The Whitehaven Coal Ltd (ASX: WHC) share price is taking a tumble today.

Shares in the S&P/ASX 200 Index (ASX: XJO) coal stock closed yesterday trading for $7.51. In early morning trade on Thursday, shares are changing hands for $7.03 apiece, down 6.4%.

For some context, the ASX 200 is up 0.7% at this same time.

This follows the release of Whitehaven's half-year results for the six months ending 31 December (H1 FY 2024).

Read on for the highlights.

Whitehaven share price dives as dividend slashed

- Revenue of $1.59 billion, down 58% from H1 FY 2023

- Underlying earnings before interest, taxes, depreciation and amortisation (EBITDA) of $623 million, down 77% year on year

- Underlying net profits after tax (NPAT) of $372 million, down from $1.79 billion in H1 FY 2023

- Net cash down 43% to $1.50 billion

- Fully franked interim dividend of 7 cents per share, down from the prior interim dividend of 32 cents per share

What else happened with Whitehaven during the half-year?

Other core metrics impacting the Whitehaven share price include coal production, which increased during the period. Run of mine (ROM) production was up 17% from H1 FY 2023 to 10.35 million tonnes.

Unfortunately, costs were up too. Unit costs per tonne rose to $111 per tonne, up 16% from the prior corresponding half year. And coal stocks declined by 34% to 1.23 million tonnes.

Whitehaven reported it achieved a realised average price of AU$220 per tonne over the six months.

In the biggest development for the ASX 200 coal miner during the period, Whitehaven confirmed its intention to acquire the Daunia and Blackwater metallurgical coal mines, owned by the BHP Group Ltd (ASX: BHP) Mitsubishi Alliance.

And passive income investors may want to mark 8 March on their calendars. That's when Whitehaven will pay out its interim dividend.

What did management say?

Commenting on the acquisition of BHP's coal mines, which is failing to lift the Whitehaven share price today, CEO Paul Flynn said:

The program of work to complete the acquisition of Daunia and Blackwater mines and transform Whitehaven into a metallurgical coal business is progressing well…

The US$1.1 billion five-year credit facility, together with US dollar cash on the balance sheet, will be used to fund the upfront payment for the acquisition. Ongoing cash flows being generated by the business will provide additional liquidity.

Whitehaven expects the acquisition to be complete in early April, subject to regulatory approvals.

What's next?

Looking at what might impact the Whitehaven share price in the months ahead, the company's FY 2024 guidance forecasts managed ROM coal production of 18.7 million to 20.7 million tonnes. Managed coal sales are forecast to be in the range of 16.0 to 17.5 million tonnes for the full financial year.

On the cost front, Whitehaven expects unit costs (excluding royalties) to be between $103 to $113 per tonne. And capital expenditure is forecast at $400 million to $450 million (excluding acquisition costs).

Whitehaven share price snapshot

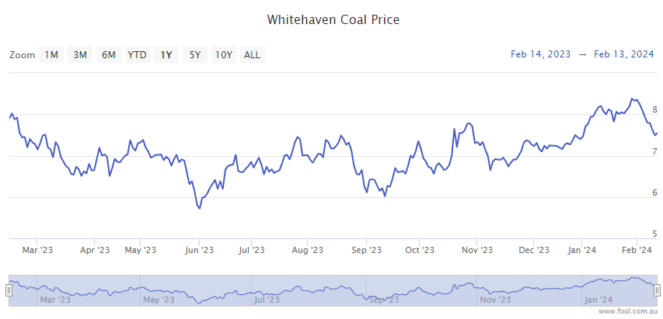

With today's big dip factored in, the Whitehaven share price is down 14% over 12 months.

Shares in the ASX 200 coal stock are up 24% since the 31 May lows.