The Super Retail Group Ltd (ASX: SUL) share price dropped more than 1% today after the ASX retail share went ex-dividend.

This is the business behind Supercheap Auto, Rebel, BCF and Macpac.

Ex-dividend date

Today is the ex-dividend date, which is the day that new investors are no longer entitled to the upcoming FY24 half-year dividend. If buyers aren't going to receive the upcoming dividend, they're probably not going to want to pay as much for Super Retail shares.

Super Retail is going to pay a fully franked interim dividend of 32 cents per share. This dividend is going to be paid on 12 April 2024, which is a month and a week away.

The 32 cents per share represents a fully franked dividend yield of 2.1% and a grossed-up dividend yield of 3% at yesterday's share price.

The company generated statutory earnings per share (EPS) of 63.5 cents, so the dividend payout ratio is roughly 50%. The company is paying half of its profit to shareholders and retaining half within the business, which can be used for growth spending and/or improving the balance sheet.

This payout is 6% smaller than the FY23 half-year payout a year ago.

What next for Super Retail shares?

The company is projected to pay an annual dividend per share of 80 cents in FY24, according to Commsec. This would be a cut compared to FY23, but would still represent a dividend yield of 5.4% or a grossed-up dividend yield of 7.7%.

In terms of the outlook, it said FY24 second half like for like sales were down 3% year over year.

It said demand in the auto category remains "resilient", particularly for products that keep customers' cars on the road including batteries, lubricants and wipers.

Rebel is cycling elevated sales in the prior corresponding period.

BCF's fishing category is continuing to "perform well", though trading has been disrupted by wet weather events.

Macpac has made a "positive start" to the second half.

The business is seeing signs of a more subdued consumer environment, but it's "relatively well-positioned". It's focusing on optimising the margin and "driving cost efficiencies". It's still seeing inflation in wages and rent costs.

Super Retail share price snapshot

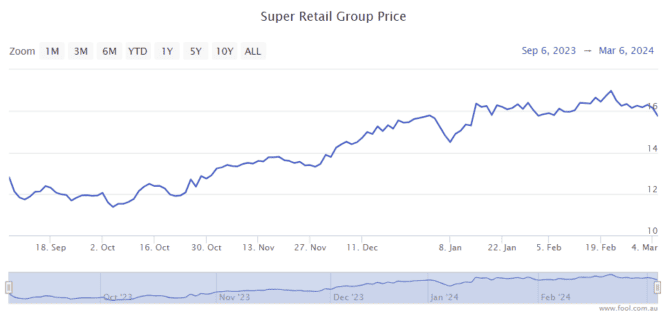

In the last six months, the Super Retail share price has risen around 25%.