As we're now nearly halfway through the calendar year I thought it worth using a 'stock screen' to see what are the 10 best performing 'large cap' shares of 2019 so far.

Using a stock screen can be useful as an investor in sorting large amounts of data to identify what are the best performing shares, as these are always worth knowing about given winners tend to keep on winning in the share market.

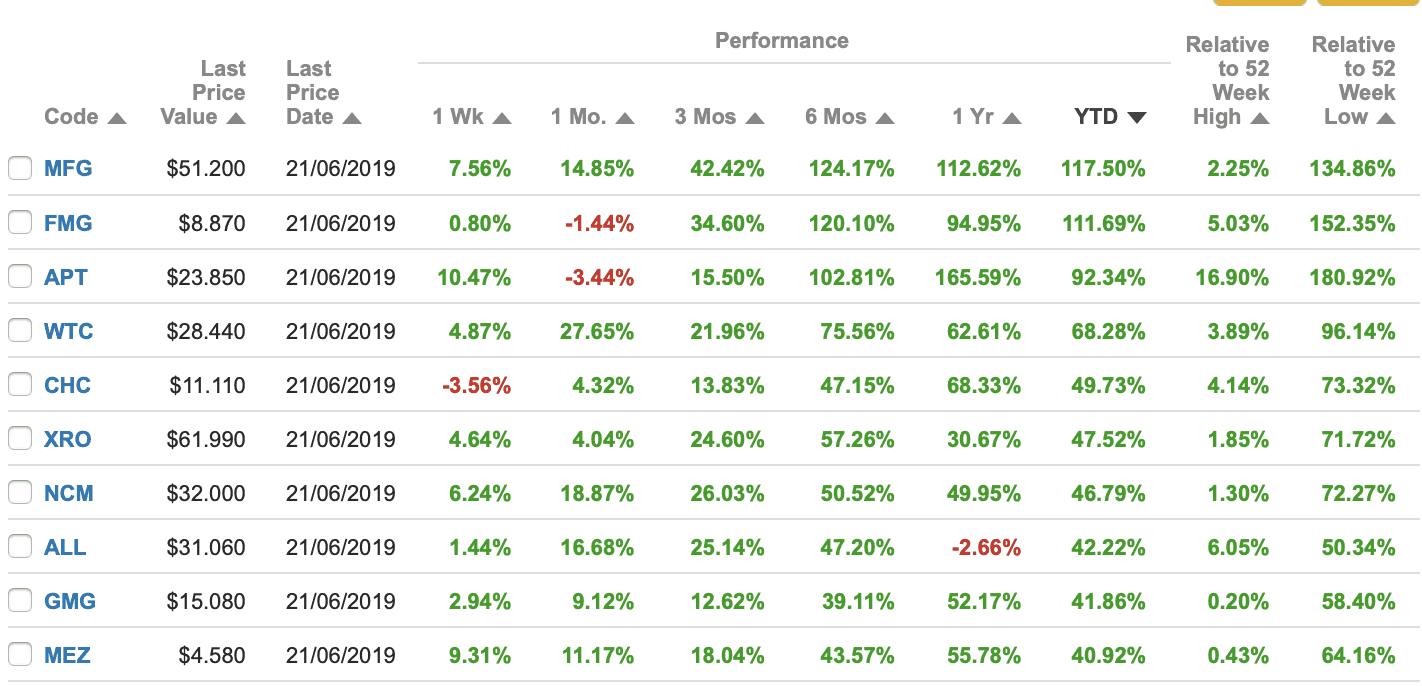

Let's take a look below at what Commsec is returning as the 10 best large caps of 2019 as at June 24, 2019.

Source: Commsec Jun 24, 2019

Magellan Financial Group Ltd (ASX: MFG) is an international equities business I regularly recommended buying through FY2014-2019. Including dividends around $4.96 since FY 2014 the stock is up around 800% since then.

Fortescue Metals Group Ltd (ASX: FMG) is up 112% in 2019 thanks to rising iron ore prices partly due to less global supply after a terrible mining accident in Brazil. According to Market Index, iron ore sits at $107 a tonne today, compared to just US$67 at the start of 2019.

Afterpay Touch Group Ltd (ASX: APT) is the buy-now-pay-later start up posting some unbelievable growth numbers in the huge U.S. consumer market. As such, it's not a big surprise to see its shares go nuts.

Wisetech Global Ltd (ASX: WTC) is a $9 billion enterprise software-as-a-service cloud-based business hiding in the innocuous inner-west Sydney suburb of Alexandria. Enterprise SaaS businesses have gone nuts globally in 2019 and Wisetech ticks the boxes on this front.

Charter Hall Group (ASX: CHC) is a property funds management business that delivered a big upgrade to earnings guidance at its interim profit report in February 2019. It also completed a $1.6 billion acquisition of Folkestone Group recently and has been growing FUM either organically, acquisitively, or by property valuation upgrades.

Xero Limited (ASX: XRO) is another cloud-based enterprise-facing SaaS business that reported a net profit of $1.4 million over the six months to March 31 2019. Now it's profitable a lot of powerful fund managers are buying into the cloud accounting growth story.

Newcrest Mining Limited (ASX: NCM) is Australia's largest gold miner that has benefited from the Australian dollar gold price cracking $2,000 in the last week as the dollar falls in value against the US dollar. This helps crank Newcrest's profit margins as costs are incurred mainly in local dollars before it sells its gold for a US dollar price that has also been on a tear to lift above US$1,400 per ounce last week.

Aristocrat Leisure Limited (ASX: ALL) is a mini-turnaround story as the pokie machine merchant fell heavily over the second half of 2018 only to rebound this year on the back of renewed investor optimism over its growth potential in the giant U.S. market.

Goodman Group (ASX: GMG) is an industrial property investment and development group pleasing investors with its strong growth in assets under management and profits. One of its co-founders in Greg Goodman still runs the business as CEO and being industrially focused it's not so threatened by the rise of online shopping.

Meridian Energy Group (ASX: MEZ) shares are up 41% in 2019 as the New Zealand and Australia operating hydro-power provider continues to see steady growth in customer numbers and lifts its return to shareholders through special dividends, dividends, and buy backs.

Foolish takeaway

Looking at the diverse mix of companies on the list we can see there's many different ways to accrue strong returns in the share market. Generally though I'd suggest avoiding the more cyclical companies (miners, etc) in favour of those likely to deliver the best returns over the long term assuming the valuations are reasonable.