Do you think you could give up something trivial if it meant you could later rake in $1,500 of passive income each month?

Well let me set you a challenge then.

Many Australians are subscribed to multiple entertainment streaming services. Are you really watching all of those?

Just to name a few, there's Binge, Kayo, Stan, Netflix Inc (NASDAQ: NFLX), Amazon.com Inc (NASDAQ: AMZN) Prime Video, Paramount+, Disney+ and Apple Inc (NASDAQ: AAPL) TV.

The cost of having so many accounts adds up.

However, the great thing is that they are all month-to-month agreements.

This means that, in any given month, you can cancel all your subscriptions except for the one that you are watching the latest and hottest show on.

Then take all that money saved, and invest it into ASX shares.

Let's explore how you could reach a monthly income of $1,500 by going down that path:

Turn streaming into growth

The typical Australian has an average of $39,459 in their bank account, according to recent research from comparison site Finder.

So let's start constructing a stock portfolio with that money, then add $85 to it each month with the cash saved from cancelling your streaming accounts.

Investment styles depend heavily on personal tastes, but if I were in this situation I'd buy a diversified stable of ASX growth shares.

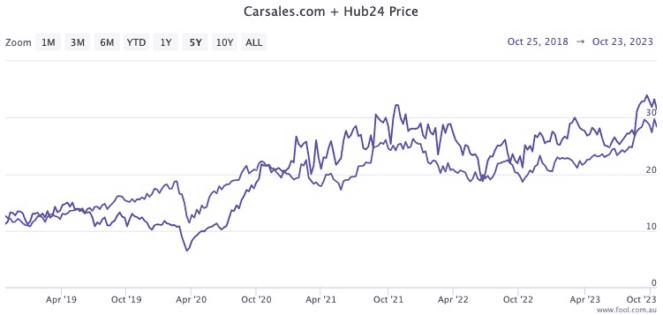

Two excellent examples that experts have recently named as buys are Carsales.Com Ltd (ASX: CAR) and Hub24 Ltd (ASX: HUB).

Carsales runs Australia's dominant vehicle classifieds site, plus similar assets overseas.

Over the past five years, even through the COVID-19 panic and the 2022 growth stock sell-off, the share price has rocketed 142%.

That's an impressive compound annual growth rate (CAGR) of 19.3%.

Hub24 is a fast-growing wealth management platform that's also managed to keep its share price elevating in the face of tough pandemic times and rising interest rates.

Over the past half-decade, the Hub24 share price has soared 185%.

That equates to a stunning CAGR of 23.3%.

It's unrealistic to imagine all the shares in your portfolio will perform as well as these two examples.

However, mixed in with some duds, it's not out of the question to keep up an overall CAGR of 15%.

After 10 years, your initial pot will have then grown to more than $180,000.

Now let's see if we can squeeze the passive income juice out of it.

Now turn on the stream of passive income

Income can be harvested in one of two ways.

Perhaps the simpler method is to keep the portfolio as is and sell off the gains each year.

Even if the businesses have matured and the CAGR comes down to 10%, that's still $18,000 of passive income each year.

And that means $1,500 cash per month, as per our original goal.

The downside with this route is that, as we all know, share markets can have bad years and good years.

That means while the passive income might average out to $1,500 a month, some years it could be nothing, some years it will be a massive windfall, and on occasions it could be a loss.

While no ASX shares are 100% predictable, an alternative method may provide a more consistent stream of passive income.

Going back to the portfolio of $180,000, you would sell out all the growth shares and use the proceeds to buy a bunch of ASX dividend shares.

A pair that typify quality dividends stocks are Viva Energy Group Ltd (ASX: VEA) and Centuria Office REIT (ASX: COF), which have been labelled buys by experts in recent times.

Fuel refiner and retailer Viva pays out an excellent dividend yield of 9.9% fully franked. As a real estate trust, Centuria's distributions are not franked but it's nevertheless handing out an 11.7% yield.

So if you can put together a bunch of these income stocks diversified across sectors and geographies, a portfolio averaging 10% dividend yield is achievable.

And with that, you will also receive $1,500 of monthly passive income that could fluctuate less wildly than the growth stocks.

Both of these methods have tax considerations, so you will want to seek personal advice to choose the best route for your circumstances.

The moral of the story?

If you want to become rich, turn the TV off.