The US and Australian share markets are flirting with record highs once again.

For many investors, that's a reason to celebrate – but an important question is also being raised: Are we in a bubble?

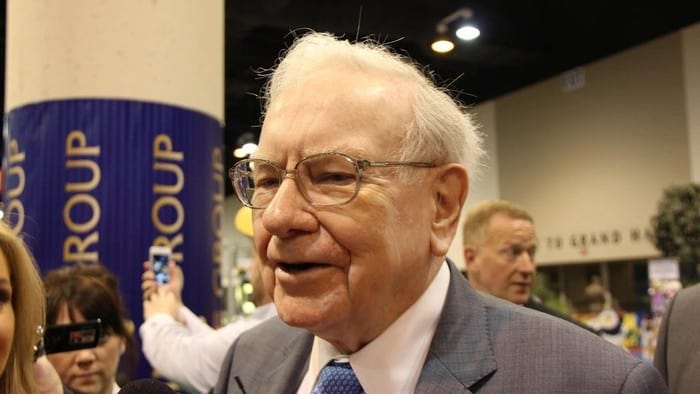

One widely followed metric is sounding the alarm, and it just happens to be Warren Buffett's favourite valuation indicator.

Let's unpack what it is, why it's flashing red, and what investors should (and shouldn't) do about it.

What is the Buffett Indicator?

The "Buffett Indicator" is a simple yet powerful tool: It compares the total market capitalisation of publicly traded companies to a country's gross domestic product (GDP).

Buffett once called it "probably the best single measure of where valuations stand at any given moment."

When the ratio is above 100%, the market is worth more than the underlying economy it represents—a potential red flag. At the time of writing, the US version of the indicator has surged past 200%, the highest level ever recorded. That dwarfs even the peaks seen before the dot-com bust (around 140%) and the 2008 financial crisis (around 100%).

What does it mean?

Historically, a surging Buffett Indicator has preceded periods of market turbulence. That's why investors are watching it closely.

It suggests stocks, particularly in the US, may be overvalued relative to the broader economy. If this ratio normalises, it could be through slower market gains, earnings catching up… or a sharp market correction.

However, before rushing to conclusions, it's worth understanding why this tool isn't perfect.

Why you should take it with a grain of salt

Markets, like economies, evolve. And many experts today are more cautious in how they interpret the Buffett Indicator. Here's why:

- Global revenue skews the picture: US multinationals earn significant income abroad. Comparing global companies to domestic GDP isn't apples-to-apples.

- Low interest rates support higher valuations: When borrowing is cheap, and bond yields are low, higher stock valuations can be justified.

- Tech dominance and profitability: Today's tech giants, like Alphabet and Meta Platforms, are highly profitable, unlike many of the dot-com era darlings. Their size alone pushes the market cap sky-high.

These structural shifts mean that while the indicator is flashing, it's not necessarily predicting an imminent crash.

Timing the market is a mug's game

Even Warren Buffett doesn't try to time the market.

"We try to price, rather than time, purchases," Buffett wrote in his 1994 letter to Berkshire Hathaway shareholders.

That's why even when his favourite indicator is sky-high, Buffett doesn't panic-sell. He simply becomes more selective.

And right now? Berkshire Hathaway is holding more than US$348 billion in cash—more than enough to buy Commonwealth Bank of Australia (ASX: CBA), Wesfarmers Ltd (ASX: WES) and Telstra Group Ltd (ASX: TLS) combined.

It doesn't mean a crash is coming, but it does suggest Buffett and his team aren't seeing screaming bargains in the market right now.

Foolish Takeaway

Whether you're watching the Buffett Indicator or just keeping tabs on your portfolio, remember this: Emotions are not a strategy.

FOMO and panic are equally poor reasons to buy or sell. Timing the market is notoriously difficult — even for the pros.

Instead, focus on what you can control. Build a diversified portfolio, keep your costs low, and invest consistently over time.

As Morgan Housel puts it: "Save like a pessimist, invest like an optimist."

Stay disciplined, keep it simple… and Fool on.