Four years after the COVID crash, the S&P/ASX 200 Index (ASX: XJO) is now hovering around all-time highs. Oh, how times have changed. However, the top end of town is now valued at a premium that has not been seen since January 2022. It might suggest that ASX small-cap shares offer more bang for the buck.

Investors shied away from small-cap land as interest rates climbed starting in May 2022. The chart below shows that the S&P/ASX Small Ordinaries Index (ASX: XSO) has underperformed the top 200 by 12.6% since the Reserve Bank of Australia began jacking up rates.

Could the minnows of the market now be the companies to catch amid estimates of interest rate cuts as early as late 2024?

Is the ASX 200 expensive?

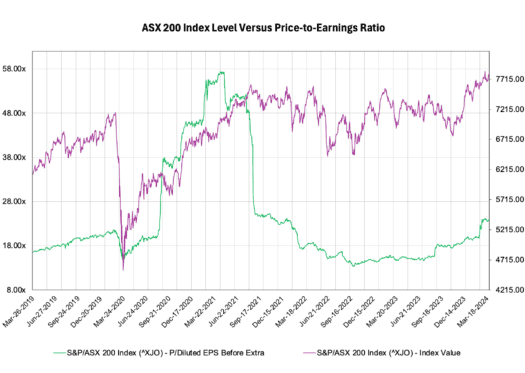

According to the S&P Capital IQ, the leading Australian index trades on a trailing 12-month price-to-earnings (P/E) ratio of 23.8 times. For context, the earnings multiple for Australia's 200 best of the best at its peak in 2019, before the pandemic, was 21.6 times aggregate earnings.

In addition, much of the 12% gain in the ASX 200 over the past year can be attributed to a rise in the earnings multiple investors are willing to pay. A year ago, the benchmark traded on a P/E ratio of 14.7 times, which has inflated 62% since then, as shown below.

Now, this doesn't necessarily mean the ASX 200 is expensive. It mainly depends on the extent of earnings growth for the top 200 companies in the years ahead. If corporate profits surge, then 24 times earnings might be justifiable.

ASX small-cap shares trading at lower multiples

More than 70 small-cap companies are trading on a P/E ratio that is 20% (or more) less than what the ASX 200 is currently commanding. This doesn't mean they're better value by default. A more in-depth review would be needed to decide on that.

Nevertheless, here are seven ASX small-cap shares that are less richly valued than the big end of town:

| ASX-listed company | Market capitalisation | P/E ratio |

| Graincorp Ltd (ASX: GNC) | $1.81 billion | 7.3 |

| Elders Ltd (ASX: ELD) | $1.47 billion | 14.5 |

| Nick Scali Limited (ASX: NCK) | $1.23 billion | 14.7 |

| Accent Group Ltd (ASX: AX1) | $1.12 billion | 15.7 |

| Platinum Asset Management Ltd (ASX: PTM) | $765.6 million | 9.7 |

| Helloworld Travel Ltd (ASX: HLO) | $471.7 million | 14.3 |

| Lindsay Australia Ltd (ASX: LAU) | $350.5 million | 9.6 |

History has demonstrated that small-caps often outperform large-cap land as interest rates fall, according to Wilsons Advisory.