Aussie Broadband Ltd (ASX: ABB) shares made their debut on the ASX in October 2020 and have since had a wild ride on the bourse.

The internet service retailer has seen its share price rocket from $1.90 on its first day to almost $6 just over a year ago. It was trading at $3.16 at market close on Thursday, a far cry from its former glory.

So, which way is the stock headed long term? Could it be worth buying right now?

How long can the little guy take the fight to the giants?

By Tony Yoo: The NBN resale industry is one of the most commoditised markets in Australia.

Many consumers will simply seek out the best deal – what speed and volume of internet data they will receive for the cost paid each month.

However, Aussie Broadband has bucked the industry trend by carving out a niche as a quality provider.

The company has managed to lure customers away from bigger rivals with deeper pockets by touting an Australian call centre and promising consistently faster speeds, all in return for more expensive monthly fees.

Is this a sustainable strategy?

I say no.

Sooner or later, Aussie Broadband will hit a cap on the number of people who are interested in paying more for better service. The simple fact is that most Australians just want the best value internet plans.

Internet connections, especially for the residential market, have become a utility, much like electricity or water. The reality is that no one chooses a more expensive electricity provider because they like the local call centre.

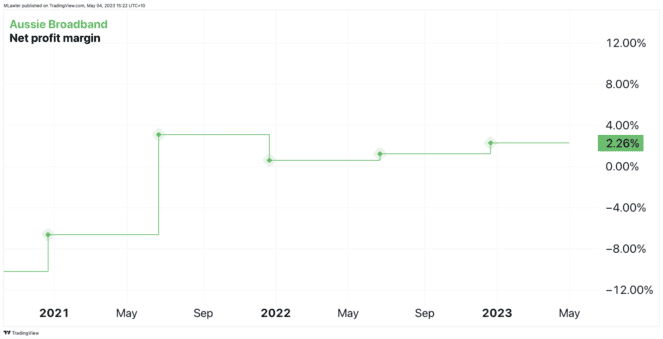

Already Aussie Broadband exists on a tiny net profit margin of 2.26% for the December quarter, as shown below.

To its credit, the Victorian company has expanded its offerings for business clientele to open up new avenues for growth.

However, the big players like Telstra Group Ltd (ASX: TLS) and Optus enjoy a huge advantage in this domain too, with existing relationships and a large network of face-to-face customer service personnel.

This is not to say Aussie Broadband cannot succeed in the future. It's just the risk is too much for me to buy the shares right now.

Motley Fool contributor Tony Yoo does not own shares in Aussie Broadband Ltd.

A classic disruption story with more growth in its sights

By Brooke Cooper: Aussie Broadband is my pick of the ASX telecommunication shares, for one distinct reason: customer service.

The company oozes a culture of customer service. Indeed, it's topped the Ray Morgan Trusted Brand Awards in its category since 2020, beating out 20 rivals for the crown of Australia's most trusted telco.

Judging from my own experiences, and the company's growth, plenty of telco customers seek value for money but stay for customer service. By providing both, Aussie Broadband has successfully disrupted the Aussie telecommunications industry.

Just look at how fast its broadband customers have grown in recent years:

| Financial year | Total Broadband services (approx.) | Year-on-year % increase |

| FY20 | 261,361 | – |

| FY21 | 400,848 | 53% |

| FY22 | 584,793 | 46% |

At the end of the first half of this financial year, the company had more than 635,000 broadband connections – a 27% increase on the prior comparable period.

It also boasted 7% of the NBN broadband market share and had just 1.2% of monthly residential customer churn over the period.

On top of that, the company has been expanding into neighbouring markets. Its growing list of enterprise and government customers is a factor QVG Capital analysts expect could drive "a re-rating of the company".

But, as we know, past performance isn't an indication of future performance. Not to mention, most disruption stories are also volatile ones with plenty of risks.

Still, I'm confident the company has the 'stickiness' and proven ability to continue growing its market share and offerings from here.

It's currently Australia's fifth-largest telco, with aspirations to enter the top four by 2025. To do so, it plans to polish its marketing strategy, develop and launch new products, and improve operational efficiencies.

I admit, Aussie Broadband will probably never take on the market share boasted by the likes of Telstra, but I still think it's a company worth investing in for growth. And the fall in its share price over the last year makes it a more affordable buy.

Motley Fool contributor Brooke Cooper does not own shares in Aussie Broadband Ltd.