'Tis the season for all the experts to put out their forecasts on shares vs. property for the new year!

So, we thought we'd collate a bunch of those forecasts and present them to you in one handy article for pondering over the Christmas/New Year break.

Let's go!

What's the outlook for property in 2025?

Our first expert forecaster is the venerable Louis Christopher, Head of Research at SQM Research.

Christopher recently released his annual Housing Boom and Bust Report.

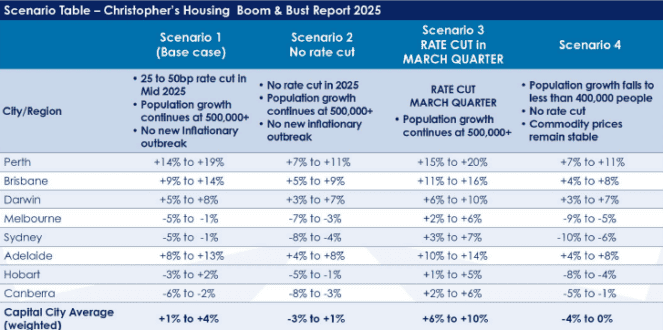

The report offers a base case scenario (that is, Christopher's opinion of the most likely scenario) as well as three other scenarios, depending on interest rates and other factors (shown in the table below).

Christopher's base case scenario involves a 0.25% or 0.5% cut to interest rates in mid-2025, population growth continuing at above 500,000 people per year, and inflation continuing on its downward path.

As the table above shows, Christopher is tipping major price growth of 14% to 19% in 2025 for Perth. This would actually represent a slowdown for the city, with SQM anticipating 25%-plus growth in 2024.

Christopher said:

Ongoing strong population growth, combined with strong employment growth and an existing undersupply of homes for sale will keep driving Perth dwelling prices up over the course of next year.

The key risks for Perth are a slump in iron ore prices (from current levels). However, the WA State Government's current financial position is very strong, enabling the State Government to respond to such an event. Forecasted interest rate cuts will also further stimulate demand in the second half of 2025.

As has been the case in 2024, Brisbane and Adelaide are also tipped to grow strongly once again. Christopher forecasts a 9% to 14% rise in Brisbane home values and an 8% to 13% rise for Adelaide.

On the flipside, he predicts home values will fall by up to 6% in Canberra and 5% in Sydney and Melbourne next year.

Other forecasts for property

According to The Australian, HSBC expects Australian house prices to stall in 2025.

HSBC chief economist Paul Bloxham says this will occur due to immigration passing its peak and high interest rates forcing some homeowners to sell.

This would add supply to a market with already weakening demand. However, he does not foresee a large enough increase in supply to cause significant home price falls.

Bloxham says a rate cut or two may lead to home price rises. However, he's not expecting many cuts and thinks the Reserve Bank won't start cutting until the June quarter.

The economist also expects Perth, Brisbane, and Adelaide to outperform Sydney and Melbourne again.

He expects modest falls in house prices in Sydney and Melbourne and a small lift in values in the cheaper capital cities and some regional areas next year.

Now, let's move on to the 2025 outlook for ASX shares and how that compares vs. property.

What's the outlook for ASX shares in 2025?

According to The Australian, Ausbil is bullish on ASX shares in the new year despite a decent rise in 2024.

Ausbil expects stronger corporate earnings amid cuts to interest rates, improved economic growth, and near-full employment.

Ausbil head of equities, Paul Xiradis, said:

We believe earnings growth will recover in FY25 more than the market expects – broadening across sectors, and moving down the market cap spectrum.

Xiradis expects Chinese economic stimulus to support China-exposed companies. He notes the risk of a trade war under incoming US President Donald Trump and the upside of a pro-business US government.

Xiradis says decarbonisation and the green energy transition will drive the ASX resources, energy, utilities, and mining services sectors.

He sees ongoing demand for iron ore from China, growing demand from India for metallurgical coal, and US steel demand for housing builds, renovations, and major infrastructure.

Looking ahead to the new year, Xiradis likes Wesfarmers Ltd (ASX: WES) shares, James Hardie Industries plc (ASX: JHX), Aristocrat Leisure Limited (ASX: ALL), Goodman Group (ASX: GMG), Life360 Ltd (ASX: 360), WiseTech Global Ltd (ASX: WTC), CSL Ltd (ASX: CSL), and Xero Ltd (ASX: XRO).

He added:

We believe the market will trade higher next year, driven by lower rates, improved earnings, and the macro-economic outlook, with the possibility of increasing corporate activity.

For companies with positive earnings growth outlooks that exceed consensus, it is definitely 'risk on'.

Other forecasts for ASX shares

The ASX 200 closed at 8,067 points on Friday, down 1.24% for the day.

Top broker Morgan Stanley predicts the ASX 200 will rise to about 8,500 points by the end of next year.

It's worth noting that the ASX 200 has already surpassed this point, setting a new all-time record on 3 December at 8,514.5 points. The benchmark index has since slipped dramatically.

Dr Shane Oliver, Chief Economist at AMP Ltd (ASX: AMP), expects the ASX 200 to rise to 8,800 points by the end of 2025. However, he factors in a "highly likely" 15% correction along the way.