National Australia Bank Ltd (ASX: NAB) shares have gone through a lot in 2023 to date. They are down 9% so far this year but have fallen 17% from 8 February 2023. That said, there are a couple of key reasons why the ASX bank share could make an effective buy today.

NAB is one of the largest banks along with Commonwealth Bank of Australia (ASX: CBA), Westpac Banking Corp (ASX: WBC), and ANZ Group Holdings Ltd (ASX: ANZ).

While they operate in largely the same ways, there are differences. The business and private banking segment of NAB makes the most profit, and the leadership style of Ross McEwan seems to have effectively reformed NAB into a stronger bank with a brighter future.

Firstly, I'm going to cover two key reasons why NAB shares could be an attractive investment today.

Cheaper valuation

As I've mentioned, NAB shares have fallen materially since February. This comes at a time of higher interest rates, which are helping profit. In the NAB FY23 first half, we saw total cash earnings increase 17% to $4.07 billion.

With the share price lower and earnings higher, it has meant the price/earnings (P/E) ratio is more attractive.

According to Commsec estimates, NAB shares are now valued at under 11x FY23's estimated earnings and under 12x FY24's estimated earnings.

It's not only the earnings that are priced more cheaply.

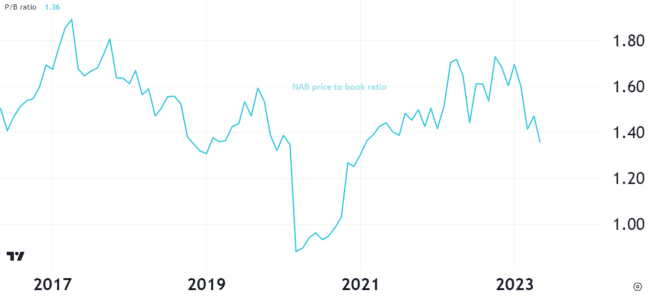

We can also see on the chart below that NAB is trading at its lowest valuation compared to its book value (or balance sheet value) since 2020, the year of the COVID-19 crash. It's also at a relatively cheap price-to-book value compared to pre-COVID times.

Source: TradingView: NAB price-to-book ratio

NAB shares could pay a big dividend yield

Banks are known for paying large dividends and the fall in the NAB share price has boosted the bank's prospective dividend yield.

According to Commsec, the ASX bank share could pay an annual dividend per share of $1.66 in FY23 and in FY24. This would translate into a grossed-up dividend yield of 8.9%.

NAB (and the other large ASX bank shares) are unlikely to achieve strong capital growth because of their already-large size, so the dividend income is important for returns. The projected yield isn't the biggest yield in the sector, but it's still very good.

But there could also be some problems ahead, so here are a couple of reasons why investors may not want to buy, or own, NAB shares.

Strong competition

Not only does NAB have large competitors, including Macquarie Group Ltd (ASX: MQG), there are the smaller banks such as Bank of Queensland Ltd (ASX: BOQ), Bendigo and Adelaide Bank Ltd (ASX: BEN), Suncorp Group Ltd (ASX: SUN), and MyState Limited (ASX: MYS). On top of that, there are many non-bank lenders.

Banks like NAB have been talking about increased competition which could mean lower margins on their deposits and loans. The fact is that all banks can provide these banking products and the internet has enabled digital banking offerings without the need for large branch networks.

The banking industry has changed and could be even more competitive beyond the foreseeable future.

Arrears to rise?

There's also a question of what's going to happen with NAB's lending portfolio after the run of interest rate rises. Not every business and household will be able to cope with the much more expensive interest payments.

This could mean higher arrears and bad debts for the bank.

At this stage, it's hard to say what's going to happen because arrears are largely unchanged for NAB, so it may be fine. But, if things do noticeably worsen, that could be a drag on profit and the NAB share price.