If you are investing with a long-term horizon in mind, there are a whole bunch of shares that are going for cheaper than $20 to buy right now.

Let's take a look at three examples of top ASX stocks going for cheap:

Heading in one direction: up

Life360 Inc (ASX: 360) is a Californian software maker that's listed in the Australian share market.

The share price is around the high $11s at the moment, so meets our sub-$20 cheaper criteria.

Its smartphone app, which is one of the most popular in both the iPhone and Android app stores, is used by families to keep track of the locations of children and assist with emergencies.

Since the business decided a couple of years ago to reform from a profligate startup to a cash-generating machine, it hasn't looked back.

The Life360 share price is up an astounding 370% since June 2022, and almost 60% just this year.

And I reckon this trajectory can continue in the years to come.

This top ASX stock proved me wrong

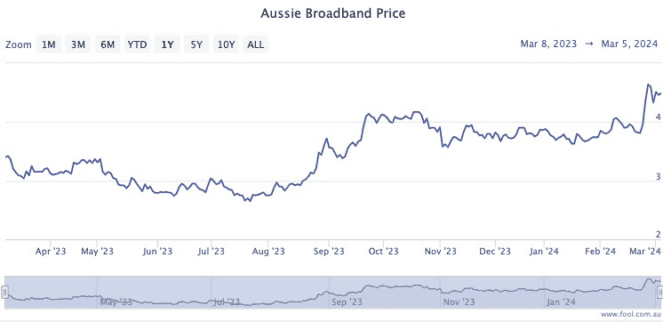

I am not too proud to admit that I wrote off Aussie Broadband Ltd (ASX: ABB) a year ago.

Since that article, the shares have rocketed 43% as it's made some savvy corporate moves.

My concern back then was that taking market share off larger telcos with far deeper pockets could only get so far in a highly commoditised market like the NBN.

But in the past six months Aussie Broadband has shown a hunger to boost this organic growth with accretive acquisitions.

At the moment, it's trying to buy fellow small NBN provider Superloop Ltd (ASX: SLC).

Each bolt-on like this enhances Aussie's economies of scale, allowing it to take the fight to the likes of Telstra Group Ltd (ASX: TLS) and TPG Telecom Ltd (ASX: TPG).

The analysts at QVG Capital are bullish on Aussie Broadband, and loved what it had to say during last month's reporting season.

"What was unexpected was the strength of the outlook," they said in a memo to clients.

"Upgraded guidance, rapid customer growth and a positive margin outlook meant FY25 earnings expectations needed to be raised."

Look past the immediate cost blowout

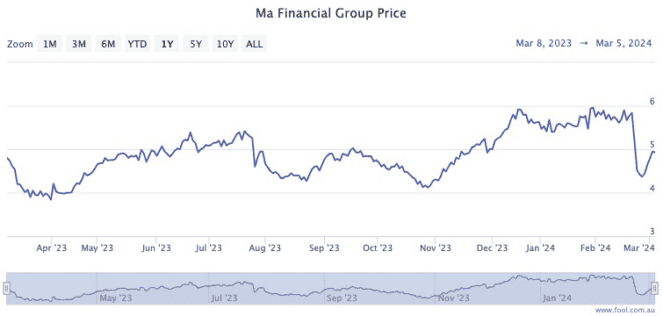

MA Financial Group Ltd (ASX: MAF) is not one that I've historically been interested in, but I have noticed recently that many fund managers are hot for it.

The share price took a 26% tumble last month after it reported its results, which is not encouraging.

But multiple analysts say the business is heading in the right direction.

"Pleasingly, net flows into the asset management business remained robust, and the Finsure business continues to take market share," the Celeste Funds team said in a memo to clients.

"MA Money is forecast to break even in 2H24 while the Corporate Advisory & Equities business endured a difficult year but should rebound as capital markets reopen."

The cost blowout seen in the latest report was the result of investment into their technology platform, the Celeste analysts added.

This could be a dark horse as a top ASX stock for the coming years.

CMC Invest currently shows all three analysts covering MA Financial rating it as a strong buy.