Last week, as part of my beginner's guide series, I discussed the basics of defensive shares and what it means to have them in your portfolio.

In this week's instalment, I look at the basics of investing in cyclical shares.

What are cyclical shares?

The share price of cyclical shares is tied to the ups and downs of the economy at large. The price is higher when the good times are rolling, and lower during downturns.

As with defensive shares, it can be easier to get your head around the concept if you apply it to your own household budget. Imagine you are between contracts or have had to take extended leave and your discretionary spend isn't what it was.

How would you change your spending behaviour? You probably wouldn't make big commitments like buying a house or car, subscription TV might go, and you'd hold off on holidays, new furniture and that kitchen renovation will have to wait.

You can surmise from the diverse range of products and services I've suggested, that any national belt tightening exercise in economic down times could have a profound effect on the profits of the companies that provide them. You can also see why media outlets often use real estate and car sales statistics as an economic thermometer.

The ASX sectors

The ASX is divided up into 7 sectors (also known as GICS, Global Industry Classification Standard) as follows: Consumer Discretionary, Consumer Staples, Energy. Financials, Health Care, Industrials, Information Technology, Materials, Real Estate, Communication Services and Utilities. For this exercise we're going to focus on the consumer discretionary sector.

What is the consumer discretionary sector?

As its name suggests, the S&P/ASX 200 Consumer Discretionary (INDEXASX: XJD) sector is home to companies that rely predominantly on customers' discretionary spending habits. There's a range of industry groups in the sector, including automobiles and components, consumer durables and apparel, consumer services, media, and retailing.

There's a lot of familiar names in this sector, including Corporate Travel Management Ltd (ASX: CTD), Webjet Limited (ASX: WEB) and Wesfarmers Ltd (ASX: WES). Shares in these companies are theoretically at the most risk of decline during wider economic downturns, and can bounce upward when the good times return. Hence the term 'cyclical' when we talk about these shares.

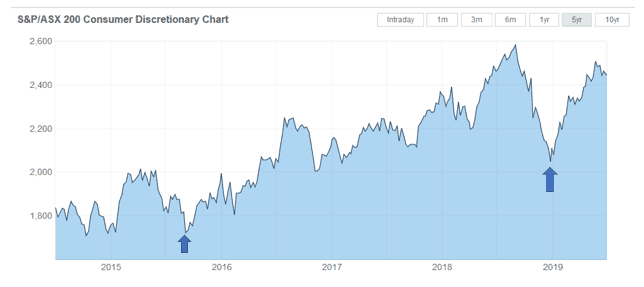

The chart below tracks the 26 companies in the consumer discretionary sector on the S&P/ASX 200 (the sharemarket's 200 largest listed stocks). The chart aggregates the share prices of these 26 companies and gives us a snapshot of how the sector is faring overall and clues to how the wider economy is performing. In the chart below I'm using a 5-year time frame. I've highlighted two 'dips' in the trendline with dark blue arrows to see if they correspond to individual share prices.

An example of a cyclical share

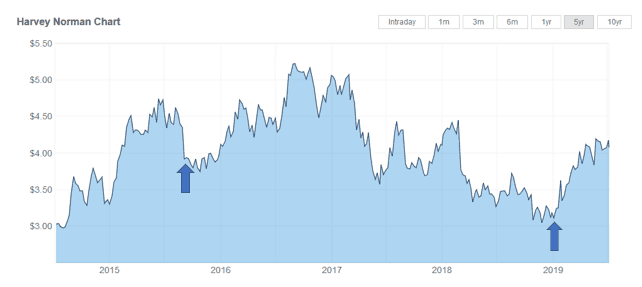

Harvey Norman Holdings Limited (ASX: HVN) is one of Australia's most successful consumer electronics retailers, as well as white goods and furniture. It relies on a confident retail environment to convince you to upgrade your TV or buy the latest gaming console. The two dark blue arrows in the chart below indicate the share price 11 September 2015, $3.93, and 21 December 2018, $3.11.

When we step back and compare it to the sector chart above, we can see that the dips in Harvey Norman's share price correspond with downturns in the wider sector. If we take a few moments to compare the charts further, we can note that the reverse also happens with both charts moving upwards since 21 December last year, concluding with Harvey Norman closing Monday's trade at $4.08. This illustrates the point that the fortunes of companies in the consumer discretionary sector can ebb and flow with the whims of the wider economy.

Foolish takeaway

Some analysts will argue that all shares are cyclical, just some far more than others. If you're just starting out on your investment journey it can be a daunting task trying to pick through all the data, but you can keep an eye on the wider picture as demonstrated above. Listen when you hear the latest real estate or car sales statistics on the news, they will tell you some of the story but not all of it. Always read widely, consider diverse opinions, and make up your own mind.