I'm always on the lookout for S&P/ASX 300 Index (ASX: XKO) shares that look like opportunities. The three stocks I'm going to write about look like buys to me, with all three trading near 52-week lows.

I've already recently invested in one of these names and I'm close to investing in the other two.

Lovisa Holdings Ltd (ASX: LOV)

As we can see on the chart below, the Lovisa share price is down 34% over the past six months. It sells jewellery which is targeted at younger women.

Understandably, investors are a bit nervous about this ASX retail share with the rise in the cost of living, which may impact same-store sales.

However, I very recently invested in the ASX 300 share because of its enormous store rollout potential. It's growing its store network size significantly in percentage terms each year, which is very helpful for growing total sales and net profit. In FY23 it grew its US store count from 118 to 190, with global stores increasing from 629 to 801

In FY23, the ASX 300 share delivered net profit after tax (NPAT) growth of 20% to $68 million. In the first seven weeks of FY24, its comparable store sales declined 5.8%, but total sales were up 13.1% thanks to the new stores it had opened over the last year.

I think it can double its store count in around five years or less, particularly if it expands into mainland China.

Rural Funds Group (ASX: RFF)

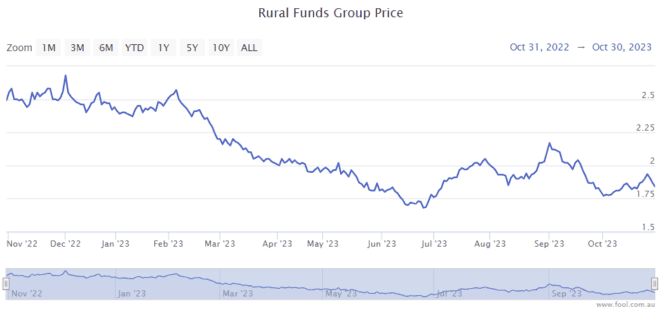

Over the past year, the Rural Funds share price is down around 30%, as we can see on the chart below.

This business is a real estate investment trust (REIT) that owns farmland across the country in five agricultural sectors: cattle, vineyards, almonds, macadamias and cropping.

On paper, higher interest rates should hurt asset values, like farmland. But, Rural Funds can benefit from the elevated inflation environment because some of its rental income is linked to an inflation benchmark, so its revenue is growing faster than before.

The Rural Funds share price is down 43% from December 2021. I think this decline more than makes up for the negative of the higher interest rate environment. The ASX 300 share has hedged (fixed) a substantial portion of its debt at an interest rate of less than 3%, so it is largely shielded from the worst of the rate hike impacts for the next three financial years.

If rental income keeps growing nicely, then this can help support the farm values.

It has guided that it's going to pay an annual distribution per unit of 11.73 cents, which is a forward distribution yield of 6.5%.

IGO Ltd (ASX: IGO)

This ASX mining share is involved with a number of decarbonisation commodities including lithium, nickel and copper.

As we can see on the chart below, the IGO share price is down around 30% over the last six months as the lithium price dropped.

ASX mining share prices often follow the direction of their respective commodity price. The relationship between supply and demand for decarbonisation commodities has seen prices pushed down in the short term, but I'm optimistic that prices can increase in the longer term as the world continues to invest more to enact decarbonisation plans.

While projections aren't guarantees, the estimate on Commsec suggests it could generate earnings per share (EPS) of $1.48 in FY24 and pay a dividend per share of 35 cents. That would mean it's trading on a forward price/earnings (P/E) ratio of less than 7 with a possible grossed-up dividend yield of 5.25%.

I like looking at cyclical ASX 300 shares when they have fallen heavily, as that could be a signal that it's a good time to invest.