If you have used ASX shares to your advantage and your portfolio has grown to a reasonable amount, you might be surprised to find you could retire early.

That's because Australia's already globally high dividend yields could be supercharged with the help of franking.

This tax benefit could help you rake in more income than what's on the label for many ASX dividend shares, according to your personal circumstances.

Such distribution income, combined with your superannuation and the aged pension, could mean that retirement could be closer than you think.

Here are three stocks at the moment that can deliver a nice cash flow for those contemplating putting their feet up:

'Another 15% to 20% upside' next year

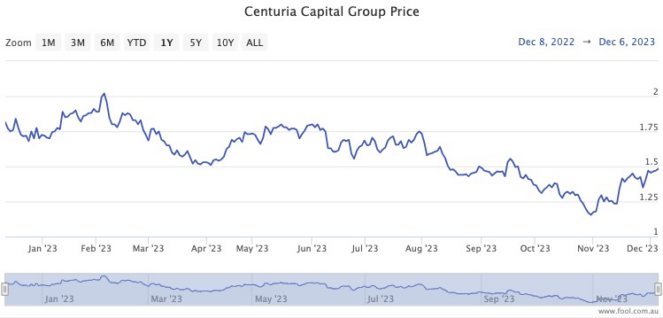

Centuria Capital Group (ASX: CNI) shares are still trading about 5.8% below where they started 2023, but they've had an impressive run in recent weeks.

Since the start of last month, the real estate stock has put on more than 36%.

Shaw and Partners portfolio manager James Gerrish, whose team is bullish on Centuria, said it demonstrated "how explosive moves can become during the festive season".

"With bond yields reversing lower and credit markets focusing on rate cuts by the [US] Fed through 2024, the real estate sector has flourished over recent weeks," he said in Market Matters.

"We believe that can continue into next year in line with our dovish outlook towards bond yields."

As a property investment manager, Centuria Capital only provides 8% franking. However, its dividend yield still stands at a chunky 7%.

Gerrish's team has bought Centuria shares for both its income and emerging companies portfolios.

"We are looking for another 15% to 20% upside for CNI into 2024, which is not a big call after the last six weeks!"

'Dominant market share'

Many experts are tipping consumer discretionary as a contrarian play right now, as the economy is bound to improve over the next few years.

Accent Group Ltd (ASX: AX1) is an excellent dividend stock in that sector, currently handing out an awesome fully franked 9.6% yield.

Despite a tough year for retailers, Accent shares have shown resilience, now trading 7.7% higher than where it started 2023.

Bell Potter analysts consider Accent Group a buy, pointing out this week that the company "commands a dominant ~30% market share in the $3 billion Australian footwear retailing market".

Their note also stated the business had "a broader opportunity, given the expansion of its entry into the athleisure market".

Rising stock with unbelievable yield

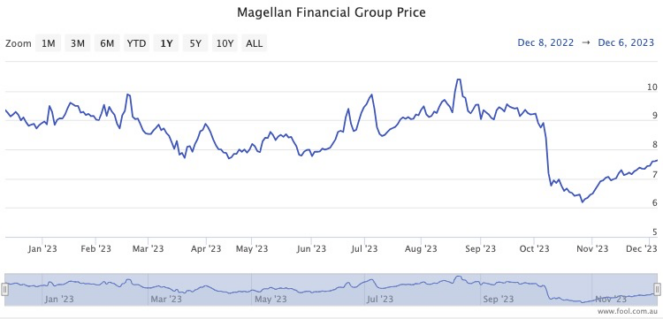

For accepting slightly more risk, how does a 85%-franked 14.2% dividend yield sound as the reward? That could help you retire early, right?

Because that's what Magellan Financial Group Ltd (ASX: MFG) is offering right now.

Yes, the stock has lost more than 83% since July 2021. But there could be a turnaround happening as we speak, as Magellan shares have rocketed more than 32% over the past six weeks.

Gerrish pointed out that, this week especially, market attention has refocused on the investment sector.

"This week's Washington H Soul Pattinson and Company Ltd (ASX: SOL) bid for Perpetual Ltd (ASX: PPT) re-ignited interest in the ASX fund managers, with Perpetual up +6.7% and Magellan +4.7% on Thursday."

Magellan shares closed 2.56% higher on Friday at $8.41.

"We can see Magellan testing $10 into 2024."