A second income is what most investors aim for, but it's probably more straightforward to achieve than many of them realise.

You can start with as little as $5,000.

Let's take a look at a couple of ASX dividend shares that could help with this mission and see how hypothetically you could arrive in the promised land:

The land of plenty

Australia is blessed to host many quality income stocks because of its favourable tax rules.

Two that experts seem to like at the moment are BSP Financial Group Ltd (ASX: BFL) and Whitehaven Coal Ltd (ASX: WHC).

The former is Papua New Guinea's largest bank, which has paid back its investors handsomely in recent years.

IG Australia market analyst Hebe Chen is bullish on the financial stock.

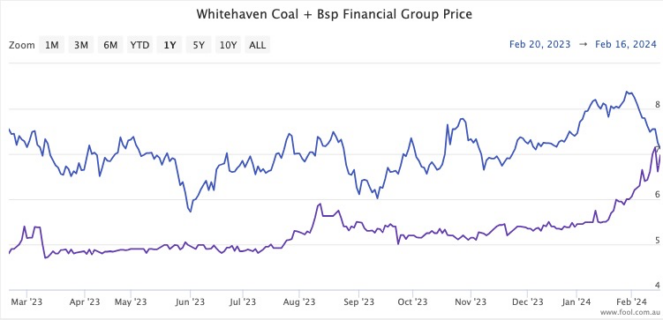

"BSP Financial's gross dividend yield was 9.75% in the past financial year, with its stock price jumping 32% from early last year and 51% over the past two years."

Meanwhile Whitehaven Coal is cashing in on the energy anxiety much of the developed world is feeling due to conflicts in the Middle East and a ban on Russian gas and oil.

The stock is paying out a sensational fully franked dividend yield of 10.6%.

Whitehaven shares have dived this month due to an unfavourable reporting season, but they have remained resilient over the past year while other energy stocks have suffered from high volatility.

Second income now or later?

Going back to the $5,000, if you are impatient you could extract passive income immediately from the above dividend stocks.

If you split that money evenly between the two stocks, you could buy around 710 shares.

For ease of calculation, if we say BSP Financial and Whitehaven Coal average out to 10% yield, that's $500 coming into your bank account each year.

That's pretty handy cash for just a $5,000 investment.

But if you can afford to wait a tad longer, you could try to secure a much more significant second income.

Check this out.

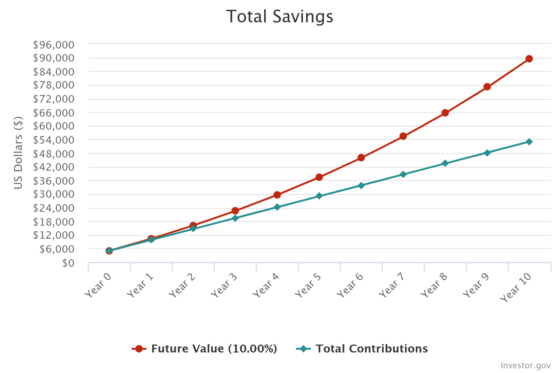

If you can maintain a compound annual growth rate (CAGR) of 10%, which is simply the current dividend yield without even taking any capital growth into account, let the investment grow for 10 years.

Moreover, keep saving and add $400 to the portfolio each month.

You will then find your shares are worth $89,468 by the end of that decade.

If you then start pocketing the annual returns, you have $8,947 in your bank account each year.

Does that sound much better?

That's a nice overseas holiday each year, or paying for the kids' education expenses.

Or in monthly terms, it's $745 of second income, which is almost double the amount you had been saving.