Every professional or 'mum and dad investor is always searching for ways to improve their returns.

One factor most experienced investors will talk about is the idea that it's just as important to avoid the losers as it is to buy the winners if you want to beat the market.

Avoiding the losers is easier said done though, as any company can unexpectedly flag an operational problem or blow-up at anytime.

Generally the higher risk that comes with buying shares in a company explains why it's possible to obtain higher returns in the share market than fixed income markets for example.

Another behavioural learning a lot of professional investors will emphasise is that it's important to cut your losses quickly if an investment does turn sour due to a material change to a company's outlook.

In fact holding onto losing shares can be a worse mistake than buying losing shares if a reason becomes apparent why a company may face problems, but an investor takes a 'head in the sand' approach to ignore it. As this will own compound losses.

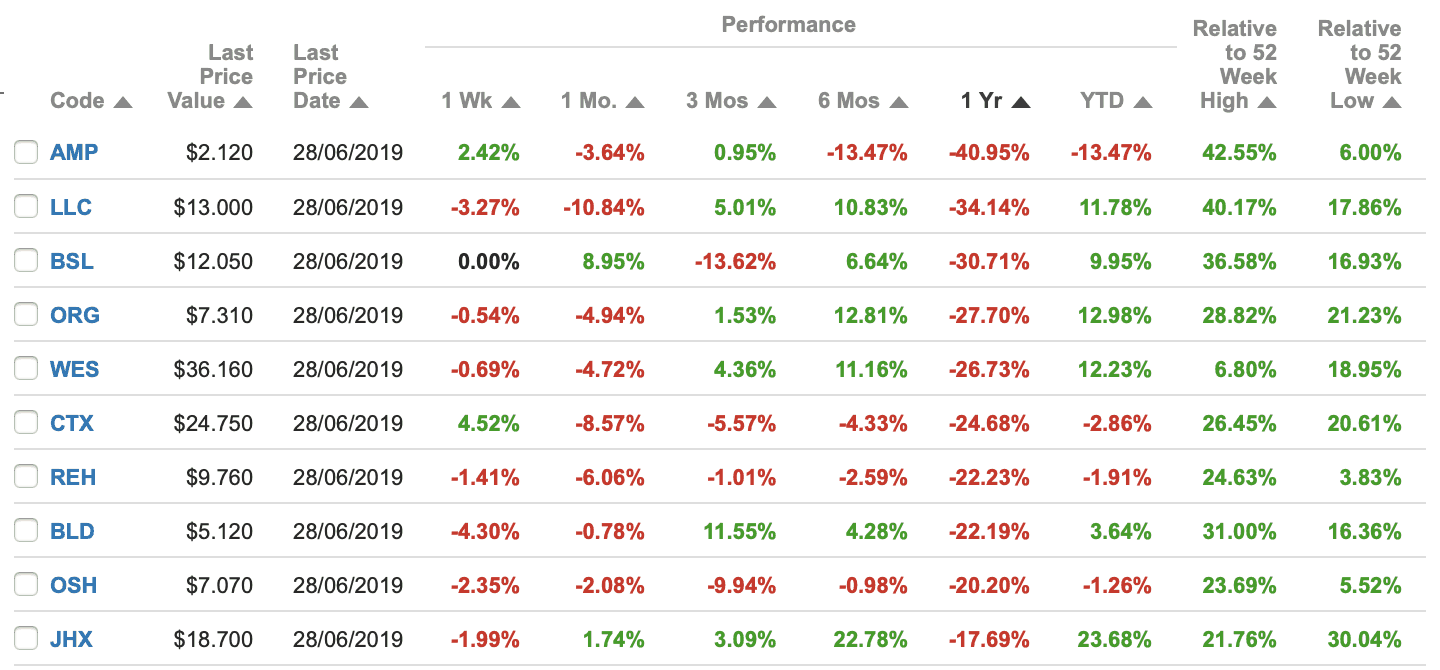

So let's take a look at the 10 worst performing 'large cap' shares of FY 2019 or the last year according to Commsec.

Source: Commsec, July 1 2019.

AMP Limited (ASX: AMP) is down 40% on the back of the Royal Commission scandal, although notably it had been on a steady downward trajectory as a business prior to the inquiry. As such investors might want to give it a miss.

Lend Lease Group (ASX: LLC) revealed in February that its engineering division has suffered a number of underperforming projects over the past 12 months. In response investors have marked down the stock 34%.

BlueScope Steel Ltd (ASX: BSL) warned in June that steel prices had recently been lower than expected. The stock is now down 31% in 12 months.

Origin Energy Ltd (ASX: ORG) is the energy retailer that is a target of the federal government to encourage it to lower energy prices for consumers. The stock has fallen 28% in just 12 months.

Wesfarmers Ltd (ASX: WES) recently spun off Coles (ASX: COL) supermarkets and the investment conglomerate has since made a couple of takeover bids for Kidman Resources (ASX: KDR) and lithium miner Lynas Corporation Ltd (ASX: LYC).

Caltex Australia Ltd (ASX: CTX) recently blamed challenging economic conditions for a big profit downgrade that has contributed to a 25% share price fall in 12 months.

Reece Ltd (ASX: REH) is the plumbing supply parts business where investors probably had their expectations for growth set a little too high. The stock has retreated 22% in 12 months.

Boral Ltd (ASX: BLD) is the building materials business that has blamed the challenging economy for softer demand for its products. The stock has shed 22%.

Oil Search Limited (ASX: OSH) recently blamed lower-than-expected LNG shipments out of its PNG base on timing factors. The shares are down 20%.

James Hardie Industries Ltd (ASX: JHX) is another building materials and cement business that recently blamed "soft" demand in the US housing sector for a moderate earnings miss. The stock has shed 18% in a year.

Foolish takeaway

As we can see with falls ranging from 18% to 41% large-cap or blue-chip shares tend to be less volatile than smaller companies.

They are commonly favoured by investors due to their perceived defensiveness, however, it's worth noting some of these fallers have been in downtrends for years or perhaps decades. This illustrates how holding onto losers can be a worse mistake than buying them in the first place.