ASX 200 bank shares have had a stellar run since the 2023 Santa Rally began in early November, as the following chart shows.

If you prefer the hard numbers, here's a summary of the share price growth among the seven biggest ASX 200 bank shares since 1 November 2023:

- The Westpac Banking Corp (ASX: WBC) share price has soared 30.44%

- The Bendigo and Adelaide Bank Ltd (ASX: BEN) share price has risen 26.32%

- The Commonwealth Bank of Australia (ASX: CBA) share price has lifted 25.03%

- The National Australia Bank Ltd (ASX: NAB) share price has ascended 22.64%

- The Macquarie Group Ltd (ASX: MQG) share price has increased 20.35%

- The Australia and New Zealand Banking Group Ltd (ASX: ANZ) share price has lifted 14.85%

- The Bank of Queensland Ltd (ASX: BOQ) share price has risen 14.71%

By comparison, the S&P/ASX 200 Index (ASX: XJO) has lifted 15.21% and the S&P/ASX 200 Financials Index (ASX: XFJ) has increased 21.68% since 1 November.

Why have ASX 200 bank shares had such a good run?

The Motley Fool's chief investment officer, Scott Phillips, says it probably reflects expectations that interest rates will come down soon and that the banks will suffer fewer mortgage defaults as a result.

Plus, as interest rates stagnate, and then fall, bank dividends will look more appealing to income investors.

Regardless of the reasons, this sort of strong capital growth among ASX 200 bank shares is unusual.

Historically, ASX 200 bank shares have typically been better income investments than growth investments.

At the ASX Investor Day in Sydney this month, attendees were reminded of this during a presentation by investment strategist Marc Jocum from exchange-traded fund (ETF) provider Global X.

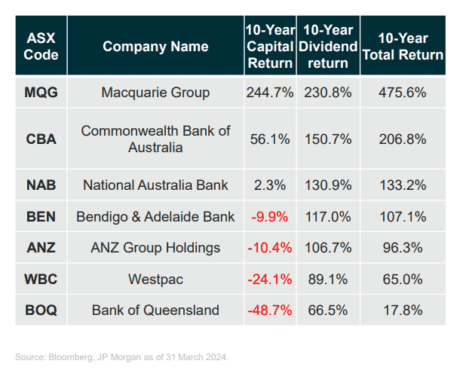

Jocum showed a table documenting the 10-year history of both capital growth and dividend returns for each of the seven biggest ASX 200 bank shares. That table is shown below.

Source: Global X investor presentation, ASX Investor Day, Sydney

Jocum was discussing how to optimise an investment portfolio for income, and emphasised the importance of a 'total returns approach' that takes annual dividend returns into account.

According to his presentation:

Most of the largest Australian banks have had negative capital returns. Dividends can add as an important source of returns and help cushion drawdowns.

As the table shows, only one ASX 200 bank share delivered more capital growth than dividends over the past 10 years to 31 March 2024, and that was Macquarie.

The other ASX 200 banks delivered more in dividend returns than capital growth. In fact, some delivered negative capital growth.

But when you combined the growth and dividends, investors in every bank stock were in the green.

The three best ASX 200 bank shares for total returns were Macquarie, CBA and National Australia Bank.

The numbers demonstrate how important dividend returns are when selecting any type of ASX share or ASX ETF to buy.

For example, CBA shares delivered just 56.1% capital growth but 150.7% in dividends over the period.

Should you buy bank stocks?

After such strong share price gains over the past seven months, many brokers currently have sell or hold ratings on the banks.

Ray David, Portfolio Manager and Partner at Blackwattle Investment Partners, says bank shares "look like they've overstretched on valuations" and ASX 200 mining stocks are better value.

After the recent round of updates from the ASX 200 banks, Wilsons says it is retaining an underweight exposure and noted a "lacklustre medium and long-term EPS growth outlook facing the sector."

In a new note this week, Goldman Sachs said bank fundamentals are weak and valuations are extreme, with bank stocks trading at "close to record expensive" levels.

Goldman said:

… while the deterioration in earnings appears to now be finished, we see very limited upside risk, and therefore, with valuations skewed asymmetrically to the downside, we now think a more negative view on the banks is appropriate …