben: The Boss Energy share price surged 89% in 2023. This saw the stock added to the ASX 200 as part of the December quarterly rebalance. And I think there's more outperformance to come.

Global uranium demand is booming amid renewed interest in nuclear power. With demand growth outpacing supply, uranium prices soared more than 50% in 2023. And with 22 nations at Cop28 having pledged to triple their nuclear power capacity, strong uranium prices are likely to continue.

Boss commenced its first mining activities at Honeymoon in October last year. And the company is set to become a multi-mine uranium producer in H1 2024 after acquiring 30% of the Alta Mesa In Situ Recovery Project in the US in December.

As at 30 September 2023, Boss had no debt, cash on hand of $63 million and a uranium stockpile worth $144 million.

Motley Fool contributor Bernd Struben does not own shares of Boss Energy Ltd.

Lovisa Holdings Ltd

What it does: Lovisa sells affordable jewellery to younger shoppers from a network of stores in numerous countries such as Australia, New Zealand, the United States, United Kingdom, France, and Germany.

By Tristan Harrison: The company has done an excellent job of growing its store count up until now. It has only just recently entered into a number of countries, including Canada, Mexico and Poland. It's about to enter other appealing markets like China and Vietnam, which have huge populations.

I think Lovisa can open stores in a lot more countries around the world, and existing markets (like the US) offer lots of room for more stores without cannibalising sales.

As its store network grows, scale can help increase the net profit before tax (margin), which could come with stronger cash flow, a stronger dividend and ultimately, a rising Lovisa share price. I'm excited by the five-year outlook for this company, which is why I recently invested.

Motley Fool contributor Tristan Harrison owns shares of Lovisa Holdings Ltd.

Wesfarmers Ltd

What it does: Wesfarmers is a rather strange company in that, despite being one of the largest shares on the ASX, is not a household name. However, most Australians would have heard of Kmart, Officeworks, Target and, of course, Bunnings – just a few of this conglomerate's bevy of brands.

By Sebastian Bowen: I love buying quality ASX shares with diversification built in. And Wesfarmers certainly ticks both of those boxes. This company has proven to be one of the most astute managers of capital on the ASX over many decades. Some of its biggest moves, like buying Coles Group Ltd (ASX: COL) in 2007, are legendary amongst the investing community.

Today, Wesfarmers offers investors exposure to industries as diverse as energy, lithium, clothing and chemical manufacturing. As well as its retail crown jewels. I think Wesfarmers has what it takes to deliver meaningful capital growth over 2024 and beyond. Plus, you get a nice, fully-franked dividend over 3% as well.

Motley Fool contributor Sebastian Bowen owns shares of Wesfarmers Ltd.