This 2020 ASX stock market crash has been nothing short of brutal (to say the least!).

Since mid-February, the S&P/ASX 200 Index (ASX: XJO) has lost over 30% of its value. ASX shares across the board have been smashed down to valuations not seen in years (or even decades in some cases).

But there's a small ray of light during this dark time for ASX dividend investors. The dividend yields that many ASX shares are now offering are at their highest level in years.

Now, many ASX shares are clearly not going to be upholding their trailing yields in 2020 – Qantas Airways Limited (ASX: QAN) would be one obvious example. But many can and will in my opinion.

So, here are two attractive ASX dividend shares to buy amid this coronavirus sell-off:

Washington H. Soul Pattinson & Co. Ltd (ASX: SOL)

'Soul Patts' (as it's more easily referred to) is one of the most diversified businesses on the ASX.

It owns stakes in a range of diverse and quality ASX companies all under one roof. It's been following this modus operandi since its inception in 1903 (which makes it one of the ASX's oldest companies).

For this reason, Soul Patts is often described as 'Australia's Berkshire Hathaway' (Warren Buffett's hugely successful conglomerate over in the US). Whilst it hasn't achieved quite as much wild success as Berkshire, it still has a long track record of delivering quality returns to its shareholders over its very long history.

Some of the companies Soul Patts owns stakes in include:

- 50% of New Hope Corporation Limited (ASX: NHC) – a coal miner

- 25.3% of TPG Telecom Ltd (ASX: TPM) – an Aussie telco

- 43.9% of Brickworks Limited (ASX: BKW) – a building materials manufacturer

- 19.3% of Australian Pharmaceutical Industries Ltd (ASX: API) – a health and beauty company

- 8.6% of BKI Investment Co Ltd (ASX: BKI) – an ASX Listed Investment Company (LIC)

- Plus many more

As of the end of FY19, Soul Patts has, on average, delivered an 11.6% annualised return over the past fifteen years (which includes both capital growth and dividend payments). That's an outperformance of the broader market (All Ordinaries Accumulation Index) of 2.6% per annum. Over 20 years, it's even better, with an annualised average return of 12.8% per annum.

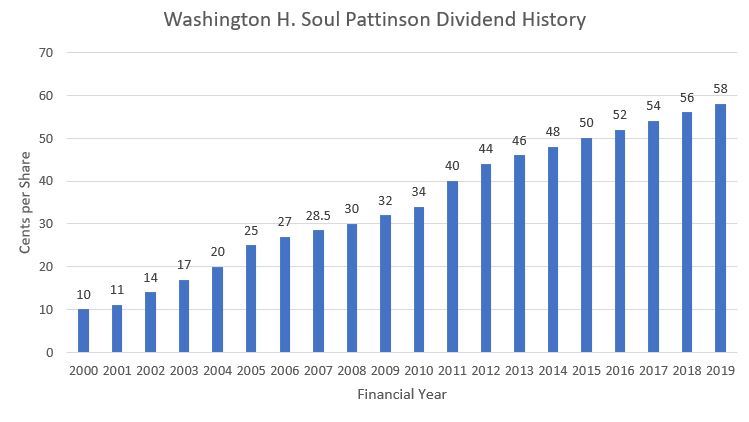

A massive part of these returns has come from dividends. Soul Patts' dividend track record is one of the most esteemed on the ASX. The company has paid a dividend every year since 1903 and has raised its dividend every year since FY 2000, including through the GFC (making it one of only two ASX companies able to claim this crown).

Not only has it raised its dividend like clockwork over the past twenty years, but it has also raised it by a compounded annual growth rate of 10.8% in this time – far more than enough to beat inflation. Take a look for yourself in the graph below!

Since Soul Patts has such a diversified earnings base, a robust and truly enviable dividend history and a long record of rewarding its shareholders, I think it is a perfect stock to put on your watchlist today.

Transurban Group (ASX: TCL)

Transurban is another ASX dividend share with a solid track record of providing dividend income to its shareholders through thick and thin.

This company owns and operates a vast network of tolled motorways across most Australian capital cities as well as some in North America. Chances are if you've paid to drive on a tolled-road in Sydney, Melbourne or Brisbane, it was to Transurban.

Below is a table of all major motorways Transurban owns across major Australian capital cities:

|

Sydney |

M2 Motorway M4 Motorway Eastern Distributor Lane Cove Tunnel Cross-City Tunnel WestConnex (under construction) NorthConnex (under construction) |

|

Melbourne |

M1 Southern Link M2 Western Link West Gate Tunnel (under construction) |

|

Brisbane |

Gateway Motorway Logan Motorway Airportlink Legacy Way |

As you can see, this is a company with a dominant position in its industry. Once toll-roads are built, there is very little competition possible – consumers either have to use Transurban's roads or take time-costly detours. With healthy population growth across these cities expected for the foreseeable future, the long-term prospects of these monopolistic assets look very strong.

Transurban is a company with a high level of earnings certainty – which carries across to its dividend/distribution payments. Most of Transurban's tolls are regulated by governments, which have allowed either a 4% annual rise or an inflation-matched increase (whichever is higher) in toll rates.

Since inflation is essentially zero right now, this is a license to print money for Transurban in my opinion.

The coronavirus is set to cause significant economic disruption, which will likely translate into lower vehicle volumes (and tolls collected) over the next few months. But once our economy returns to normal, I think Transurban's business will rapidly follow.

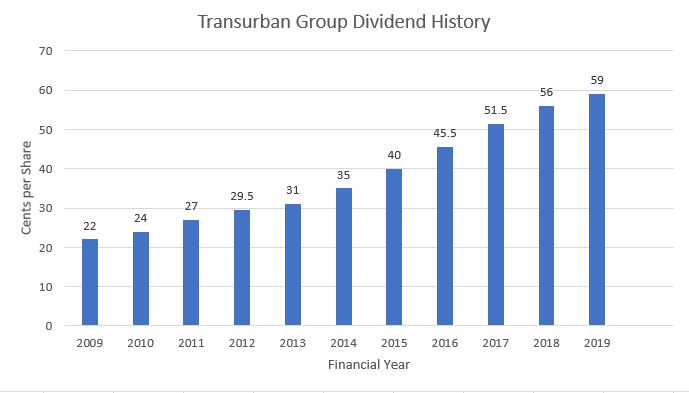

Turning to dividend/distribution payments, Transurban has managed to increase its payouts every year since FY 2009. This it has done at a healthy rate, as you can see in the graph below!

Due to a recent drop in the Transurban share price, Transurban shares are offering a yield of 5.07% on current prices. I think this is a great deal for ASX dividend investors, especially considering interest rates are now at practically zero.

Foolish takeaway

Both Transurban and Washington H. Soul Pattinson are dividend shares that I think are currently offering a great deal to ASX dividend investors in today's share market.

When the dust settles from the coronavirus situation, I believe income potential will once again command an unprecedented premium on the share market, and these two companies stand to benefit enormously from this paradigm. Thus, buying these two companies today might set your portfolio up very well for the future.