The niggling threat of an inflationary acceleration is rearing its ugly head once again, setting ASX All Ord shares on track for their worst month since August last year.

Nervousness has re-entered the chat this month. Increasing conflict, supermarket inquiries and record gold prices paint an uneasy scene. Yet, the fear of higher — or at least the same for longer — interest rates is front of mind for investors.

The cost of money, which is determined by interest rates, can have severe consequences on companies. This is especially true for businesses dependent on debt. A second bout of rate rise-inducing inflation could be catastrophic for those already on the edge.

Second wave of inflation

Expectations of approaching rate cuts have arguably fuelled much of the market rally before the recent souring. At its peak, the ASX All Ord index was up more than 7% in under three months. But those gains have now been vaporised.

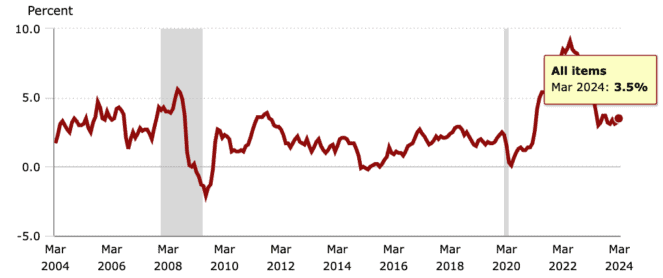

Earlier this month, the monthly consumer price index (CPI) out of the United States gave investors pause for thought. The country's March inflation figure rose to an annualised rate of 3.5%, increasing month-on-month from 3.2% — depicted below. That's not the direction you want when aiming for 2%.

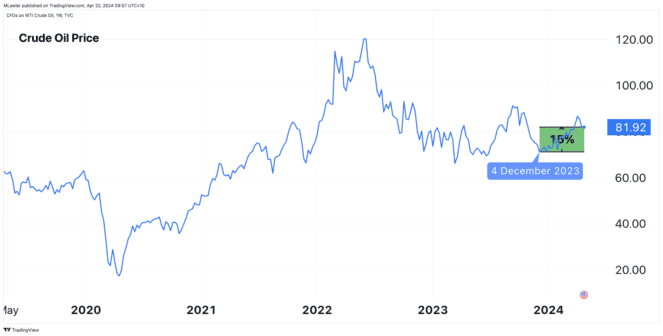

The conflict between Israel and Iran could exacerbate the issue.

Australia's Treasurer, Jim Chalmers, said, "It's not hard to imagine an escalating conflict in the Middle East putting upward pressure on inflation, just when we've been making welcome and encouraging progress in that fight."

In 1973 and 1974, inflation rapidly resurged, instigating those crushingly high interest rates that some may recall. The situation emerged following an oil embargo on the US. A retaliatory action after $2.2 billion of aid was provided to Israel during the Yom Kippur War.

The uncanny resemblance to 1973 could be causing some apprehension among investors.

The chart above shows that crude oil prices have surged 15% since December last year.

What happens next is unknown. However, I'm wary of history rhyming — taking Warren Buffett's sage advice of "Never lose money". That's why I avoid companies carrying a load of debt on the balance sheet.

Which ASX All Ord shares could be in danger?

Two handy measures for gauging a company's financial strength are the debt-to-equity and interest coverage ratios. The first provides insight into the level of debt, while the second shows the extent of the debt's burden on profitability.

Three ASX All Ord shares that I think could be poorly positioned for higher interest rates are:

Zip carries a lot of debt to facilitate buy now and pay later purchases. Meanwhile, Finbar Group holds $282 million worth of debt to construct apartment buildings. Lastly, Elanor is heavily indebted to finance its real estate portfolio.

If rates were to rise again, consumer spending would deteriorate further. That's a bad situation for a BNPL company, leveraged cash-tight constructors, and REITs with a heavy skew towards retail property.

Instead, I'd hold ASX All Ord shares with conservative balance sheets.