Share market investing carries substantial risk and knowing when to fold and when to hold is one of the toughest challenges facing any successful investor. As a general rule of thumb you should consider selling an investment if the business has taken a structural turn for the worse to suggest the shares are unlikely to beat the market going forward.

A serious downturn should be evident from a company's accounts or operational updates and generally if a company is facing rising competition, falling sales or profits. it's time to ask yourself why. If you conclude the problems are potentially long lasting enough to push shares lower it might be time to sell.

Another common investing mistake to avoid is 'averaging down' into a company in structural decline, as this will compound your losses and mistake.

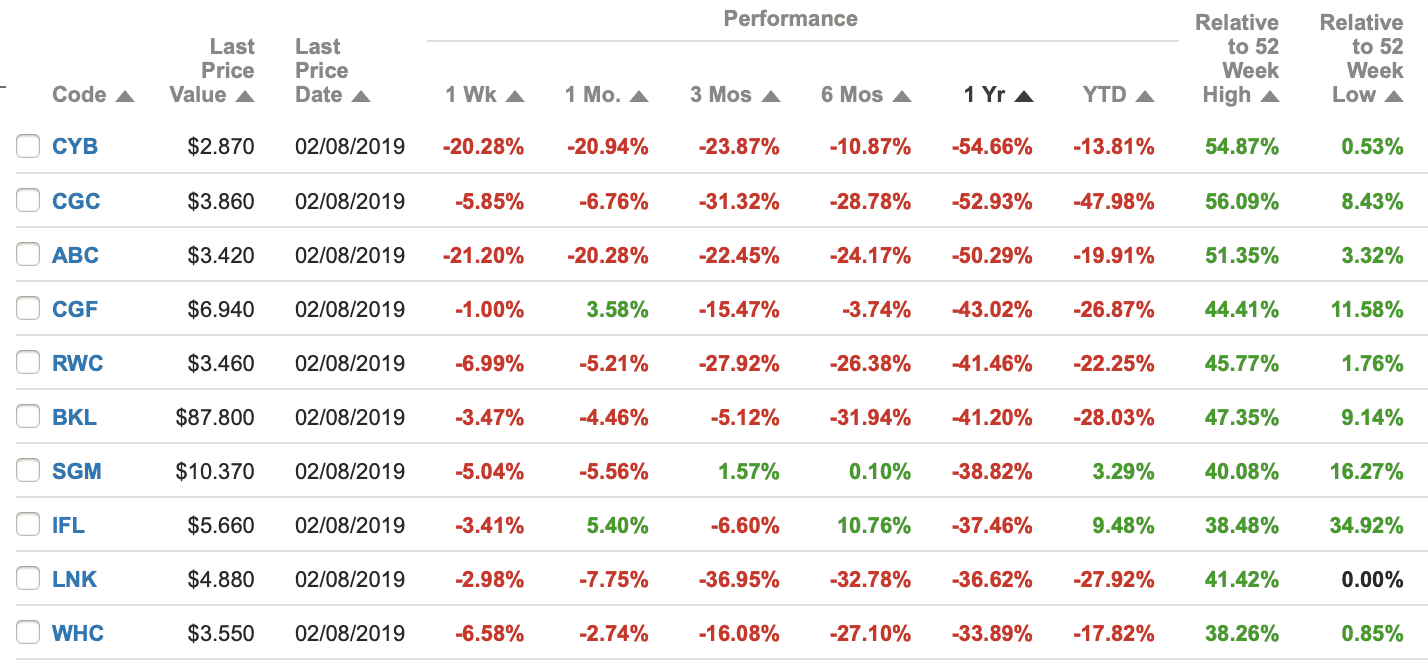

So remembering that every case is different and in some cases substantial price falls in good quality companies may be a buying opportunity, let's take a look at the 10 worst mid-cap shares over the past year.

Source: Commsec, Aug 5, 2019.

Clydesdale & Yorkshire Bank (ASX: CYB) has been a laggard for over 10 years now as it continues to battle huge compensation claims for regulatory breaches, a tough competitive environment, and weak regional economy in the UK.

Costa Group Ltd (ASX: CGC) shares got hammered after handing investors a significant profit downgrade on the back of weaker-than-expected prices for berries, tomatoes and avocados. Its newly-acquired blueberry business in Morocco has also underperformed.

Adelaide Brighton Ltd (ASX: ABC) handed investors a profit downgrade last week on the back of weak construction activity in Australia.

Challenger Group Ltd (ASX: CGF) is struggling as the ultra-low rate environment sees margins, return on equity, profits, and product sales tumble. I've sold out of this business.

Reliance Worldwide Corp (ASX: RWC) is the plumbing parts business that has not met the high profit growth expectations of investors.

Blackmores Limited (ASX: BKL) is reporting slower sales in its key growth market of China. One question for investors is whether this is a temporary blip or could be due to more permanent problems. Sentiment around this business can swing wildly on overseas sales, which equals a volatile share price.

Sims Metal Management (ASX: SGM) is the metal recycler that has struggled to post much in the way of returns for shareholders over the past 10 years.

IOOF Holdings Limited (ASX: IFL) is the financial advice and planning business hit by APRA's December 2018 demands that a large number of its senior management team be disqualified from working on APRA regulated entities. No wonder the stock has tanked.

Link Administration Holdings Ltd (ASX: LNK) is a former market darling hit by a profit downgrade and facing a regulatory investigation in the UK over its role as a legal supervisor of a suspended investment fund.

Whitehaven Coal Limited (ASX: WHC) is a volatile stock due to the company's debt profile and leverage to the fast-changing coal price. As such it could be on the best or worst performer list in any given year.

Foolish takeaway

In my opinion the one business above that might be worth more research for bargain bin hunters is Reliance Worldwide. While Link could return to form assuming sentiment around the business and its recent problem reverses. The others I'd personally avoid for now and for full disclosure I have sold Challenger and Blackmores shares myself in 2019.