Taking your first step into the world of investing can be daunting. Stock prices are telegraphed constantly — one day they're up, and the next day they're down — and 'experts' are rattling off acronyms like a bowl of alphabet pasta. That's why I'd start by buying top stocks that are beginner-friendly.

I learned the hard way that a quick way to lose money from the outset is by making this wealth creation process more complex than it needs to be. Difficult-to-understand businesses, broken companies that might bounce back, quick flips for an expedient return — all unnecessarily challenging.

Here are my top five beginner stocks if I had to start again.

A top Australian retail stock

I'm a huge advocate for investing in companies you understand and are a customer of. Over decades, Wesfarmers Ltd (ASX: WES) has become a substantial slice of Australian retailing, owning the likes of Bunnings, Kmart, Officeworks, and Catch.

Leveraging huge brand power and scale advantages, Wesfarmers is a force to be reckoned with inside the retail industry. Additionally, management has allocated capital productively in years past, acquiring attractive businesses when opportunity knocks.

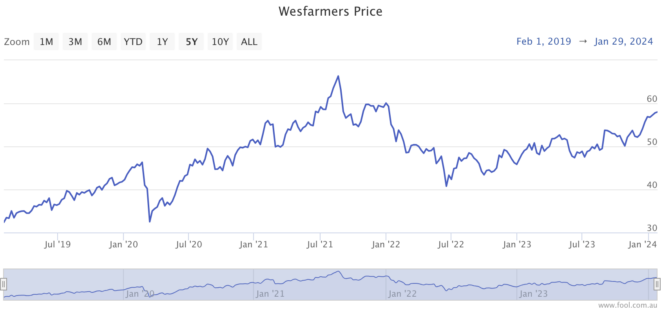

It mightn't be the most exciting business, but the performance of this top stock speaks for itself. The Wesfarmers share price has climbed 79% over the last five years, as shown above. A 49% better return than the S&P/ASX 200 Index (ASX: XJO) by investing in a simple, proven business… I'd take that offer every day of the week.

A healthcare company with a strong moat

Another company most people are probably familiar with is Sonic Healthcare Ltd (ASX: SHL). The laboratory services, pathology, and radiology provider is one of the largest diagnostic companies in the world. It is best known locally by the Sullivan Nicolaides banner.

Sonic Healthcare is arguably in possession of a strong moat (competitive advantage) — efficient scale. It can require multiple billions of dollars to buy land in a central area, create the logistic network, and purchase expensive diagnostic equipment to compete with Sonic. The reality is once one company has reached scale, there is usually no need for a second or third, deterring new entrants.

I suspect, due to the enormous economic mountain to climb, Sonic Healthcare could be a top stock for many years.

A growth stock for a digital world

Next on my beginner-friendly list is Altium Limited (ASX: ALU). The technology this company provides its customers is state-of-the-art, but the business is relatively simple. Altium sells cloud-based software for designing printed circuit boards (PCBs) with more than 60,000 paying subscriptions.

A rival electronic design software company, US-based Snynopsys Inc (NASDAQ: SNPS), is nearly 13 times the size of Altium. However, Altium is holding its own, continuing to grow its revenue at a commendable pace.

As computer chips become more commonplace, Altium stands to benefit. If I were Synopsys, I'd contemplate a takeover offer before the little Aussie-listed company evolves.

A top-quality dividend stock

Speaking of beginners… when I initially got into investing, I was blown away upon receipt of my first dividend. Getting paid to own a slice of a company seemed too good to be true, but it's as real as the money deposited into your account.

One company that ticks the beginner-friendly box for dividends, in my opinion, is Super Retail Group Ltd (ASX: SUL). It is a simple business whereby it purchases products from suppliers and sells them to customers with a markup. Under the Super Retail umbrella are Supercheap Auto, BCF, Macpac, and Rebel.

The company uses brand, loyalty memberships, and large store networks to attract and retain customers. This approach has paid off over time, with the share price returning 120% over the last five years.

In addition, Super Retail shares are trading on a dividend yield of 4.9%. That's a cool $490 in dividends over the last 12 months from $10,000 invested.

A profit powerhouse

My last entrant to the beginner-friendly picks is a wild card. I'd pick Smartgroup Corporation Ltd (ASX: SIQ) as a top stock mostly because of the exceptional net profit margins it has achieved in recent years.

Smartgroup is a provider of salary packaging services, novated leases, and other employer payroll solutions. Landing margins of more than 20%, there are likely some competitive advantages at play here.

I say this because its rival, McMillan Shakespeare Ltd (ASX: MMS), just lost out on a tender conducted by the South Australian Government. Yet, if margins are anything to go by, one would imagine McMillan would have had the cheaper deal as it operates on a slimmer margin.

Furthermore, Smartgroup is benefitting from an influx in novated leases of electric vehicles, a trend I believe will continue.