This week I took a look at the 10 best-performing large cap and mid cap shares so far in 2019. Out of the large caps only two had managed to double in 2019 including Magellan Financial Group Ltd (ASX: MFG) and Fortescue Metals Group Limited (ASX: FMG).

Among the mid caps 9 out of the 10 shares have doubled in 2019 with 5 out of the 10 even tripling over the longer period of the past 12 months. Those five are ZIP Co Ltd (ASX: Z1P), Nearmap Ltd (ASX: NEA), Jumbo Interactive Ltd (ASX: JIN), Pro Medicus Limited (ASX: PME) and Clinuvel Pharmaceuticals (ASX: CUV).

So we can see that the smaller a company is by market value the more potential it has to deliver outrageous returns.

So at the small cap end of the market you can find some rockets, but be warned as small-cap companies commonly lose money and often fall faster than they climb.

In effect this is the 'speculative' or 'casino' end of the market where light regulation, day traders, speculators and dubious operators collide to produce some extraordinary stories. As such small caps come with a very high risk warning.

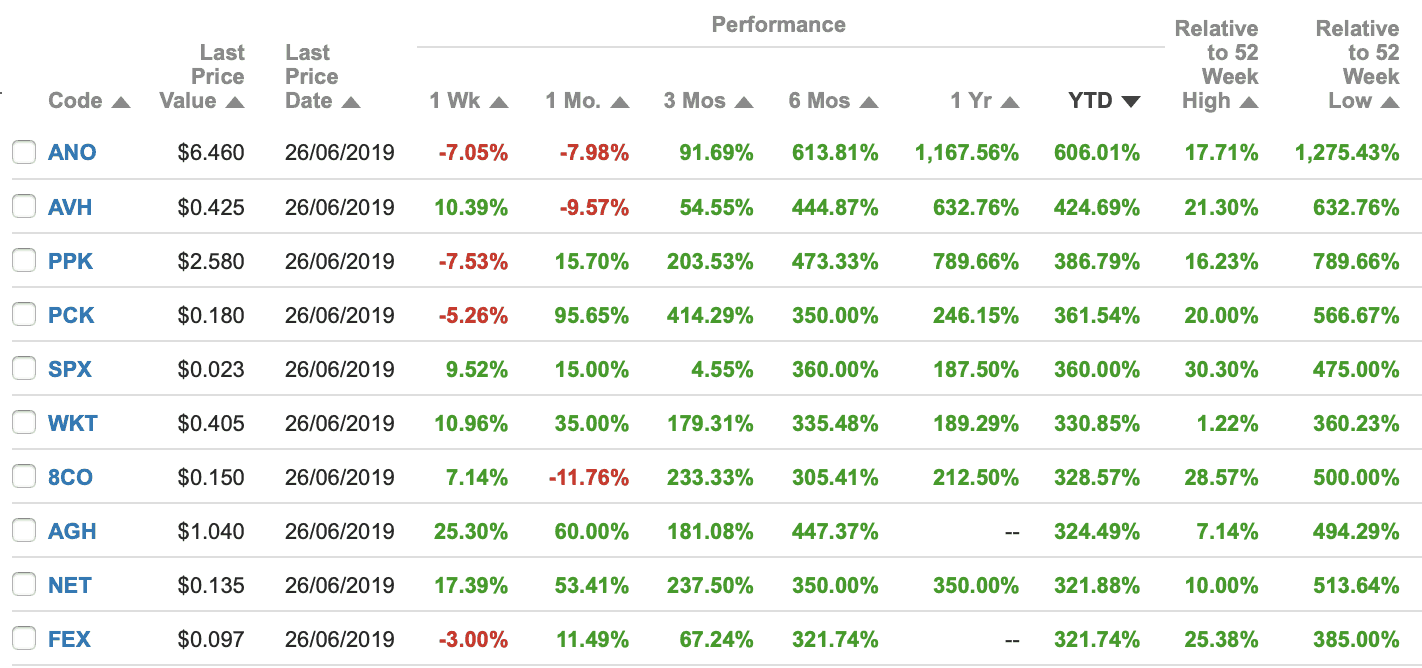

Still if you can find the real deal stars of tomorrow at this end of the market you can generate the biggest returns of all. Take a look at the what Commsec reports as the 10 best performing small caps of 2019 in the chart below.

Source: Commsec, June 27, 2019.

Advance Nanotek Ltd (ASX: ANO) is up 606% in 2019 and develops advanced materials or polymers that can go in sunscreens for example to improve skin protection. It made a profit around $1.4 million in the March 2019 quarter and could be on the right track.

Avita Medical Ltd (ASX: AVH) is a regenerative medicine business with a RECELL product that helped take in $4.7 million in revenue for the quarter ending March 31, 2019, although it still posted an operating cash loss of $6.48 million.

PPK Group Ltd (ASX: PPK) is a coal mining services business that posted a net profit of $0.9 million on revenue of $19.8 million for the half-year ending December 31, 2019. Investors like what they see with the stock up 387% in 2019.

PainChek Ltd (ASX: PCK) is the group being the PainChek app or technology that assesses pain in residential aged care patients. It's been soaring on the back of federal government support, although only posted $87,000 in revenue for the first 9 months of FY 2019.

Spectrum Metals Ltd (ASX: SPX) is a gold prospector or driller boasting of excellent initial drilling results at its Penny West project in WA.

Walkabout Resources Ltd (ASX: WKT) is another prospector or driller, but in the graphite space as it boasts of excellent drilling results at its Lindi Jumbo Graphite Project in Tanzania.

8Common Ltd (ASX: 8CO) is a fintech or software business that reports it provides travel and expense management services under its core expense8 product.

Althea Group Holdings Ltd (ASX: AGH) is a medicinal cannabis business that recently announced it has been selected to supply a pilot drug trial scheme in the UK.

Netlinkz Ltd (ASX: NET) is a cyber security business that recently reported $160,000 worth of sales to clients in China. The stock is only at 13.5 cents which may partly explain its huge rise in percentage terms anyway.

Fenix Resources Ltd (ASX: FEX) describes itself as a "mineral explorer transitioning to miner" in the iron ore space. It has boasted of strong drilling results at one of its WA tenements recently.

Foolish takeaway

As we can see many of these companies have very little or zero revenue which means anyone buying shares is taking a punt in the hope of huge returns.

Companies with little revenue generally also burn through cash and view the share market and its punters as sources for additional capital via raisings in exchange for new equity. For example debt via bank loans is generally not an option for companies with no revenue as the banks won't lend.

As such these kinds of companies are all incentivised to paint the best picture possible of their outlooks, as they're likely going to need to ask you for more capital sometime in the future.

Overall then I would not suggest buying shares in this space, as the 10 above are the best performing small-cap companies out of a screen of 1,454 on the market according to Commsec.

We can see then that the odds are stacked against you as a punter in this space, unless of course you have some specific expertise, information, or knowledge that gives you confidence you know of a company likely to go gangbusters over the long term.