One of the best tried and tested methods to grow profits and sales in the retail sector may not work anymore and investors should sit up and listen!

It used to be that you'd buy shares in retailers that have an ambitious store rollout program as it would almost always lead to sales, profit and margin growth.

But this strategy could now backfire and our leading retailers may actually need to shrink to grow, according to Citigroup.

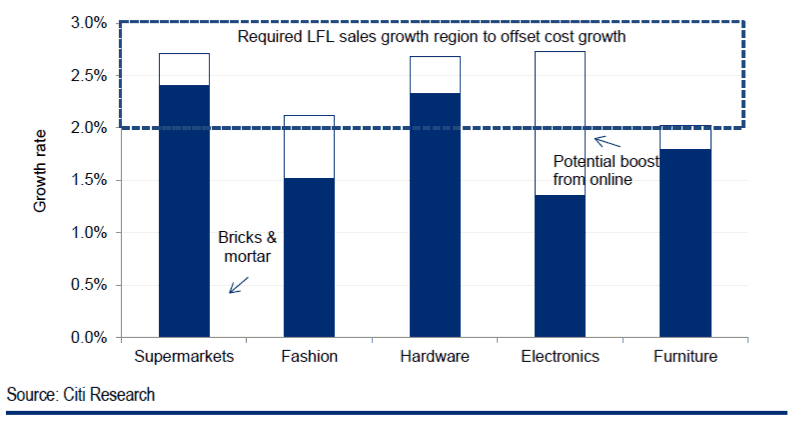

The broker believes that retail space will grow ahead of population growth over the next three, and that like-for-like (LFL) sales growth cannot keep up with rising costs in for most retailers.

Sales growth from opening new stores is not keep up with cost growth

LFL is an industry term that refers to sales from stores that are opened for at least a year.

"Planned shopping centre developments point to space growth near 2%, but the higher growth of online and weaker demand means that LFL bricks and mortar sales growth is closer to 1.5%," said Citigroup.

The retailers most at risk are electronics, fashion and furniture. This means investors should more closely scrutinize the store expansion plans from the likes of JB Hi-Fi Limited (ASX: JBH), Harvey Norman Holdings Limited (ASX: HVN) and Premier Investments Limited (ASX: PMV), just to name a few.

However, the broker did note that retailers have been slowing their store network expansion in more recent times – possibly in response to the growing online threat with the entry of competitors like US shopping giant Amazon.com.

But there's good news for Wesfarmers Ltd (ASX: WES), the owner of the Coles Supermarket chain and hardware superstore Bunnings, as these two categories aren't expected to feel the margin squeeze as LFL growth is forecast to keep ahead of cost growth.

This is also good news for Australia's largest supermarket chain Woolworths Group Ltd (ASX: WOW) although there isn't any good news for its struggling department store business Big W.

Citigroup believes that department store floor space will need to contract by 15% before margins can bounce back to 5% and return on capital can reach more satisfactory levels above 10%.

But the real loser from this analysis is embattled department store Myer Holdings Ltd (ASX: MYR) as it has nothing to offset the weakness.

Sounds like all the more reason to avoid Myer and Harvey Norman in favour of Wesfarmers and Woolworths.

Looking for other blue-chips that are well placed to outperform in 2018? The experts at the Motley Fool have nominated their three favourite large cap stocks to buy.

Click on the free link below to find out what these stocks are and why they should be on your radar.