Mid-cap shares tend to offer investors the best potential returns on a risk-adjusted basis as they're usually already profitable, but still small enough for them to double profits or market cap in as little as 12 months for example.

It's always worth looking at the best-performing mid-caps as they could be the blue-chips of tomorrow given the rapid rate of globalisation and technological change today.

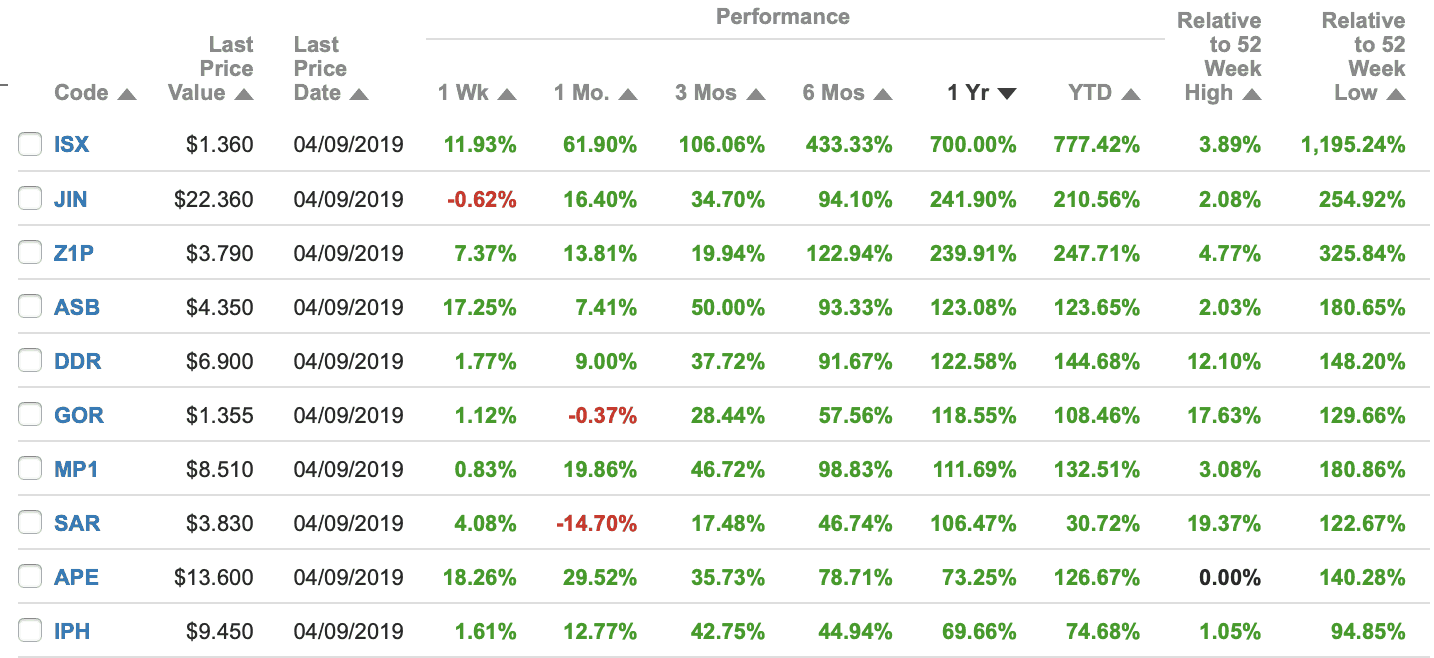

For example it looks like 6 of the top 10 companies below are using the rise of the Internet or digital economies to deliver their growth. So let's take a look at them.

Source: Commsec, Sept 5, 2019.

iSignthis Ltd (ASX: ISX) is the client ID verification business for payments platforms. Its shares have shot up 700% over the past year perhaps over investor excitement related to its potential to help buy-now, pay-later payments providers. For the six months ending June 30 2019 it reported a statutory loss of $0.7 million on operating revenues of just $7.5 million, but it is forecasting positive EBIT for FY 2019 of $7.7 million. Therefore its current valuation over $1.4 billion looks huge versus its trailing financials.

Polynovo Ltd (ASX: PNV) posted a loss of $3.19 million on revenue of $13.68 million for fiscal 2019. It uses its patented bioabsorbable polymer technology to help develop medical devices.

Jumbo Interactive Ltd (ASX: JIN) is the online lottery retailer that operates ozlotto.com and is benefiting as customers switch to buying tickets online rather than over-the-counter at a local shop.

Z1P Co. Ltd (ASX: Z1P) is the buy now, pay later start-up delivering some blockbuster growth in Australia thanks to the popularity of its 'interest free' service as an alternative to traditional credit card debt.

Austal Limited (ASX: ASB) is the commercial and military shipbuilder that has won and delivered a couple of big contracts with the US Navy over the past 12 months.

Dicker Data Ltd (ASX: DDR) is the IT hardware distribution business based out of Sydney. Its COO just bought another 20,000 shares on market at $6.90. This suggests he thinks the share price is going higher yet.

Gold Road Resources Ltd (ASX: GOR) is a WA-based gold production and exploration company that delivered first production in FY 2019 and has benefited from a soaring gold price.

Megaport Ltd (ASX: MP1) is an internet services group that lets enterprise clients adjust their amount of internet connectivity bandwidth in order to potentially save money for example.

Saracen Mineral Holdings Ltd (ASX: SAR) is another junior gold miner benefiting as the gold price soars.

AP Eagers Ltd (ASX: APE) is the second-hand and new car dealership business that is attempting to complete a takeover of rival Automotive Holdings Group Ltd (ASX: AHG).

IPH Ltd (ASX: IPH) is the patent law firm that has benefited from an aggressive acquisition strategy and as the US dollar remains very strong. This is because the law firm commonly invoices clients in US dollars.