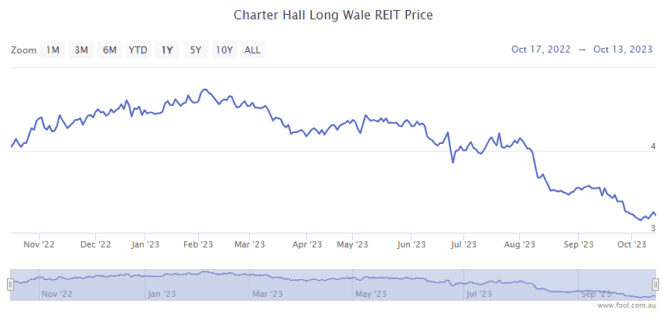

Charter Hall Long WALE REIT (ASX: CLW) is a real estate investment trust (REIT) that could be a leading ASX dividend share investment idea in 2024 and 2025. Why? It has the potential to offer a very large dividend yield.

The Charter Hall REIT owns a portfolio of properties across Australia. They are in a variety of sectors focused on key defensive tenant industries that are "resilient to economic shocks."

It owns office buildings, pubs and bottle shops, telecommunications buildings, grocery and distribution, service stations, food manufacturing, waste and recycling, logistics, Bunnings buildings and so on.

Long-term income with good tenants

A key part of the REIT's investment proposition is that it has rental income locked in for a long time. The weighted average lease expiry (WALE) of the business was an impressive 11 years at the end of FY23, which provides "long-term income security".

It has a large number of quality tenants, including government, ASX-listed, multinational and national tenants. And its portfolio has a 99.9% occupancy rate.

That includes Australian federal and state governments, Endeavour Group Ltd (ASX: EDV), Telstra Group Ltd (ASX: TLS), BP, Inghams Group Ltd (ASX: ING), Coles Group Ltd (ASX: COL), Metcash Ltd (ASX: MTS), David Jones, Arnott's Group, Myer Holdings Ltd (ASX: MYR), Wesfarmers Ltd's (ASX: WES) Bunnings and Westpac Banking Corp (ASX: WBC).

In FY23, 51% of its leases with inflation-linked annual reviews had a 7.1% weighted average increase. Meanwhile, the other 49% of leases had annual fixed reviews with an average fixed increase of 3.1%.

While higher interest rate costs are certainly a problem, it appears the growing rental income can make up for that.

The ASX dividend share's generous payout ratio

The ASX dividend share typically pays out all of its operating earnings each year as a distribution to investors. In other words, it sends out all of its rental profit to security holders.

In FY24, the REIT is guiding that it will generate operating earnings per security (EPS) of 26 cents and pay a distribution per unit of 26 cents.

That means it's valued at 12x FY24's estimated operating earnings, and it could pay a forward distribution yield of 8.25%.

2025 predictions

No-one can say what's going to happen with inflation and interest rates over the next couple of years, but analysts have forecast how large the annual distribution could be from the Charter Hall REIT in 2025.

The projection on Commsec suggests it will pay an annual distribution per security of 26.9 cents. That would be an incredible 8.5%.

Can you imagine telling investors two years ago that Charter Hall Long WALE REIT would pay a yield of more than 8% in FY24 and FY25?