The final days of the ASX reporting season are now upon us, so there is plenty of data for investors to digest.

Amid the information overload, don't forget to monitor these events that could impact your ASX shares:

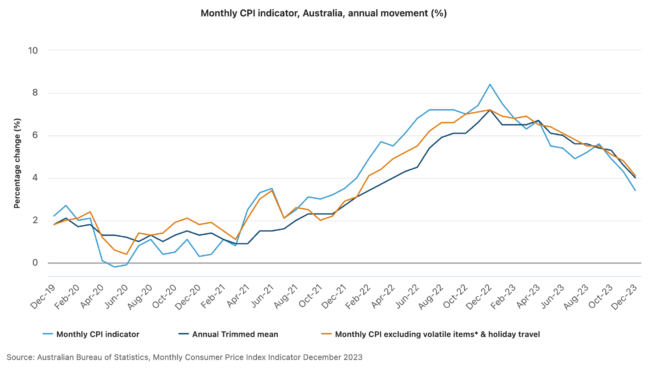

1. Australia monthly inflation

The January consumer price index statistics will be released on Wednesday, which will have a big impact on what the Reserve Bank will do with interest rates.

"Expectations are for inflation to rise 3.5% year-over-year, stalling slightly from January's 3.4% and snapping a streak of continuous easing," said eToro market analyst Josh Gilbert.

"Market pricing has shifted in recent weeks, but June is still the first meeting where the expectation is a cut."

The great news for consumers, mortgage holders, and ASX shares is that economic data has recently been coming in as the RBA predicted.

Gilbert reckons this provides "the potential for three cuts" this year.

"This week, the ABS also reported that Australians experienced the highest recorded rise in wages in almost 14 years, and the first significant pay increase in nearly three years," he said.

"This marked the first time since March 2021 that wage growth outpaced inflation — a welcome figure that many Australians will be hoping continues in 2024. "

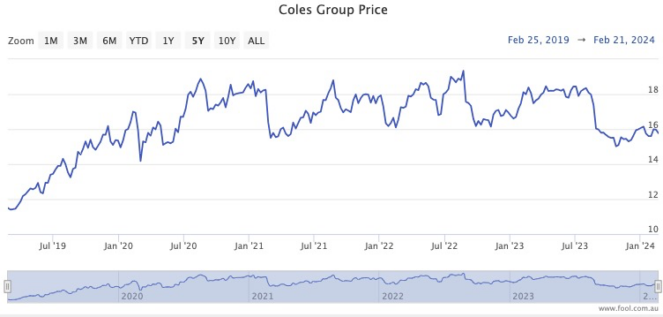

2. Coles results

One of the big S&P/ASX 200 Index (ASX: XJO) reporting season events will take place Tuesday morning when Coles Group Ltd (ASX: COL) reveals its numbers.

The market will be especially interested after its supermarket rival Woolworths Group Ltd (ASX: WOW) last week copped a $781 million loss.

"Similar to Woolworths, Coles is also expected to report declining profits, but revenue is set to grow at the fastest pace for almost three years, which may prove to be a silver lining."

With the social contracts of big business under political scrutiny, the grocery giant will walk the tightrope.

"Coles has experienced intensifying scrutiny over the past couple of months, with an influx of media interest and the Australian government directing the ACCC to review prices and competition in the supermarket sector following accusations of price gouging," said Gilbert.

"Balancing profitability alongside customer relations is no easy task, and this will be an ongoing challenge for Coles,"

3. Flight Centre results

Wednesday will see travel agent Flight Centre Travel Group Ltd (ASX: FLT) make its contribution to reporting season.

Gilbert pointed out how the COVID-19 pandemic forced the company to slim down, which ended up a blessing in disguise.

"Around 15,000 staff were laid off in a bid to greatly reduce costs.

"This appeared to be a good move for the company, with Flight Centre announcing solid results for FY23, reporting revenue that was up 126% to $2.28 billion, and EBITDA rising by 260% to $300 million."

Travel demand remains high, according to Gilbert, but the wind has been taken out of sky-high airfares from 2023.

"Investors will be focused on future guidance given that the market expects solid profits for the full year that have not been since the pandemic.

"Any shift away from current guidance will put shares under pressure, but reaffirming guidance will put shares on the front foot."