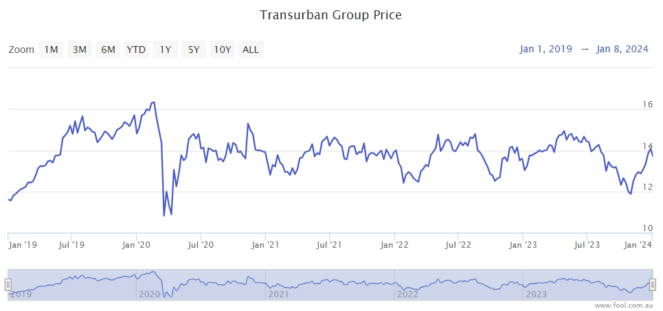

ASX infrastructure shares took a beating in 2020 and again in 2022. Higher interest rates are meant to hurt valuations, in theory. So, could this be the right time to invest in the sector?

Just look at the share prices of names like Transurban Group (ASX: TCL), APA Group (ASX: APA), Auckland International Airport Limited (ASX: AIA), Chorus Ltd (ASX: CNU), Atlas Arteria Group (ASX: ALX) and Magellan Infrastructure Fund (Currency Hedged) (ASX: MICH).

They're all lower than the high seen in the past few years, with some still lower than pre-COVID times.

Why do interest rates matter?

As legendary investor Warren Buffett once said:

The value of every business, the value of a farm, the value of an apartment house, the value of any economic asset, is 100% sensitive to interest rates because all you are doing in investing is transferring some money to somebody now in exchange for what you expect the stream of money to be, to come in over a period of time, and the higher interest rates are the less that present value is going to be. So every business by its nature…its intrinsic valuation is 100% sensitive to interest rates.

Many ASX infrastructure shares have a lot of debt on their balance sheet, which means the debt has become more expensive as they re-finance it following all of the interest rate rises. The higher rates are impacting/will impact the ASX infrastructure shares' cash flow.

Is this the right time to invest in ASX infrastructure shares?

No one can truly know when interest rates are going to go down (or up). It seems central banks in Australia and the US are pleased with the progress they're making against elevated inflation, so we may not see any more interest rate hikes, though there's no guarantee of that.

If the next move in the US and Australia is a cut – whenever that is – it could be helpful for the share prices of Transurban, Auckland Airport, APA and others.

Of course, if I had a time machine, I'd choose October 2023 as the best time to invest over the past 52 weeks. But, I think it would be a mistake to think that this is the highest share prices of these businesses are going to reach.

With COVID-19 impacts on limiting travel essentially gone, I think names like Transurban, Auckland Airport and Atlas can continue to see more travellers.

When interest rates do eventually fall, I think businesses with significant assets on their balance sheet will benefit.

If investors are looking at ASX infrastructure shares, I'd say this could be a better price to invest at compared to two or three years in the future. However, that doesn't necessarily mean they're going to outperform the S&P/ASX 200 Index (ASX: XJO).