Recently there has been much talk about productivity in Australia.

The basic theory is that the amount of output from each person must increase for the economy, wages and standard of living to also climb upwards.

So if productivity is that important, which are the best ASX companies by that measure?

For stock investors, surely it would be useful to find out which publicly listed businesses are the most efficient on a per-employee basis?

Top 10 most productive ASX companies

To gauge productivity, The Motley Fool turned to S&P Market Intelligence.

That service helpfully provides a listing of every ASX company's revenue per employee for the last 12 months.

The top 10 best ASX companies for productivity looks like this:

| ASX company | Revenue per employee (last 12 months) | Revenue (last 12 months) |

| Carlton Investments Limited (ASX: CIN) | $19.57 million | $39.1 million |

| Growthpoint Properties Australia Ltd (ASX: GOZ) | $5.37 million | $347 million |

| Magellan Financial Group Ltd (ASX: MFG) | $3.75 million | $431.6 million |

| Australian Finance Group Ltd (ASX: AFG) | $3.6 million | $1 billion |

| Goodman Group (ASX: GMG) | $3.08 million | $1.97 billion |

| Data#3 Limited (ASX: DTL) | $1.77 million | $2.56 billion |

| Suncorp Group Ltd (ASX: SUN) | $1.41 million | $18.35 billion |

| ASX Ltd (ASX: ASX) | $1.34 million | $1.4 billion |

| Mount Gibson Iron Ltd (ASX: MGX) | $1.21 million | $452.6 million |

| Liberty Financial Group Ltd (ASX: LFG) | $1.15 million | $1.23 billion |

The top three are all investment companies, which are arguably not a fair comparison to other businesses.

That's because the employees don't themselves directly make the goods and services, but rather the revenue reflects the performance of the company's investments.

So for any given year, a two-staff entity like Carlton Investments could rake in tens of millions in revenue. On the flip side, they could have lost money during the year for performing the same investment work.

Therefore, if you exclude the top three from analysis, this is where it gets really interesting.

Mortgage broking seems to be a very productive venture, with $3.6 million of revenue figuratively passing through the hands of each Australian Finance Group employee.

Pointedly, with interest rates rising, the AFG share price over the past year has declined 8.4% notwithstanding this efficiency.

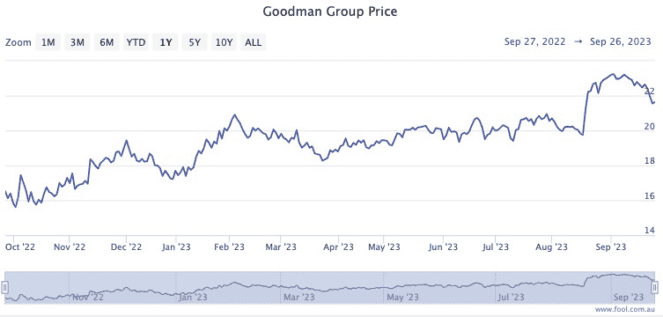

Industrial real estate manager Goodman Group also rakes in more than $3 million per staff member.

Perhaps the market appreciates this more, sending its shares up 31.8% over the past 12 months.

Service providers holding their own

The next two are fascinating to me personally.

Data#3 Limited (ASX: DTL) is a provider of information and communications technology services to business clients.

The stereotype is that services do not scale very well.

That is, if you have a factory making lollies, it could take the same number of employees to create 10 or 100,000.

But if you're providing a service, you can't scale it to multiple clients. Each client needs to be looked after by a particular human.

Regardless, the services that Data#3 offers its customers must be of tremendous value, seeing that a whopping $1.77 million of revenue is generated per employee.

Data#3 shares have risen 13% over the past year.

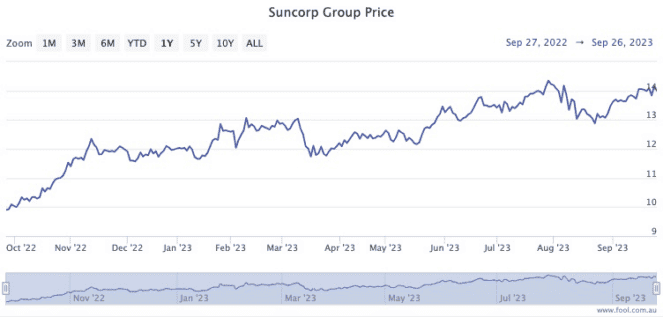

As a contrast, Suncorp is a large financial institution, which has been trying to offload its banking arm to ANZ Group Holdings Ltd (ASX: ANZ).

But even with this deal facing stumbling blocks from the competition watchdog, the business seems to be doing fine, at least by the revenue per employee productivity metric.

Suncorp shares have admittedly risen 39.2% over the past year, while each staff member has been generating $1.41 million of business.